I try to stay away from master-metered properties. (gas, electric - it’s normal that the LL pays water and garbage). I believe “free” electricity and gas does not encourage tenants to save.

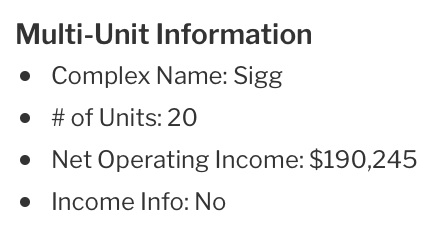

We had one 6plex in Boulder Creek where all utilities were master-metered, and we had private electric sub-meters. The tenants were billed monthly for electricity, gas, water, even garbage. The gross rent was $84k/year, and landlord’s only expenses were taxes ($8k), insurance ($2k) and maintenance ($3k). We were looking at ~$70k net.

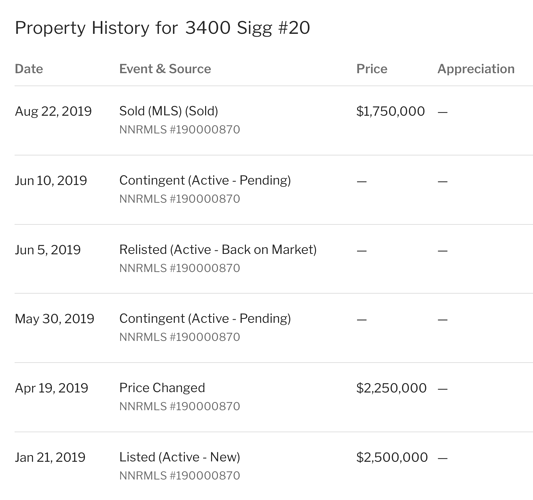

I had the property listed for $995k, and dropped a few times (10% each) to $825k.

It sold last month for $812k.

With the as-is rent, that was around 8.5% cap.

Keep in mind, half of the rents were low, e.g. a 4-BR detached house was rented for $1700, with new paint and carpet, that should be $3000/mo…

the new owner is relocating the tenants unit per unit… investing about $75k… will collect $120k/yr

($105k net)

His cap rate would be 105/(812+75) = 11.8%

There’s a potential to do improvements beyond 75k, one could even do an addition to 2 of the buildings… my experience is that cost of construction is too high to make a good rental, but it’s a possibility.

I really liked the property, was a difficult decision to sell, as are some other upcoming sales, but it’s the only way to break up with a business partner.

Here is the redfin listing:

https://www.redfin.com/CA/Boulder-Creek/12869-CA-9-95006/home/2382557

![]()