Why are you voting NO on Prop 10 then? These both go in concert IF you are an owner. Unbelievable…

I am a citizen first, owner second.

Whatever… keep in mind that one day you will be old and you might want the benefits of Prop 5. Honestly, I am not going to cry too much about this if it goes down but who doesn’t like options or the flexibility to do something?

We need people to pay taxes, and homeowners are already much richer than renters. Why be so greedy? Don’t want to pay? Just don’t move then.

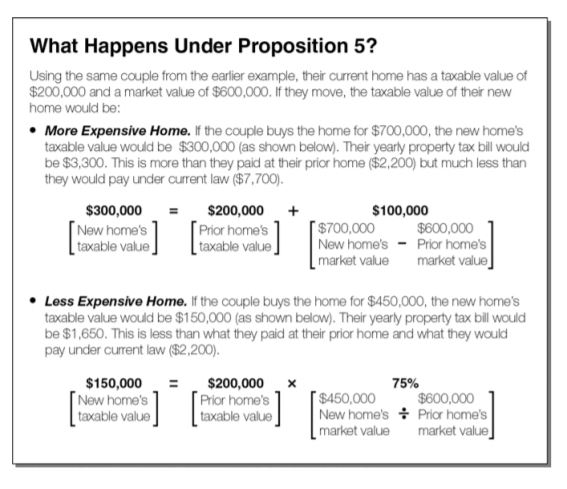

Do you know under Prop 5, if you buy a less expensive house than the market value of your old house, your property tax actually goes down, from the already ridiculously low rate under Prop 13?

Jim’s a realtor down in San Diego, and even he doesn’t support Prop 5.

We have to support Prop 5 since boomers are against Prop 10.

Prop 5 is us fighting back. When the voices of darkness come with shit like Prop 10, why not shoot for the moon with prop 5. If the progressives take over the state, boomers will leave in droves. Prop 5 will keep them in the state, provide a boom for rural counties and make room for newcomers in the big cities. Win win win.

Prop 10 everyone looses. Prop 5 everyone wins

The $1B is a big number and a scary headline. That’s literally 1/3rd of the $3B annual increase in property tax revenue. So even with it, revenue would increase by $2B/yr.

The use the schools thing to scare people. Meanwhile schools keep spending more money on administrators not teachers.

School district can issue bonds and let owners pay more property tax. There are ways to get funding for school outside of state tax.

Only state property tax is limited by Prop 13. Local property tax has no limit.

All school money is wasted on mandatory PC stuff that has nothing to do with core curricula

Why bother if they just want to be freeloaders?

By that logic, you should kick out most Californians who don’t pay enough taxes to cover the services they use. The top 1% are paying almost 50% of the income taxes. The state is full of free loaders. Why only kick out the elderly ones?

California’s tax base is so narrow exactly because its property tax on older properties is so low. Under current law seniors can already port their super low tax basis over if they buy a lower priced property. But no, we don’t even want to stop at that. We have to lower their taxes even if they choose to buy a more expensive house.

Prop 13 and its derivatives are creating a landed aristocracy that can be passed down generations. That’s antithesis to American value.

Repeal property tax. Replace with income tax and sales tax.

Before that, let renters pay property tax.

This will remove unnecessary misunderstanding and avoid the population hate each other for nothing.

Property tax does not make any sense. Why do you want to make elderly people homeless by charging a property tax? When people are young and working, they can pay some tax. When they retired and lost income, they should not need to pay a property tax.

How can you honestly say that when:

- Since prop 13 passed property tax revenue has increased more than income tax revenue

- 40% of Californians pay zero state income tax

- The state population has doubled and the number of returns paying state income tax is the same

- Property tax revenue is still growing at 5%+ a year

Prop 13 created a huge distortion. Cities don’t want to build housing anymore because the income stream will be capped at current level but services it has to provide to the residents will grow. It’s much better to build office buildings and tax the businesses inside, which will grow along with the economy.

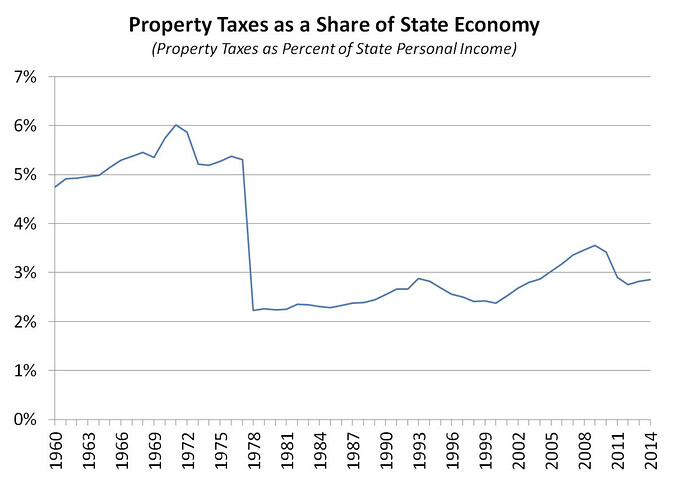

The falloff in 1978 is a correction to the uncontrolled growth in property tax.

Since 1978, property tax revenue has been growing nicely, following the general economy. Apparently, Prop 13 works wonderfully correctly.

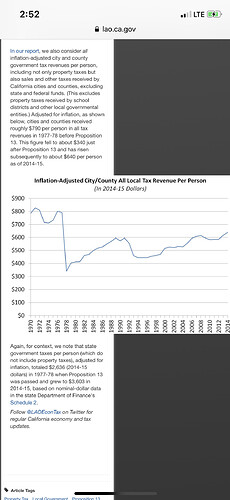

The total local tax per person doubled from $300 to $600 with inflation adjustments since 1978. Local government is doing wonderful and Prop 13 has worked wonders

Why the sudden drop in 1978? Your graph shows that even with prop 13 it’s been slowly increasing as a percent of the state’s economy. So even with prop 13 property taxes grow faster than income.

In 1977, the average property tax rate in California was 2.67 percent .

In 1978, Prop 13 reduced property tax rate to 1%.

That’s the reason for the drop.

KEY FACTS AbouT ProPoSiTion 13

• Provides Certainty. Removed much of the fluctuation of property tax revenue, creating a more stable revenue source for local government by using an acquisition-based assessment system.

• Established new base Year. Rolled back locally assessed property values to 1975 lien date original base-year value, effective with the 1978-79 fiscal year.

• Limits Assessments. Limits property tax rate to 1 percent, plus the rate necessary to repay local voter-approved bond debt.

• restricts rate Hikes. Restricts annual increases in assessed value of locally assessed real property to the lesser of market value or an inflation factor, not to exceed 2 percent per year, except when there is a change in ownership or new construction.

• Established Vote Thresholds. Requires two-thirds vote of the Legislature to raise state taxes, and specifies that a vote of the people is needed to raise local taxes.