No cliff notes for busy executives?

So far AAPL BABA FB

NFLX MSFT TSLA AMZN👎

BIDU TCEHY NVDA

No cliff notes for busy executives?

So far AAPL BABA FB

NFLX MSFT TSLA AMZN👎

BIDU TCEHY NVDA

My net worth is back to where it was at the end of 2017.

![]() outside need to check

outside need to check ![]() looking at AAPL closing price, should be the same for me

looking at AAPL closing price, should be the same for me ![]()

Since Aug 28, 2017,

F10 +15.37% ![]() Up 1.8% from last week

Up 1.8% from last week

AAPL +3.13% ![]() Turn green

Turn green

TCEHY +6.86% ![]() Up 0.5% from last week

Up 0.5% from last week

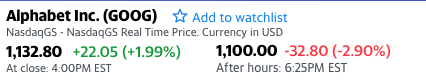

GOOG +21.6% ![]() Up 3.2% from last week

Up 3.2% from last week

AMZN +71.9% ![]() Down 4.8% from last week

Down 4.8% from last week

NFLX +102.3% ![]() Down 0.7% from last week

Down 0.7% from last week

DimSum +0.12% ![]() Turn green, just in time for BJ

Turn green, just in time for BJ

Market Cap

AMZN $795.2B

MSFT $789.1B

AAPL $787.6B

GOOG $775.7B

Amazon’s retail dominance in questiom

The bottom line: Amazon remains the brand to beat online as consumers continue to see Prime membership as important to their lives. But an army of retailers — led by Walmart and Target — have begun to land successful strikes on Amazon. The formidable retail beast should consider using its $40 billion in cash to make another physical store acquisition.

Zuck will push e-commerce on Instagram too. That is far more exciting to me than Walmart or target.

Feb 4 is time for giggling, any1 make an easy to die bet?

BIDU on Feb 12. Goner?

NVDA on Feb 14. One dead?

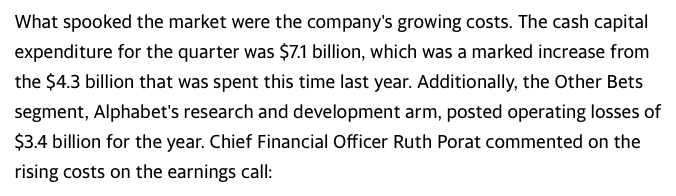

As usual GOOGL result is 18% over expectations and stock down 3.5%.

Looks like MSFT, TSLA, AMZN and GOOGL are sell on good news, profit taking strategy going on.

Other than AAPL, FB, and BABA, rest of the F10 sucks.

Market Cap at close

MSFT $811B

AAPL $810B

AMZN $802B

GOOG $790B

Darn. Four horse race.

Aapl and Fb went up only because they dropped too much. Other F10s didn’t drop enough to allow for a jump after earnings.

recovered a little with the broad market surge.

recovered a little with the broad market surge.

Google is quietly building this money-making business that could rival Amazon’s

Google Cloud is still dwarfed in size by Amazon Web Services and Microsoft’s Intelligent Cloud business. Amazon Web Services and Microsoft’s Intelligent Cloud businesses hauled in $7.4 billion and $9.4 billion in sales, respectively, in the most recent quarter.

But both competitors should keep a close eye on Alphabet’s more aggressive posture in expanding its cloud solutions for businesses. It could lead to more competitive pricing and an all-out war for already scarce tech talent.

Are these the same talents employed by cloud royalists and for iCloud? Shouldn’t this development bearish for GOOG, AMZN and MSFT as margin would be compressed? Big companies like AAPL are building data centers to be self-sufficient. So there is a danger of over build i.e. excessive supply, in the face of slower future growth in demand.

GOOG is above 200-day SMA.

Market cap

AAPL $825B calling @manch

MSFT $821B

AMZN $815B

GOOG $785B

Any surprised by the results isn’t paying attention. Their R&D ROI is horrible. At some point, digital ad spend will stop taking market share from other formats. When that happens, there will be aggressive price wars to take market share of digital ads. The one cash cow Google has will be ruined. Especially when you consider FB has much better ability to target ads. Google is really digital ads 1.0 while FB is 2.0.

SNAP? AMZN? Also 2.0 or 3.0?

I don’t think anyone is 3.0 yet. They are just better at targeting due to all the person info they have from your social media activity or shopping history.

From digital ads perspective, isn’t Yahoo! 1.0, Google 2.0, FB 3.0 then? I think Apple tries 4.0 during SJ era but didn’t work out.

Hmm. You might be right. Yahoo was literally just pay per impression with no analytics. Google made ads a little bit smarter using browser history. FB made ads a lot smarter with your profile info. I totally forget about Yahoo.

Since Aug 28, 2017,

F10 +15.4% ![]() No change from last week

No change from last week

AAPL +5.54% ![]() Up 2.4% from last week

Up 2.4% from last week

TCEHY +6.78% ![]() No change from last week

No change from last week

GOOG +18.7% ![]() Down 3% from last week

Down 3% from last week

AMZN +67.5% ![]() Down 4.4% from last week

Down 4.4% from last week

NFLX +108.0% ![]() Up 6% from last week

Up 6% from last week

DimSum -1.9% ![]() Down 1.8% from last week

Down 1.8% from last week

MAC/PC stalwarts are number 1 and 2 largest market cap.

MSFT $811B

AAPL $804B

AMZN $780B

GOOG $764B

Nvidia: Nvidia’s “really bad” earnings pre-announcement may have successfully “de-risked” the stock ahead of the chipmaker’s actual quarterly report, Cramer said.

“You don’t slam yourself again after that kind of guide-down. You get much more muted,” he said. “However, Nvidia has major exposure in China and it’s also got some gaming issues, so it’s kind of caught up in a couple of negative themes right now.”