Is AWS an enterprise software?

Marc says enterprise software company not a cloud computing company or a cloud infrastructure company.

Who is that old man in the photo?

SPLK, SHOP and VEEV are above 200-day and 50-day SMAs ![]()

NTNX exhibits double bottom!

Jil - Not sure why you want me to sell all above? Technicals look good.

I am not suggesting you to sell.

This current volatility will go off soon, but that will not be perm.bull run. If we get next one, say in 3 or 6 or 9 months later, that will be severe (may be recession, we do not know) as FED would have added few more 0.25 rate hikes.

These are not great bull run period, but slow recovery period.

We need to hold fundamentally strong company than looking out technical.

Technical is only for traders, not for buy and hold.

Technical look good should be Fundamentally looking good and buy them now.

Just happened to see this pages

For one reason, why I was behind TSLA repeatedly when it was down and when analysts were putting negative opinion when Musk tweet issue was going on? I was repeatedly buying again and again, why?

All those negative hypes are sensational, but company is fundamentally strong to deliver and make profit.

Even if there is loss making, if you know fundamentals (esp financials) are going to be positive, then holding is good.

If you have $50k fresh money to invest, which one (1 only) would you buy?

MPVTC

MSFT

PYPL

VMW

TMUS

CRM

Note: Two cloud kings is in the list

Cloud Kings

ADBE

CRM

NOW

RHT

VMW

SPLK

WDAY

I’d chosen SPLK. Which one would you choose?

You can cross out RHT now. It will be part of IBM. For now I will buy CRM, but I need to research more in this space. I just finish researching CRM. Let me do a deep dive into NOW now.

I would choose AMZN or ADBE as I have AAPL.

Or I would suggest keep the money as cash and when you see a deal sometime when some good stocks are falling, get in.

I just got into Boeing (BA) like that recent fall, that is where we have good margin.

ServiceNow was founded by Fred Luddy in 2006. This is what his Wikipedia page said about him:

Luddy grew up in New Castle, Indiana, the son of an accountant father and a Catholic-school teacher mother.[2]

Luddy went to Indiana University, but dropped out, as he was spending too much time doing computer programming.[1][2]

In 2004, his then net worth of $35 million was lost due to an accounting fraud at his previous company, Peregrine Systems, of which he was the CTO.[2]

Luddy founded ServiceNow two weeks before his 50th birthday, “I couldn’t wait, because there was something psychologically that said I couldn’t start a company at 50.”[2]

Luddy stepped down as CEO of ServiceNow in 2011, then focused on product development, and moved at an advisory role in 2016.[1]

In April 2018, Luddy’s net worth was estimated at $1.1 billion.[1]

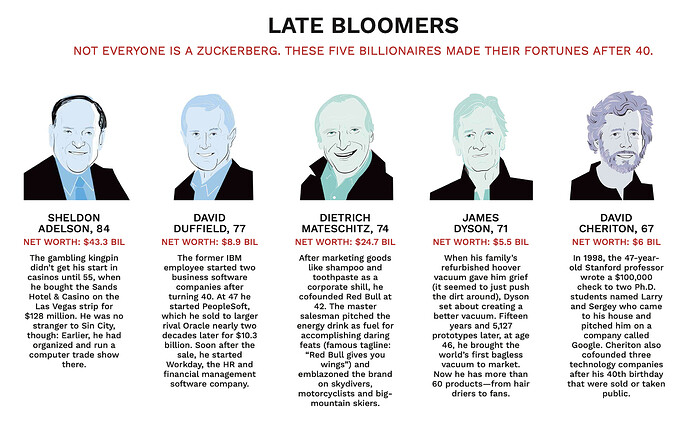

Very interesting life story… ![]()

50 years old  start a hi-tech company. Impressive.

start a hi-tech company. Impressive.

There are a few 40s old farts here, when are you guys starting a company?

From EW perspective, the duration is too short to have completed wave 4, so likely to be at wave 4.b. So I’m quite reluctant to buy now. Btw, wave 4 comprises a wave 4.a (down wave), a wave 4.b. (up wave) and a wave 4.c (down wave).

Is Santa Claus coming tomorrow?

I got this email today

Midnight Deadline Approaching

Just a final reminder to take advantage of a market that is primed to start back toward record highs we saw earlier in the year (and much higher, I’m convinced).

For starters, you get 30-day access to Zacks Ultimate with all our private buys & sells at a critical time when great stocks are "on the cheap."

Your total cost: $1. No obligation t

Nutanix, meet your fate: Death.

That might squeeze out NTNX if the customer used amazon cloud and on-premise. I really thought on-premise was dying. That’s why Dell bought EMC to try delaying the inevitable and to get VMware.

https://finance.yahoo.com/quote/COUP/financials?p=COUP

They have impressive growth. I really don’t get it. Their product is mediocre. They literally took your average mediocre procurement interface, made it web-based, and sell it as SaaS.

https://finance.yahoo.com/quote/AYX/financials?p=AYX&.tsrc=fin-srch

Their product is actually cool. It lets you query and join across different database protocols/technologies.

One huge minus for ServiceNow: its current CEO is John Donahoe, the loser ex-CEO of eBay.

I can’t tell the two men apart. To my Asian eyes Luddy and Donahoe look almost the same.

Yesterday, in this article, 3 Financial Stocks to Buy While They’re Cheap, InvestorPlace pumps SQ. Today…

Pump and dump…

• Veeva Systems (NYSE:VEEV) has taken a turn for the worse, down 4.5% now but off lows from a sudden plunge, after Citron Research tweets out a price target indicating 34% downside from yesterday’s price.

• The firm’s price target is $65, vs. yesterday’s close of $98.90.