Your own decision ! Sorry, I can not help…

It’s really not that bad. If your biggest bet is 10% of your portfolio, then it means you’d cut the loss if it goes down by 10%. Putting 10% into a single options trade is pretty intense. I limit myself to 5% per options trade and 4 trades at a time max so 20% total. Part of that is just the time involved in tracking them.

For stock positions, they need to be big to make a difference. There’s not a lot of point in 5-10% positions.

Moving this to MRNA thread…

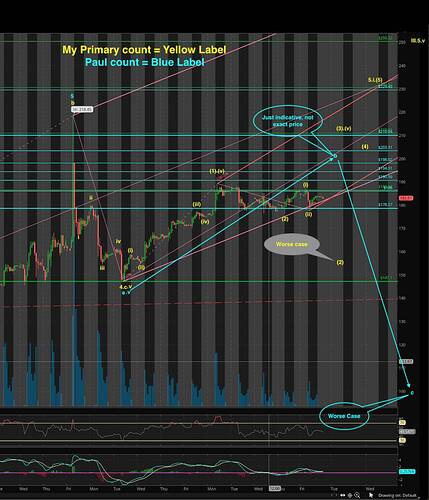

Here is Paul’s EW,

the wave 3 ends at $178,

then 4.a around $140,

then quick repulse back 4.b at $168 (Note here 4.b never exceeded peak of 3!)

and then comes to 4.c at $102 range.

Overall, 3-4 is a clean downward trend correction wave from $178-$102,

The next wave $102 to $218 is an impulse bullish wave which exceeds the previous node 3 ($178) and will be the wave 5. This is 100% in line with the Elliot wave Theory.

One thing I’ve done lately (since I’m mostly in volatile momentum stocks), if I feel some wind shifting or see topping patterns, I’ll buy a chunk of UVXY overnight or during the particular hours of the day to mitigate some risk. Sure, I can lose a few percents of UVXY but upside is much bigger for protecting my daily portfolio losses.

You are describing a zigzag ![]() In an impulse, the first zigzag means either wave two or wave a of a wave four or a triangle, although occasionally occurs as wave four.

In an impulse, the first zigzag means either wave two or wave a of a wave four or a triangle, although occasionally occurs as wave four.

His chart didn’t say so. Where is his latest count that reflect the short squeeze to $218? And to now? I want to see how he labels the move from $102.66 to $218 and from $218 to $147.10 ![]()

Guess you don’t have his latest count… have you continued to count you would be surprised!

Anyhoo, I am keeping Paul’s count as alternative which is actually bearish short-term (few weeks time frame). That is, if I continue Paul’s count, MRNA could drop to $100. so I am monitoring closely.

Read up more ![]()

Elliott Wave Patterns: What is a Zigzag?

Zigzags are typically found in the 2nd wave of a 5 wave impulse

https://www.24elliottwaves.com/elliott-zigzag-trading

One does not often come across the zigzag pattern during a shallow corrective phase like the fourth Elliott wave.

This is in dream now!

MRNA can fluctuate but not to that level of $100, it can reach $160 lowest (IMO) = 102+(218 - 102)*0.50 = $160

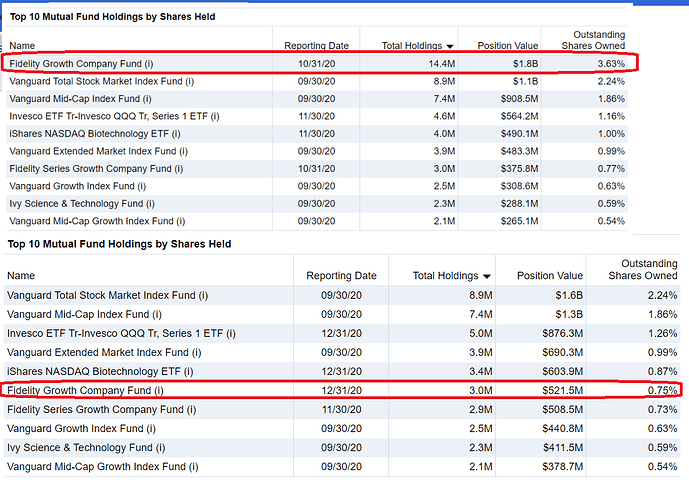

The fundamental reason why MRNA went down during Dec was Fidelity growth mutual fund was taking its profit after 580% run. They were the largest holder until Dec 2020. FDGRX had 67% growth last year! They are one of the best growth fund !

Last qtr, fidelity’s alone sold 11.4 Millions shares of MRNA from 15M holding to 3.4 Millions. However, other institutions like Vanguard acquired the stocks keeping the institutions holding same level now at 51.2% holdings.

