For whatever reason, my goals were very much aligned with yours our fearless leader (this wasn’t the first time, I think)! I don’t know it could be the age (tempted to find our where you are). I haven’t really looked into Florida much, maybe I should as well. My thinking is I could buy one more property in BA right now, but wanted to balance with some cash flow opportunities (it could be REIT / Dividend stocks, Out of State property, Crowd funding multi-family deals, or some local Investor funds for flip projects). Have been following @Jil’s posts around REIT and Dividend stocks, but I am more scary of putting in large amount of money to Stock market. My only experience has been dollar-cost-averaging with retirement accounts or company RSU.

I used to sneer at people buying income properties. I thought of course you want to go for appreciation. But gradually I started to see their point of view, and I want some of that cashflow for myself. My current goal is to grab an additional 100K/year cashflow. Whatever I bought over the last few years are starting to turn the corner and cashflow is increasingly positive. I figure with another 100K I don’t need to worry about income for the rest of my life. Well, baring some unforeseen disasters which because they are unforeseen I can’t do much about them anyway.

I try hard to remind myself to be open minded. That’s why I like to study markets all over the US and sometimes even abroad. Money is money. It doesn’t matter if it’s in Texas or California or Florida. For stable income I still prefer real estate over stocks. I like to get deeply involved in a couple markets and I want direct control. For a REIT it most likely invest in many different markets and sometimes in different asset classes. No, I don’t want that, unless you are talking about bigger commercial projects like office buildings. If it’s residential why can’t we do it ourselves?

Hong Kong was pretty good even 2-3 yrs ago

My friend was in the business of chopping up rooms

he purchase his last one 2 yrs ago around 5 mil the older apartments. 30% down and monthly around 20 something k. he chop up 6 rooms for 5.5k each. now i think is more 6k each. pretty much he’s retired now and he’s only less than 40

You can’t live off of appreciation unless you sell. You can live off cash flow.

Chopping up rooms is pretty sketchy. It’s against the law but somehow nobody cares. If a fire broke out and many people died because of the lack of escape routes you bet they will crack down hard. Anyway Hong Kong just tightened mortgage rules again.

No, you can’t. But what I found out is, with appreciating property value, rent will rise too.

All my properties were slightly negative in cashflow when I bought them. But overtime cashflow got more and more positive. So if you are willing to wait, appreciation can get you income.

Only in California though, because of Prop 13.

Hk does not have and never will have enough housing for the people. I bet over at least 70% of the apartment has chop up extra room by owners. And gov is very pro home owners. So i don’t see anything will change. Now people are start coverting commercial building and even shipping storage bin into living space. Perhaps should crack down those first.

In 2011-2012, many low priced condos and even houses have positive cash flow. You can buy a 200k condo and rent for $2000 per month. Now that 200k condo might be worth 500k but rent may only increase to $3000. It’s definitely not the best time to buy now

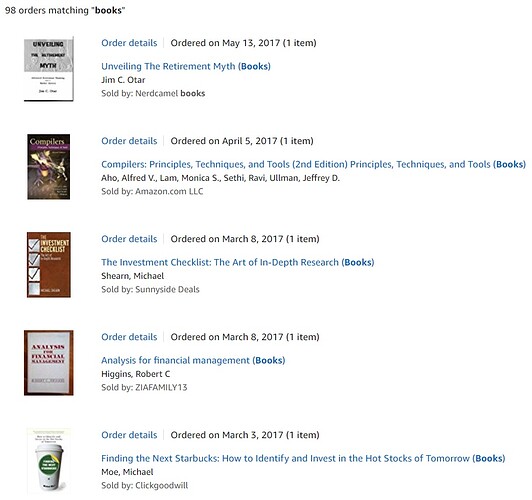

I learnt from here, redfin forum members mainly inspiration from bugmenot, hanera and wuqijun, further reading some good investment books. I still keep on reading books that gives me more confidence. It is simple, but training comes from practice exactly like what we do in real estate.

IMO, In fact, real estate investment is tougher than stocks ! Getting a deal in bay area is really tougher than buying stocks deals.

Presently reading investment checklist. I buy those used books even though I could download those books from internet!

Yea, also you can start selling off some of your appreciated property and trade it with cash flow properties. Appreciation is something a must have for poor man investment so that you can invest like Rich man in short future timeframe. Starting with just cashflow only is sub-optimal, IMO. Start with appreciation play, you don’t need cashflow coz you should still be working for your day-to-day needs. Then started to turn the portfolio to cash flow and your appreciated property will help make it quicker.

Sound the same for stock investment. Invest in growth stocks during wealth accumulation phase, transition to dividend-paying stocks during wealth preservation phase. Also, has the same problem as RE, interest is so low that many dividend-paying stocks are hitting ATHs like never before, now face the risk of capital loss in a rising interest environment. For example, PCG (PG&E) just hit an ATH of $67.83, can it continue to appreciate? So far, tailwind of weak oil prices overwhelmed headwinds of alternative energy and rising interest. I bought it at $45 for dividends, now get capital appreciation as a bonus.

Look like we all think alike. Me, building up a rental portfolio in Austin and a dividend-paying stock portfolio for passive income just like you guys. IMHO, rental is not very passive even with a PM.

I don’t know how actively change the assessment value. But I did see the sizable increase in last couple of years, maybe @hanera might know more since he owned the property longer there.

One more thing, investing in SV might sound like for capital appreciation initially, but in the long run because of Prop 13, it could turn into a solid cashflow investment, at least for those who bought in 2009-2012 period. The initial cap rate for my Cupertino rental (bought in 2011) is around 1.8%, now 3.5% whereas the Austin (78759) rental bought in 2014, has stayed at 4.9% because increasing property tax eats away the rent increase. If this continues for a few years, cap rate for Cupertino would be higher than Austin (78759). Btw, Austin (78660) rental has 5.5% cap rate, annual appreciation unknown yet since bought only 7 months ago, so far appreciated 8%.

It depends on county. For my property in Austin (78759) bought in 2014, tax increases slowly despite fast rising property price. Was happy as cap rate is creeping upwards. But last year, Travis county made a big jump in assessed tax by increasing the land worth by 140%, hardly changed the improvement and in fact, reduce the tax rate.

For my property in Austin (Avery Ranch) bought in 2013, Williamson county didn’t make any sudden big increase. They increase the land worth by 20% last year. Improvement increased by less than 2%.

This is a key point. If one can wait 10 years or so a CA property bought in 2017 can cashflow pretty well in 2027. With a healthy dose of appreciation to boot.

OTOH buying for cashflow is not as dumb as I first thought. But one has to be vigilant to plow back all the cashflow into buying more properties. Both ways can build wealth. Buying for appreciation looks like a better way in the last couple years because of the depressed market after the crash. Going forward appreciation may be back to the normal 5% or so a year, not the 10% we have seen in the last 5 years.

My SFHs in 7x7 are over 1% believe it or not. All legal and no kitchen.

Year of purchase is important, is why I mentioned that. If don’t mention year of purchase, might as well don’t talk about it. There are many SFHs in Austin that is over 1% too. For example, the Cedar Park that I mentioned in this thread, if have bought in 2012, cap rate is about 13%, and appreciation rate of 12%, giving a total average annual return of 25%! If buy now, 5% cap rate, 8% appreciation, total average return of 13%, big difference. Reason is 2012 is the low ![]() and now is the 5th year of appreciation.

and now is the 5th year of appreciation.

Is called DRIP in the stock world.

Now that appreciation is slowing down the timing is right to look outside for cashflow deals.

2016