Sell and have dinner at HDL?

![]()

in China or HK?

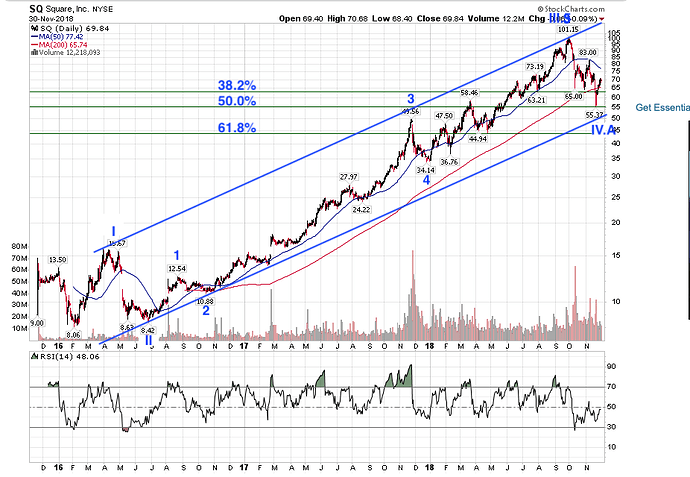

SQ is either in Cycle degree wave IV.B, up wave or wave V. Unfortunately this is a multi-year wave which means my calls can be decimated, for wqj who is holding shares can sleep well and let it rip.

@hanera You need to put an @ sign in front of my name. Then I will get a notification when I log in. I almost didn’t see this post.

As I mentioned earlier I turned optimistic at the end of last year. I am in the market now but with caution. I think the earning season next week can have some negative surprises from big companies. That will be a buying opportunity.

You mean Apple and Tesla? ![]()

Both Apple and Tesla already disclosed their information ahead of time so there will be no more surprises to show. The only negative surprises will be coming from the companies that haven’t revealed anything yet, such as Amazon.

Can’t remember when did I start the 10x portfolio, just assume the auspicious day of Jul 18, 2017.

Also didn’t define 10x means what, let say is 10x over 10 years i.e. 26% annual appreciation for 10 years.

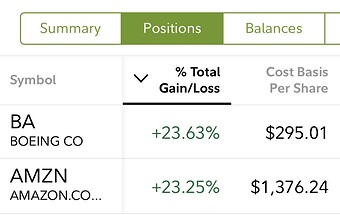

To date, 10x portfolio up 148% since Jul 18, 2017 i.e. over 1.5 years approxly => 30%, above the necessary 26%

You can’t count anything out yet. Forward guidance matters a lot.

Absolutely. I plan to buy Amazon at below 1k when it misses the forward guidance.

![]() I would buy $50k worth ie 50 shares.

I would buy $50k worth ie 50 shares.

Did you buy this time dip?

I bought AMZN last time at $725, but prematurely sold at $1250, regretted selling at that price, waiting for $1250, but finally got it at this price.

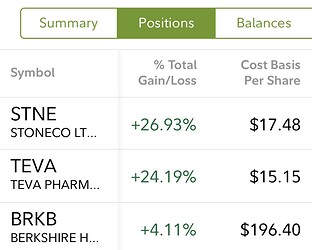

Here you go (except BRKB, everything else on 12/26)

Same way, STNE, TEVA and BRKB.

Was good timing. But I didn’t buy into it because I felt I already had too much allocated and didn’t want to use more margin.

Buying Amzn at below 1k was a joke. Not expecting that to happen

You should up it to 300% using portfolio margin ![]()

You should’nt be advising people to use risky margin when you don’t even dare to spend one cent on margin yourself…

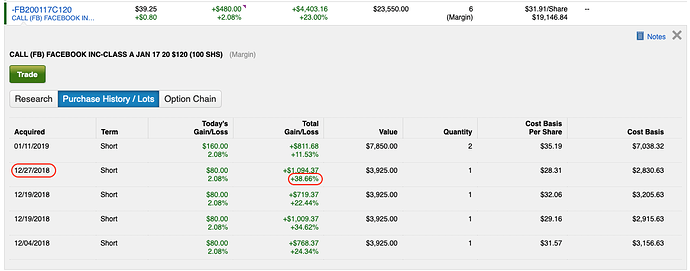

Walau eh, @Jil is always bragging. Look at my Fb calls purchases… Yes I did, up 38.66%

Actually I have 10 calls, sold 4 in anticipation of a retracement as pointed out earlier in the FANG, ANT, BAT thread.

TheStreet bashed SQ, Square: Avoid This Red-Hot Stock

Closed my calls upon reading the article for a small profit. Also closed PANW. Reducing exposure ![]()

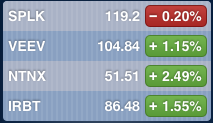

My 10x continues to rock hard ![]() pretty near to ATH established last year.

pretty near to ATH established last year.

