According to a query of over 1,400 active listings for apartments in San Francisco and Oakland, including one-off rentals as well as units in larger developments, the weighted average asking rent for an apartment in San Francisco is currently running around $4,100 a month, which is 5.6 below the weighted average asking rent at the same time last year and 7.9 percent below a peak of closer to $4,450 in the fourth quarter of 2015.

In Oakland, the weighted average rent for an apartment is currently running around $2,550. And while that’s still not cheap, it’s roughly 5 percent cheaper than at the same time last year and 8.4 percent below its peak in the fourth quarter of 2015 as well.

Well, at least on the SFH side, only about 155 homes. That is nothing. Condos (upwards of 1,000 of them?), I would really worry about. As I only follow the Sunset exclusively since it is my home base, I am simply not seeing major price reductions or homes sitting unsold. The feedback I am receiving via Zillow, Redfin and Realtor.com continue to point to everything around here selling if not at asking but above asking price. I know for a fact that China/HK money is still managing to come through to buy in the Sunset. Wife’s friend did it recently. How, I don’t know. I don’t ask questions.

Sure, do I expect this to last forever? No, but I am in it for the semi long haul anyway. I bought for a tad over a half mil and I hope to clear a mil one day soon since that 15 year loan is rapidly going down beautifully. Should be easily doable down the road since we now have that $2M sale breaking through. What has made the Sunset desirable is not going to one day just change. Who isn’t always going to want a SFH with some yard and some parking?

Even a 1000 condos for sale in a city of 750k is not a lot…Look at Miami, probably 8000 condos for sale…155 sfhs is low for even a town of 100k, Hell South Lake Tahoe has 300 houses for sale. and the population is less than 30k…Still a sellers market…Think about how many people need housing…a thousand or two places to live is a drop in the bucket…

Well, that may be low in comparison to other cities but it is something to keep an eye on. The number keeps growing as new product comes off the assembly line. At some point, one would think the numbers or projected sales simply aren’t penciling out and developers will pause. I mean, what is eventually going to happen with these, just sit rotting away? I am thinking haircuts baby, all around!!! Or, rental market. Why not? Make some money on your decaying building and hope for a better tomorrow.

According to Redfin Miami with a population a little over 400k, there are almost 5000 condos for sale.

With Miami beach over 3000 more…and Miami beach only has a population of 91k

Months of supply is the key. How many months does it take to sell all the inventory? If it’s only 1-2 months, no worries. Socket site did not even provide months of supply, intentionally causing sensationism

I watch the average DOM meter…A sellers market is less than 5 months…BA is still less than 30 days…Most sellers expect to sell in 2 weeks…Unique in the whole country…

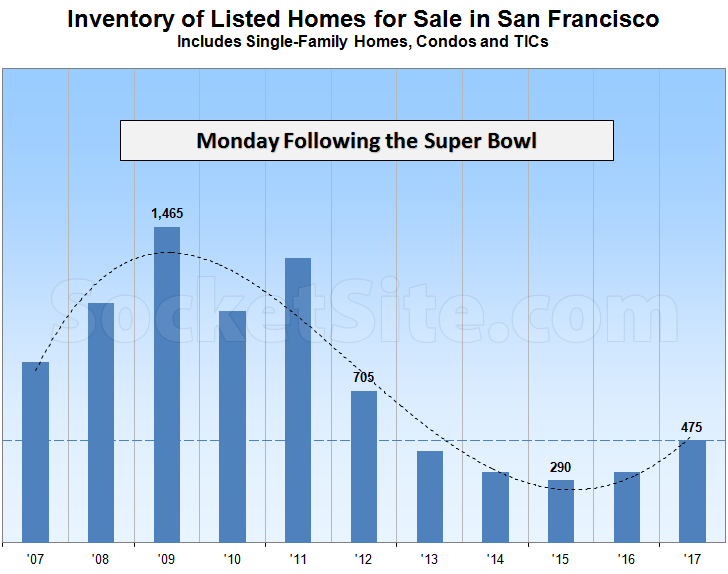

the number of single-family homes currently listed for sale in the city (155) is now running 28 percent higher versus the same time last year, the number of listed condominiums (320) is 55 percent higher

Number of SFH is 28% higher in SF.

320 condos for a city of 800K people is not exactly flooding the market IMO.

see the next line, I think the inference is that there is much more than that, like 1,000

1000 is still no big deal

Those are teaser listings, i.e. not real:

goosed by teaser listings for new construction units on the market, the vast majority of which are not included in the aforementioned counts and the inventory of which currently totals 1,000

And I agree with @Elt1. Even 1,000 is no bigger for 800K people.

Regarding your precious lil condos:

In terms of measuring potential buyer demand and actual behavior in a weaker market, keep in mind that despite a 12 percent dip in pricing, new condo sales dropped 25 percent last year.

not a rosy picture…and more is coming!!! Nothing escapes the law of supply and demand Sir!!! Nothing!!!

There is plenty of demand…It is all about price…If the sellers want to sell they will go quickly…If they don’t they can be rented…