Last to curse those companies where people here work there or big investment ![]()

We have googlers, amazon guys and you invested big time in TSLA.

6 FB

6 BABA

25 TCEHY

6 NVDA

5 BIDU

1 TSLA - Added today

All greens  except the newly added

except the newly added  .

.

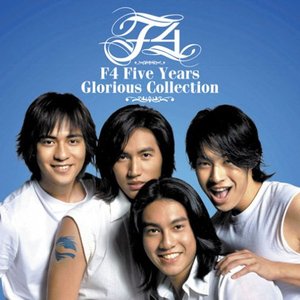

F3 coming?

F4 ![]()

Since Aug 28,

F10 … .+26.47%  Down a few % after some cursing

Down a few % after some cursing

AAPL…+9.13%  Up a little

Up a little

TSLA…-3.05%  Backsliding again

Backsliding again

NFLX…+80.14%  This counter just refuse to decline, messing up F10

This counter just refuse to decline, messing up F10

mCap…-9.96%  Decline a little

Decline a little

sCap… +15.9 %  Fast catching up with F10, was 20% behind last week, need to curse NFLX

Fast catching up with F10, was 20% behind last week, need to curse NFLX

I don’t get why you buy five shares of a stock. Isn’t that chump change for you? Can barely buy an iPhone X with tax even if you get 100% return.

Refer to early posts.

Did the market rotate back to F10?

6 FB

6 BABA

25 TCEHY

6 NVDA

5 BIDU

1 TSLA - Added today

All greens  except the newly added

except the newly added  .

.

Looking great!

Since Aug 28,

F10 … .+32.76%  Recover strongly today!

Recover strongly today!

AAPL…+11.46%  The one that matters close at $179.98

The one that matters close at $179.98

TSLA…-5.35%  Backsliding again

Backsliding again

NFLX…+98.31%  Rocket 10% from last week

Rocket 10% from last week

mCap…-14.61%  Double digit decline

Double digit decline

sCap… +23.95%  Narrow F10’s lead by 2%

Narrow F10’s lead by 2%

Don’t Buy Netflix, At Least Not Now $NFLX

In 2017, Netflix generated almost all of its cash from financing activities, of which $3.02 billion from the issuance of debt and $88.3 million from issuing common stock. (Add cf statement) By the end of 2017, the firm has $2.82 billion of cash in hand. Assuming Netflix continues to burn $450 million USD of cash each quarter on operating-related activity, the firm can only support itself for 6 quarters before needing another capital injection.

Now is not the moment to short the stock. After breaking through previous resistance in January, Netflix’s stock price is going all the way North and it is not showing any signs of stopping yet. The momentum of the stock is too strong to short, therefore, I recommend investors to purchase 287.5 (previous minor resistance) Put option that expires in a year to take advantage of the initial drop and wait for the stock’s momentum to weaken before entering the short position.

It’s crazy difficult to make money on puts or shorting a stock in a bull market. It’s way easier to find the tons of opportunities going with the market momentum. I always go for the situations where the odds are in my favor.

I won’t bother with 11% correction. If it happens, buy some calls or short puts to earn some lunch money🐕

F10 is doing well recently. TSLA bought one day ago is already green. My puny investment in F10 is green ![]() more than enough to pay for a dim sum lunch.

more than enough to pay for a dim sum lunch.

If I’m aware of what Netflix is doing as pointed out by this article, Netflix’s real advantage is that it’s a tech company first, would have bought long ago. I wonder whether DIS has a similar application like MOVE. When I was still in IT industry, there are many companies selling workflow applications, most of them have disappeared. VEEV sounds like a workflow company focus specifically for life sciences.

With regard to Netflix, is it time to sell it finally? I sold it once and regretted later. But now the interest rate seems to be taking off, while Netflix continues to fund its operation through debts, it becomes more and more expensive. The US market is almost saturate. International market requires years of upfront investment without making a profit.

Though Netflix has proved me wrong so many times throughout the years.