Hanera likes to create his own obscure language

I FOMO’ed and bought some Netflix. Time to admit I was wrong and get on the train with everybody else.

How many shares did you buy?

Very little. Will scale up slowly.

Hope is more than 6, that is how many I have. NFLX seems unstoppable.

He always says that. “Very little”. How little is little? That’s like said nothing at all.

All you guys trading individual stocks - here is a genuine question.

Premise: Few Tech companies generally become docile in 20 - 25 years time. Many become that in 15 years. So one needs to sell them.

If your income is high, you are paying 33% taxes on long term capital gains. (20% fed + 3.5% net investment tax + 10% state tax). Is it not super high? Looks like you are all okay with that.

Would it not make more sense doing something like mega backdoor roth + 401k (33.5 k+ 18k) and do index funds instead? You get automatic rebalancing and with your roth, you can ear gains tax free.

rocketfast see us no up.

Not necessarily true. IBM is a 100 year old company. If your grandpa had bought some of it back in the 1930s and bestowed them to you, I’m sure you would have no interest in buying any of the hot stocks today.

You are right ! I understand the pain of high tax.

For my case,since my first year of income, I maximize tax advantaged avenues full such as 401k, full Roth,(mega backdoor) after tax and Backdoor Roth, Catch up…etc and then excess funds are used in taxable stock account.

I am also mortgage heavy in real estate for depreciation tax deduction reason and avail every opportunity to maximize fixed mortgages (and cash outs) to make max write off.

I do not prefer “index funds” as their returns are low. While stocks are returning high, the only way to avoid (or postpone) long term capital gain is to hold for long (not selling) like WQJ (FB or TSLA) or hanera’s AAPL. Unless we sell, tax won’t kick off.

There comes hanera’s AAPL which gives him decent dividend (Qualified) return that is taxed at 15% (or zero) or 20% + ca tax.

In the past people used to prefer dividend stocks than growth stocks and many retire/live with dividend income.

This is the main reason, you need to identify good company which can survive long and produce dividend income.

Once a company grows to certain limit, they start giving dividends like AAPL or Cisco or Boeing or T or VZ. They stay in the same level, but produce nice cash flow as dividends.

Check out dividend aristocrats.

By going to stocks (high return) instead of index funds (low return), even if you sell, you are paying tax on your capital gain whatever higher returns you make (buying stocks). In this case, it is worth paying tax.

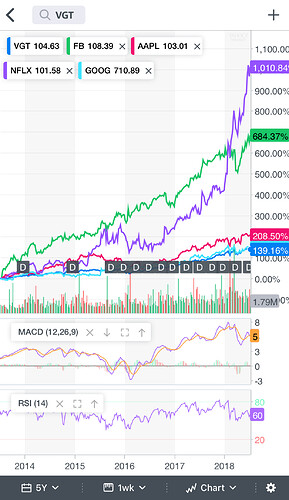

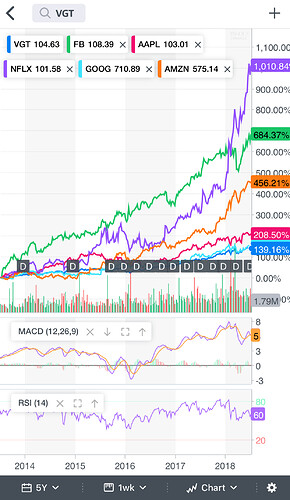

I see what you are saying. If you are investing in taxable, even then, let us take the example of VGT (Vanguard tech etf). It grew by 30% over the last year. The nice thing about it is that I don’t have to sell to rebalance. It will automatically rebalance for me. If a tech stock has done well, I automatically have more of it. If a tech stock stock is not doing well, I automatically sell it. And I don’t pay taxes on any of the sale. In effect, individual stocks will have to grow 40% for me to have the same effect - which looks like a hard thing to do - because you will be buying both winners and losers when you pick individual stocks.

I like how you dumped Amzn and replaced with Aapl…

Let’s compare two approaches.

1: You pick your own individual stocks. Every 10 years you completely liquidate your old portfolio and buy some new hot stocks. Let’s say annual compound growth rate is 20% and you pay 50% capital gain tax.

2: You buy some index and hold it still for 50 years. Compound rate is much lower at 10% but you don’t pay a dime in tax for 50 years.

Both start with $1. Here’s the math for Approach 1:

Pre tax End of 10th Year 1*(1+ 20%)^10 = 6.19

Cap Gain Tax (6.19 - 1) *0.5 = 2.60

After Tax End of 10th Year 3.60

Pre tax End of 20th Year 3.60*(1+20%)^10 = 22.26

Cap Gain Tax (22.26 - 3.60)*0.5 = 9.33

After Tax End of 20th Year 12.93

Pre tax End of 30th Year 12.93 * (1+20%)^10 = 80.06

Cap Gain Tax (80.06 - 12.93)* 0.5 = 33.57

After Tax End of 30th Year 46.50

Pre tax End of 40th Year 46.50*(1+20%)^10 = 287.89

Cap Gain Tax (287.89 - 46.50)*0.5 = 120.70

After Tax End of 40th Year 167.19

Pretax End of 50th Year 167.19*(1+20%)^10 = 1035.21

Approach 2 is easy. It’s just (1+10%)^50 = 117.39

So even after paying crapload of taxes Approach 1 still leaves you almost 10x Approach 2.

You can build your own spreadsheet and play with different parameters. What if you rebalance every 5 years instead of 10? What if your growth rate is more, or less in either approach?

Changing Approach 1’s growth rate to 15% instead of 20 will drastically lower the return to 163.87. Still higher than Approach 2. Any lower the buy and hold forever Approach 2 wins.

Moral of the story: Growth rate matters much, much more than tax savings.

The assumption above is that you can pick stocks and do 1.5 - 2 times as better as large hedge funds (most of whom historically haven’t been able to do that).

Actually doing 100% better than hedge funds is not hard. Many to most of them lose money anyway. It’s doing vastly better than indices that’s not easy.

If you can achieve net worth growth rate of 15% for 50 years, you are a genius on par with Steve Jobs, Mark Zuckberg and Jack Ma. So far I am getting 15%+ p.a. since 1997 thank to AAPL.

Note that I say net worth not stock portfolio.

Annualized growth rate of AAPLs since 1997 is 33%.