Moderna has almost 3x since I invested at January low. I should have bought more…

We (myself and partner) missed the boat big time !

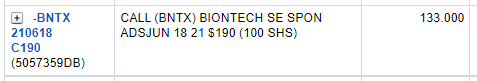

We just sold for double the profit. Here is the screen shot of my old holdings.

My partner was regretting, yesterday as he bought 25 call options. Now, neither share, not options.

It was great mistake.

.

You have missed many boats, otherwise you would have NW similar to @wuqijun. Many of your buy n hold ideas works but you always sell them when it becomes volatile. You can’t stand volatility. You have to learn from me and @marcus335 I recall @marcus335 bought TWLO and it declined 50-80% (can’t remember exact number) but he held on and now made 10x (I think, may be more).

I sold mine slightly above $200 and closed that account. I have closed all except one trading accounts. Idea is to minimize trading and reduce the number (type) of tickers.

Uber dropping them was amazing long-term. It hid the underlying growth rate.

I took your advice and bought 300 shares at $112. Home run. Will never sell

Based on your advice bought 400+ shares of MRNA & 600+ shares of BNTX in Dec.Plan to hold them for long term.

Buy and hold is not enough. Need to buy and hold in BULK. For example, if you believed in MRNA, should’ve bought at least 2000 shares when it was at $25. Now, you need to buy at least $500k worth of MRNA in order to be meaningful. Otherwise just lunch money.

Now that you have higher NW, change from $50k to $500k?

This lesson is for @manch. I have thrown in all I got into AAPL in late 1990s/ early 2000s, so I knew this idea. Look like I need to use absolute like $500k, word like all in (as in all your investible funds), he doesn’t understand English ![]()

Nothing to do with net worth. Has to do with lifecycle of the company. For example, back in 2012, I only spent $50k on Tsla. That investment is very meaningful now. But I don’t think buying only $50k in Tsla today makes sense anymore as Tsla is more mature. So I spent $500k to buy Tsla this year.

.

NW matters. It means if you don’t have high enough investible funds, no point investing in TSLA and MRNA now ![]()

I thought H-NW > W-NW !

That goes without saying. Unless if you’re just interested in earning lunch money.

AAAGH. I sold MRNA at a huge loss in Feb…we needed the money for the house purchase so I let it go. SO annoyed at myself. Good job all who held!

.

This type of situation is common. Hence is always better to invest with spare money, money you can afford to lose it all. I sold some AAPLs to buy a SFH in 2007, didn’t lose money but miss HUGE gain. I can’t help it, essentially cash poor then, need to sell AAPLs to buy big ticket item like SFH in CU.

“spare” money is a foreign concept around here…

unreal, a 4x for me now. I had to get options approval for my ROTH as I’m ready to do some aggressive CC’s on this for the short term.

MRNA looks like it’s consolidating and ready to make another big move. I haven’t been looking at this for a while but all my other small biotechs are ripping. Looks primed. Anyone have TA for MRNA?

Bought and hold. Still bullish. But is it cheap enough?

I don’t think being cheap or expensive matters anymore. Almost every stock is inflated by historical measures at this point. Just riding the momentum wave and charts/TA can be an indicator.