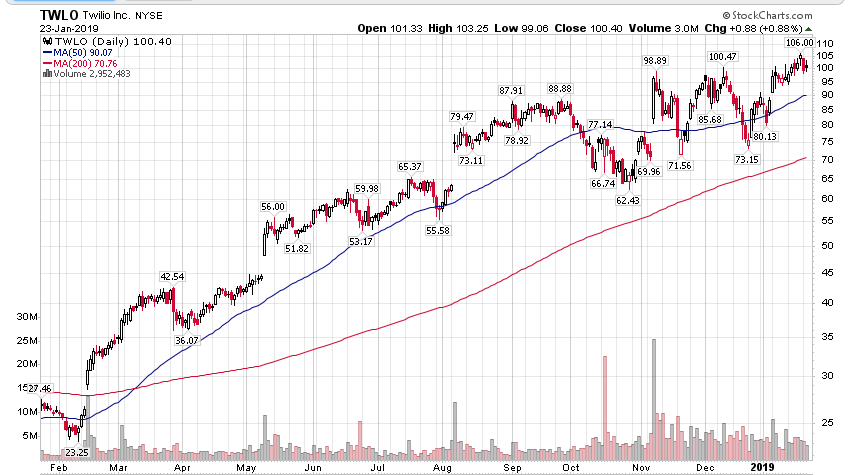

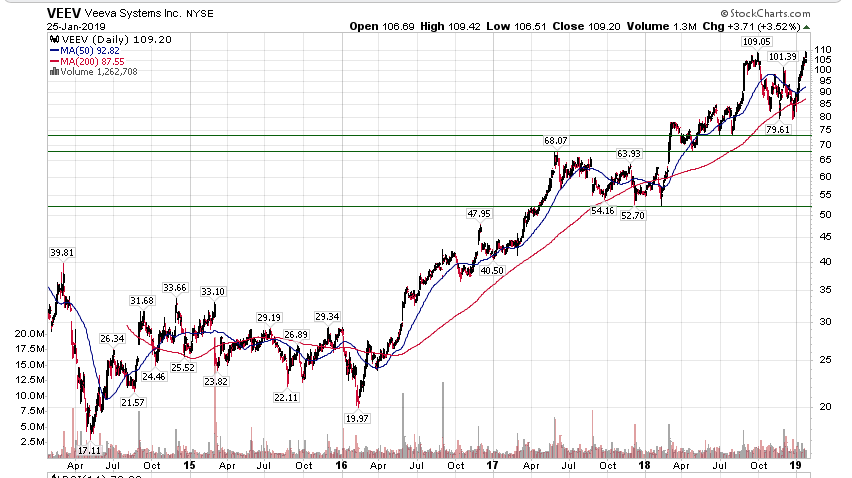

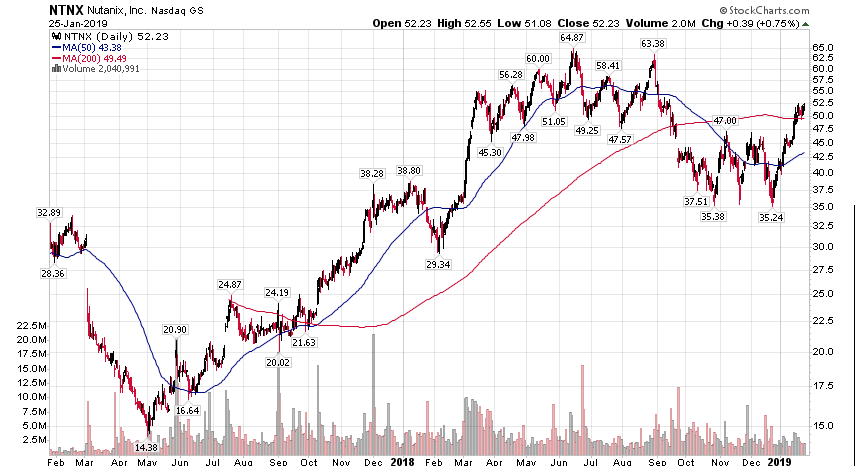

3 of them above 200-day SMA, view by market as in long term uptrend ![]()

My wife recently bought a xiaomi vacuum robot for our house. She did her own research and concluded it’s the best on market and cheaper than IRBT. So far it has been working great.

She single-handedly confuse the investors whether to buy or sell iRBT!

Longer term, I believe it would hit $130 ![]() Watch me make $$$

Watch me make $$$

Loser company. Put your money elsewhere.

I second this on IRBT…too many competitors, even though product quality is good, eating their profit margin. Change companies like UBNT, PFE or ABBV, LRCX, AVGO…