That’s my count ![]() 's worse case which is not high probability. Paul’s count is BEARISH. Just show me his count to last Friday close. If you can’t get Paul’s latest count, show me what you think Paul’s count till today would be. I am withholding this grading: “F for your EW understanding because you support Paul’s count yet believe price behavior that support my count.”

's worse case which is not high probability. Paul’s count is BEARISH. Just show me his count to last Friday close. If you can’t get Paul’s latest count, show me what you think Paul’s count till today would be. I am withholding this grading: “F for your EW understanding because you support Paul’s count yet believe price behavior that support my count.” ![]()

How come you are attaching after-the-fact reason to price behavior now? You said is all planned by market makers ![]() ?

?

Refer to the chart below (hope you look at it ![]() )

)

Yellow labels = My Primary count

Blue labels = Paul’s count (alternative count)

You do not understand how trading or how market forces are working, that is why laughing at the “after-the-fact reason to price behavior”.

With the same ignorance, when news/media nicely written (wrong) posts about millennials, you believe they are the real force.

You must know how market forces HFT, Trading desk, banks, funds are working. It is beyond my level to discuss further.

I understood well before, took the screen shot to verify the changes. If I do not have such understanding, I can not excel well with current market!

Paul is promoting his business and he does not publish daily. He gives, at times, nice correct EWs so that people will follow him and subscribe to him. I am not a subscriber, but just scan him for ideas.

He is a good businessman. Post the initial few waves that sure to be correct regardless of the higher degree waves (initially they are the same for both cases) and then stop posting.

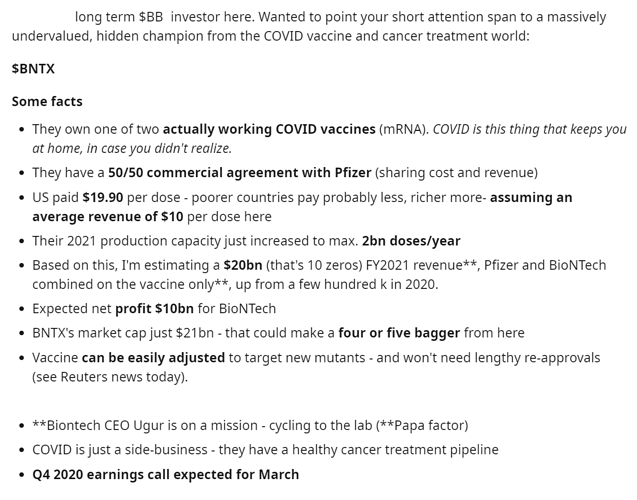

BNTX: Just eyeballed the daily chart for BNTX, look like a rising wedge around to roll over. Assuming the writer is correct, for safety, buy after the dip. Not going to buy his shares ![]() May be he wants to sell his

May be he wants to sell his ![]()

His intention, definitely, is not selling stocks, but sharing his due diligence with reddit community.

I hold more than 1000 BNTX stocks since $82 range. If dips, I will buy more. This is my second buy and hold stock ! This is slow raise stock, but institutions are holding 94%. IMO, This will touch $200 in next 2 years and grow more.

$80k and you pump so much? Next time pump only if you have put in $500k like @wuqijun

Btw, rising wedge normally drop back to the bottom of first zigzag i.e. $100, if you buy, would be average up in price

Why dump any money into these companies. COVID is not here to stay. Where are they going to make money after COVID is over? Do you know who the CEO is and does he have a strategy post COVID?

How is covid is not going to stay? Who provides such solution or medicine?

Even the experts today say that even if you have been vaccinated

You must where a mask do not travel and not go to restaurants

Why does everyone think this covid19 nightmare is over?

I bet there are millions of people that will never fly again

Never go on cruise ships, concerts, sporting events or any large gatherings. Covid19 has been a huge traumatic event that will

change society forever.

The better analogy is who makes the flu vaccine and how many billions is the flu vaccine business worth? That or any of the other vaccines people have to get.

COVID is a virus. So are smallpox and polio. Both smallpox and polio are now eradicated by vaccines. COVID will go away just like them. Not a good long term investment strategy.

@Jil is not good at debating. His investment thesis for MRNA and BNTX is not Covid only. It is the mRNA platform. Covid is the first successful application of the platform which would bring in the necessary cash to fund development of other applications. This is similar to Apple’s candy iMac and iPod (both are fashions) that bring in the cash to fund the development of the hugely successful iPhone, services, wearables, M1 devices and possibly Apple Car. For TSLA, car is the instrument that bring cash to get into energy distribution? Out of my depth ![]()

Interesting thesis… good luck!

100% right! Thanks for the summary! You saved my time !!