My guess is that in 2 weeks there will be a “price reduction”. Or what Jane said - the seller found a property they want and needed extra $$.

I thought they weren’t supposed to remove historical data, but I’m pretty sure I’ve seen listings erased and re-listed, and when I went to check my emails, I had received Redfin daily listing emails with the property in it. (Not saying it was a Redfin property, but the Redfin listings based on my saved searches.)

Looks like the new strategy for houses sitting in the market without an offer for 2 weeks in Saratoga seems to be increase the price.

https://www.redfin.com/CA/Saratoga/18800-Casa-Blanca-Ln-95070/home/917988#property-history

Flood zone, Campbell schools, closer to freeway than desired, …

Both of these properties are still on the market

https://www.redfin.com/CA/Saratoga/18800-Casa-Blanca-Ln-95070/home/917988

https://www.redfin.com/CA/Saratoga/12760-Bach-Ct-95070/home/839618

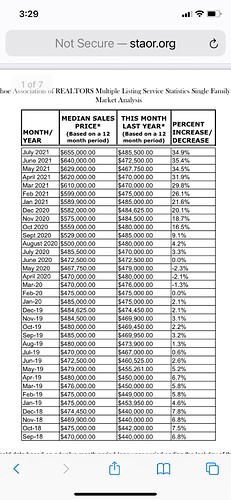

Are we seeing a slight slowdown in Saratoga? or just that these homes are not in desirable part of Saratoga?

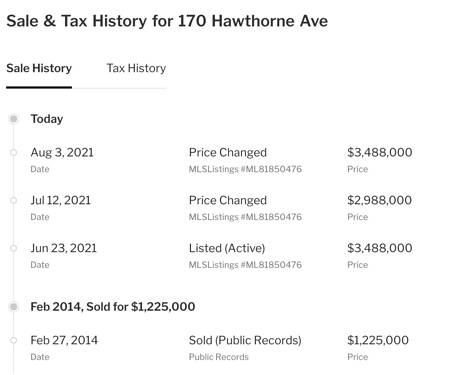

This house in PA also raised prices after sitting on the market for 1.5 months.

https://www.redfin.com/CA/Palo-Alto/170-Hawthorne-Ave-94301/home/606658

Interesting for a 2K lot… This has been reduced first and then increased again… Anyways, does this mean we see a hint of seasonal slow down?

Here is a case of a house in Sunnyvale that was listed for $2.588M in May, and sat on the market for a month (don’t know why, because list price was fair given that it is a 2000 sq ft house).

In June, seller increased price by 100k to $2.688M, and the sale closed for $2.668M, or 20k less than the increased list price…

So the price hike strategy worked for the seller. They were able to get 80K more than the original list price of 2.588M.

Yes, in the sense that they sold above list price.

But I wonder if the seller may have turned down even higher offers when the house was initially listed…

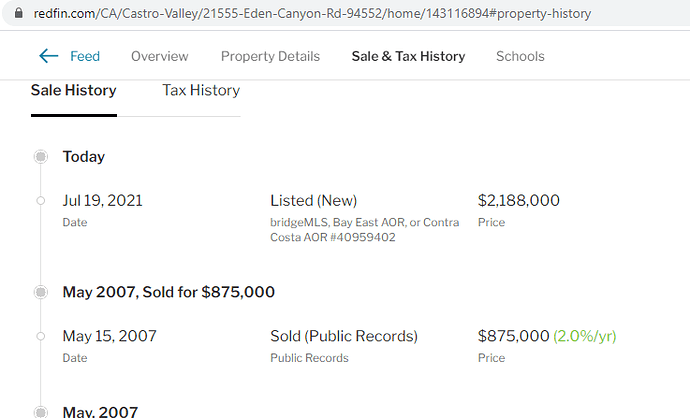

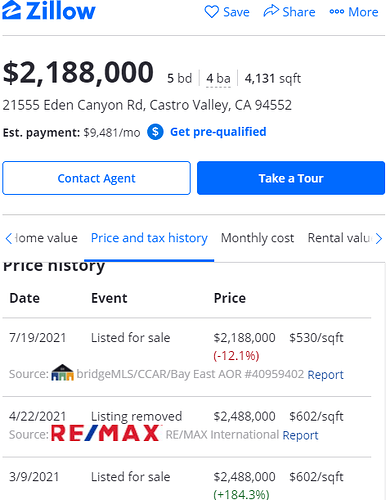

It’s listed by an out of the area agent, on the Contra Costa County MLS. Not sure if it has anything to do with it. I wonder what’s in the private agent notes on the MLS? Did the agent indicate it’s the “real price”?

This is one scenario why a property comes back with a higher price:

https://www.bubbleinfo.com/2021/08/07/re-engaging-after-buyers-remorse/

A listing goes pending for a day or two, then comes back on the market at a higher price.

They are most likely the bidding wars that failed. The seller/listing agent took what they thought was the best offer, but then the winners had second thoughts and/or buyers’ remorse set in – and they cancelled.

Because one buyer was willing to pay over list price in the heated moment of engagement, the seller/listing agent decides their offer price must be the market value and others should pay that much too, and they RAISE the list price when re-entering the market.

If they really had multiple offers, then why not just counter the other bidders at the new price? Whoever agrees to it first wins.

If it goes pending / contingent, and came back with higher price, this makes sense. In this case, looks like there were lack of offers hitting the price target of the seller.

On a similar note, what you folks think about preemptive offers? do they work in this market?

Are price increases for no good reason not a tell a tell sign of runaway inflation (or hyperinflation)?

During the hyperinflation, do not the buyers rush to buy before goods become more expensive, and the sellers pull back and wait to sell at higher prices? In other words, both buyer and sellers anticipate prices to rise imminently - and adopt different strategies to exploit that.

Prices are going up due to supply and demand. Econ 101. 150m Gen y and z will be buying for the next 20 years. Meanwhile nimbyies and environmentalists are restricting supply. An easy sure bet for speculation.

Yes, 150 Million new buyer over the next 20 years spread out all over the US does not look like a very intense demand, considering that many homes will come into market with people downsizing or dying.

I am betting you are wrong. Only 1.5m homes can be built compared to 2.5m in the last boom. Costs of construction skyrocketing. No supply of skilled labor. Shortage of building materials and approved land potentially allowed to build on near employment. This will be the biggest RE boom in history. Reminiscent of the 70s boom in prices.

Even if we agree with you that there is an organic demand to justify the rising home prices, other than hyperinflation, what else can justify the prices rise every month, week, every day, every hour?