Why?

I considered going to roth actually just so i can trade options from time to time. Then said dont be stupid and greedy.

Vanguard 401k does have brokerage option but doesnt allow options trading.

Why dont you show me the math why not.

Is it because conversion is taxed highest bracket, but eithdrawals will be taxed at different rates as you withdraw more?

Starting with $1,000. Assume tax rate is 30% for everything. Compound growth rate 10% for 30 years.

Roth:

After tax: $1,000 x 0.7 = $700

After 30 years: $700 x 1.1^30 = $12,215

Gain: $12,215 - $700 = $11,515

Tax: $11,515 x 0.3 = $3,454

After tax: $12,215 - $3,454 = $9,061

Traditional:

After 30 years: $1,000 x 1.1^30 = $17,449

After tax: $17,449 x 0.7 = $12,415

Tell me where I did wrong in my math.

There’s no tax on ROTH Withdrawals.

What about traditional?

Traditional is taxable, i believe.

you will arrive at the exact same number if you never sell.

OK, so if Roth has no tax for withdrawal but traditional tax everything, then same for both.

Retake your algebra please ![]()

This is basic algebra

(Balance * 0.7) * 1.1^30 = (Balance * 1.1^30) *0.7

Difference is if you sell every now and then.

Pretax might get ahead since low incomes have low taxes and it increases marginally.

OK now I remember how traditional and roth work. The math would come out the same if tax rates were the same.

But most likely the tax rates won’t be the same. People’s earning power tends to rise with age until retirement and with that higher marginal rate. Traditional would beat Roth under this scenario. But tax rate may rise in the future too.

With traditional you also have a bigger cash pile at the beginning. This can be critical for investment with higher minimum threshold like real estate, but doesn’t matter as much in stock market. Unless you really are talking about BRK-A or something like that.

I also think I can afford to hire a better tax strategist 20 years from now, who can help me with some loopholes that I am not even aware of now.

Traditional can have both deductible and non deductible contributions, so be careful

If present marginal tax rate is less than future marginal tax rate, Roth is better. Last four/five years, based on my stock investments returns I will be in to higher marginal rate after retirement as I will pay off all my mortgages at that time.If I continue to pay traditional 401k, I will be forced to pay lot of taxes based on RMD.

It is all how much return on investment you get now. Your future tax rate depends on returns in your retirement account. Hiring tax person 20 years after is too late. Calculating future returns, based on last 5 to 10 years, will provide you a balpark figures where we will land in future.

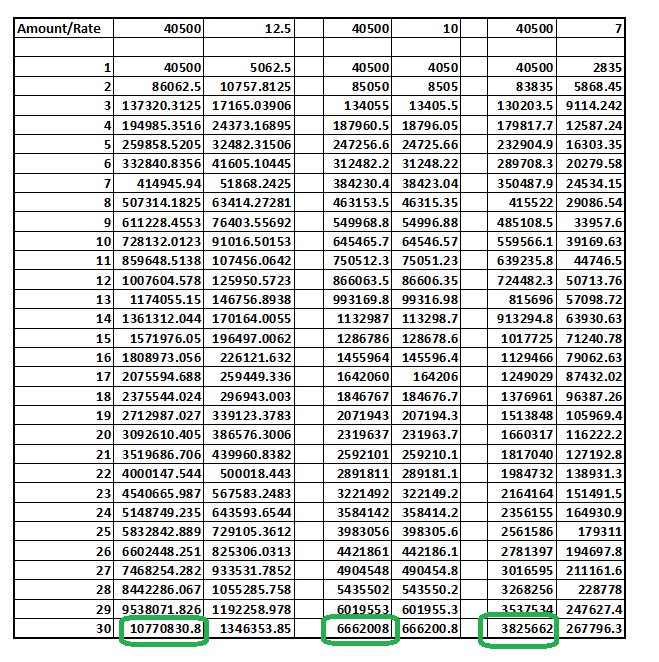

Here I assume a 30 years working person, uses $5500 Roth IRA and $30000 megabackdoor (auto roll in plan as given above) until age 60. Three different rates I assumed 7% (S&P500), 10% and 12.5% which is possible by common investor. Even with 7%, the person will end up 3.8M, with 10% reaching 6.6M and 12.5% it is 10.77M.

I haven’t read up on mega back door. So are you saying with mega back door people can contribute 30k a year? Right now the limit for 401k is 18k and IRA is 5500.

I only have a Solo 401k for my business.

Yes, Mega back door is mainly from after tax 401k contribution.

Now, the rules are changed as per this link Automated Roth in plan conversions better than Mega Backdoor to Roth IRA? - Bogleheads.org

Based on the rules, every time someone contributes to After tax 401k, we can automatically convert to Roth IRA. with this, they can possibly contribute 35k/year Roth conversion and 5.5k regular Roth or backdoor Roth counting total 40.5k.

To my knowledge, all the 401k rules (limits 55k) are same to solo 401k. Additionally, you can contribute for your spouse too with solo 401k and same Roth and after tax is applicable too.

https://www.nerdwallet.com/blog/investing/what-is-a-solo-401k/

OK. This is another piece on 401k:

http://www.jhwfs.com/after-tax-401k-contributions/

I have my business contribute to my and wife’s 401k. So together with personal contributions it’s very high already. I suppose I can get right to max $55k per person limit with after tax 401k, but I’d rather not because I am saving down payment for another house. There’s a limit how much you can borrow from your retirement accounts.

Cool guys! Learned something cool today. This is where our forum shines.