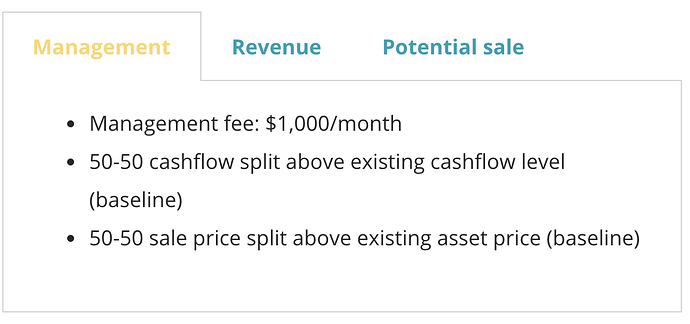

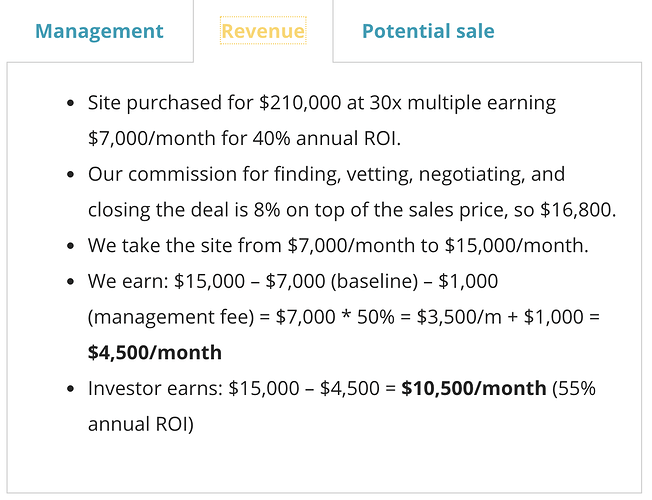

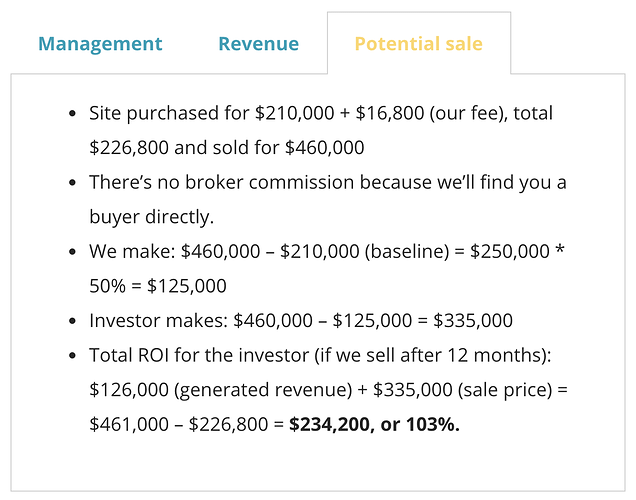

A buddy told me about this website that sells other websites. They can even run it for you for a fee and later sell it for you. Kind of like a “flipping + property management + real estate agent” but for online businesses.

30x earnings is insane. Most small businesses sell for about 2x. Why pay far more than SPY earnings multiple?

If it was really that easy to do and profit, then they’d buy the sites themselves.

The same criticism can be said about flipping, or any investment at all. There are always buyers and sellers in every transaction. Just that some people chose to sell doesn’t automatically mean it’s a bad deal.

30x is too rich a valuation. Not sure if they chose it to make their numbers look better. I surely won’t pay 30x for a website with no moat. Yes, most small biz sell for around 2x PE.

Paying 30x for a business that normal sells at 2x is a path to financial ruin. You’d have to find another fool to pay 30x.

For any business, the website is just an interface with the customer. What is the activity that happens in the backend. For example, AMAZON is not just a website, but an interface with a giant supply chain and fulfilment system.

Upto 3x for a good small business is OK. But, not all small ones are same. For example, you could buy a subway for 50 k (about 10 years ago). But, buying a subway or any business is like buying a slave job for yourself. There was a time when having a two or three subway meant good passive income, but these days these franchise owner take all the cut. So, even 2x seems like a lot for buying a slave master for yourself.

There’s another website to buy and sell businesses. I learned about it from @tomato:

It mostly lists brick and mortar businesses but my buddy told me they have online businesses as well.

Speaking of brick & mortar business, I always thought W2 income can’t be deducted for loss from those business, but apparently you learnt something everyday (learned from a doctor that his CPA is doing this: Tax Reduction Letter - Apply Section 179 Expense against W-2 Income

Maybe some of you already know about it, but do share if you do know any way to deduct W2 income through investment

the 30x referenced is monthly, not yearly. So 2.5x yearly net. Very comparable to your 2x example.

Most brick n mortar sells for a multiple of yearly net. Like laundromats are usually 3-5x yearly net, higher than others since its more absentee. Most other businesses are 2-3x yearly net, depending on how much the owner has to operate it.

Websites sell at a multiple also, but are almost always expressed as a monthly net multiple, not yearly. Due to the fact many sell prior to even being around a year or 2.

bizbuysell is good, but the best for CA is bizben. They only list CA businesses. I personally found a wine bar in Oakland off of bizben in 2012. Owned it 3 years and flipped it after making it a lounge. I also found and purchased a convenience store and 3 apartment mixed use building in Oakland in 2014 off of bizben. Great site.

Great catch. I didn’t check their numbers. It all makes more sense now.

the best for buying websites/online businesses is empire flippers. The businesses are vetted and there is an escrow process to protect both sides. mainly Amazon FBO, dropship, e-commerce, but some SAAS companies as well. My buddy bought a SAAS business for $600K 3 years ago, and used an SBA loan and only had to put 10% down. He puts in 10 hours a week and nets 200k. I’ve tried finding others like it, but haven’t tried hard enough.

What kind of SaaS biz is it? What does it do?

he tried explaining it to me, but I still can’t understand it. Some type of Microsoft Sharepoint server business. but not h/w

30x makes the business sound more productive that it actually is.

How would it sound if I say 120x return?

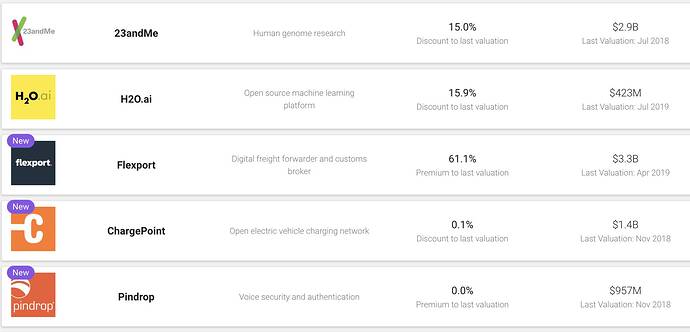

My 2 cents for all private placements.

Equityzen or sharespost , I would suggest stay away for those investors having cash less than 10 M.

My friends bought lyft, Robinhood using such platform stuck their money forever and also underwater, with hefty 5% charges.

Main issue : Liquidity.

SEC rules (safer) do not apply pre-IPO and we may not know proper financial information to assess the health of a company.

Rarely they hit a. Great company like FB.

It may take 10+ years to see returns.

Read the prospectus and understand the details! You are buying equityzen mutual fund not exactly the shares of that final company. You are forced to sell to equityzen after ipo also with 5% commission.

very good advice.