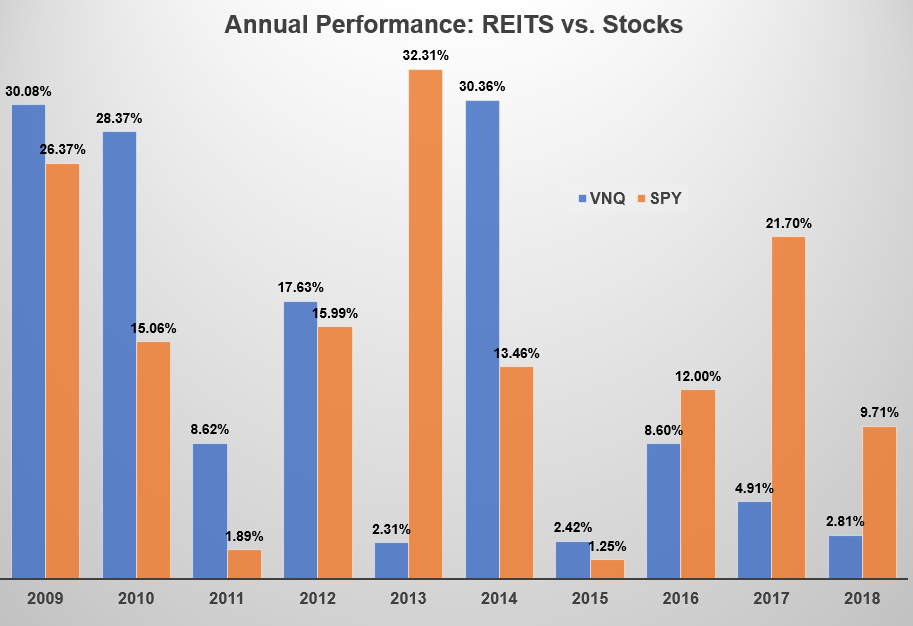

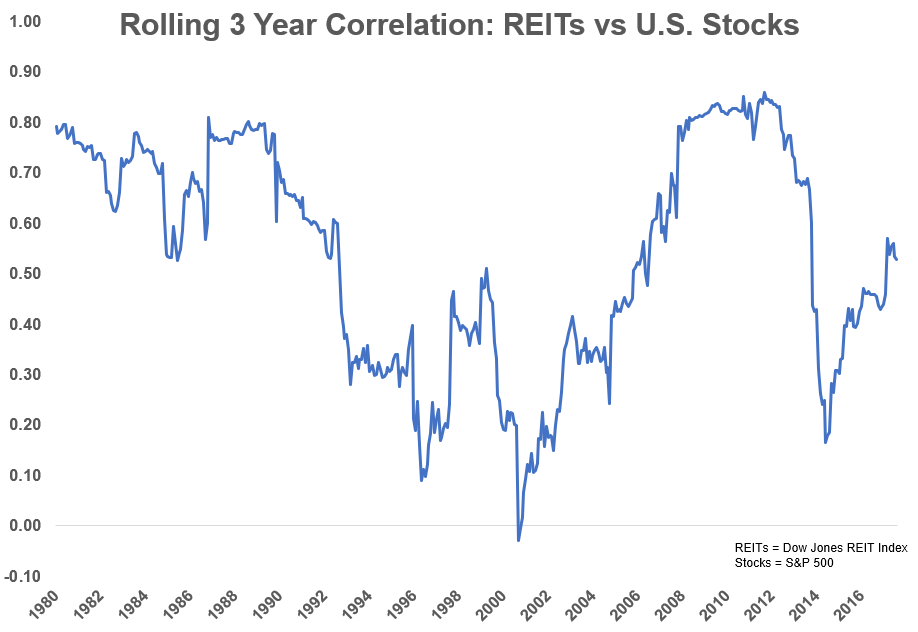

From 1978 through July of this year the Dow Jones U.S. REIT Index showed returns of 12.02% with a standard deviation of 18.25%. The S&P 500 saw returns of 11.74% with volatility of 14.77%. But if you were to use a mix of 75% in the S&P 500 and 25% in the REIT index, rebalanced annually, the return would be 12.11% with volatility of 14.18%.

TL;DR

Is the cliff note in a nutshell is REIT + Stocks is a good strategy since they are not correlated?

real estate correlation is around .5 with major asset classes. So not terrible, but not great either