I continue to believe in Zuck and Sandberg. Just wish it wasn’t so costly.

So what are you guys going to use after G+ shuts down? Slack?

Google drive, clearly. Design docs, prds, dd, pdds, etc. For everything else, hangouts. Noone uses allo or duo

If you feel market has irrational fear, then FB is extremely great buy now with $153 range.

If not, read this carefully, Risk is yours…

Here you compare GOOGL and FB. When Google PM is 13.2% while FB PM is 39.3%, how is this possible? There is no control or tight security on FB data.

You need to understand clear fundamentals. FB has monetized users data without proper controls. With Euro and US putting additional mesaures, asking them to restrict accounts, usage and higher security, lot of expenses involved coupled with revenue channels reduction. They increase 47% employee addition. Result is both growth and Margin reduction. Mark Z told in the last results conference call that his future margins are not going to be like what is current now.

With the above condition, do you see FB will go back to $217 or worth $217?

Read carefully what I have indicated.

In the past, FB was selling at $217/share when the results had 22.2% revenue Growth rate YOY with profit Margin of 39.3% every quarter. In this case, a person buying FB at $217 will double his money (Through earnings) in 10 years

With current price $153.74, in order to double the money in 10 years, FB should have YOY revenue Growth rate of 20% and Profit Margin of 35% every quarter. Expecting a Dip in growth and Profit margin, the current price is fluctuating between 150 and 160 range.

During this down fall this week, I purchased so many stocks, but stayed away FB even though price looks very attractive.

I am skeptical, Buying/Selling FB, risk is yours. All I say is think on fundamentals, analyze deep and take a dive.

This is my last post on FB as I do not want to say negative about FB as market may think differently or I may be wrong.

Still don’t know the difference between allo and duo.

You and me both, pal.

Easy income is for AAPL. I didn’t say is for TSLA although in the same blog but is in different para - look like I need to use different post.

ATM is $257.50, worth $12 ![]() since is 2 weeks equivalent to $312 per year i.e. more than $100% gain for a year.

since is 2 weeks equivalent to $312 per year i.e. more than $100% gain for a year.

Since Aug 28,

F10 … .+22.91%  Down 5% from last week

Down 5% from last week

AAPL…+37.55%  Down 1% from last week

Down 1% from last week

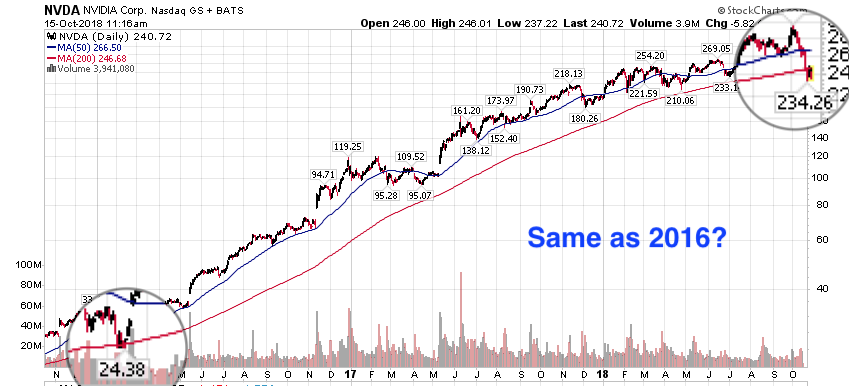

NVDA…+45.45%  Down 18% from last week. manch - Won’t take long for AAPL to overtake

Down 18% from last week. manch - Won’t take long for AAPL to overtake

AMZN…+89.07%  Down 10% from last week

Down 10% from last week

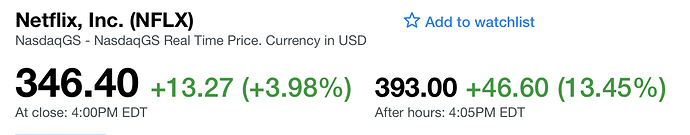

NFLX…+103.18%  Down 7% from last week

Down 7% from last week

DimSum…-8.47%  Down 1% from last week.

Down 1% from last week.

路遥知马力

Can only tell the strength of the horse after traveling for a long distance

Yield To Date

AAPL +30.42%

FB -15.26%

AMZN +50.43%

NFLX +68.88%

GOOG +4.23%

NVDA +23.89%

Decline from ATH

AAPL 5% - Not in correction

FB 30% - Bear market

AMZN 13% - In correction

NFLX 20% - Bear market

GOOG 13% - In correction

NVDA 16% - In correction

Market roars.

Now I look foolish not to buy a lot of TSLA at $250s. Congras, JIL.

Also didn’t buy SQ at $60s, GTC price too low. Congras, tomato.

Those who purchased last week or yesterday, enjoy. All thanksgiving and black Monday stock sale is over by now…

You don’t need TSLA or SQ. Enjoy the big gain in your AAPL porfolio today…

No need to think about any kind of bottom when you bought it at $38 per share like I did…

Good Job Jil! I bought a little on Friday to shore up my portfolio that was down. Turned out to be right choice

Did you buy any?

Don’t rub it in. Obviously he didn’t.