So never did any option trading. So want to see how I can remain exposed to the market while I use this uptick to cash out of the market again (of my winners and losers since I got back into the market). The key stocks I want to continue to have exposure to is FB and BABA. I bought the former at about 157 or so and the latter at 172. They both have climbed a fair bit since when I bought them. So what could be potential strategies if I expect they will continue to rise in the long-term but I want to take some of the appreciation off the table?

Do you mean you already have FB and BABA stocks but thinking of selling them? And buy options instead to retain exposure?

Use margin is your best bet.

yes

One method is replace your shares with at-money or in-money calls. I think in-money is better as it has less time premium in the calls.

Let’s use FB as example. It closed at 176 today. So you sell your shares at 176 and buy really long dated calls like Jan 2020. Take 80% of 176 and it’s approximately 140. Calls are selling for $55.

176-140 = 36. So out of that 55 you are paying only 17 is “wasted” in time premium. And you are taking 70% (1 - 55/176) of your money off the table.

I wouldn’t do that if I were you… options are wasted effort in general…

I wouldn’t do that if I were you… options are wasted effort in general…

Options is a sharp tool and prone to be misused. You can be very conservative or very aggressive. It just lets you express your opinion very precisely.

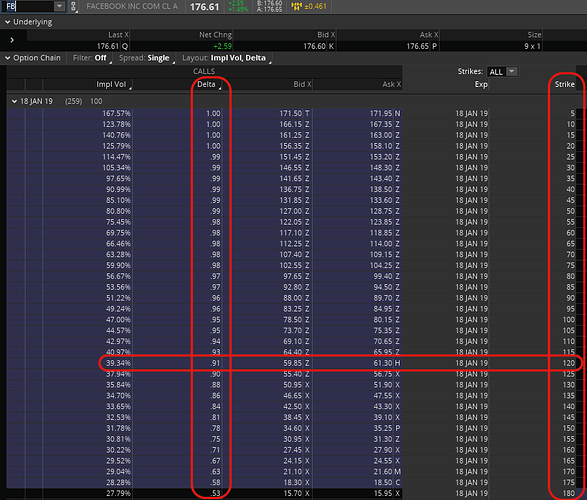

What is your time horizon? Jan, 2019 calls aren’t too expensive. For stock replacement, I prefer to go in-the-money to minimize the cost of the time premium. $120 are $60.59. That’ll make you money if the stock is over $180.59 vs today’s closing price of $176.61. Time premium is only $3.98 for 8 months of time. It requires 66% less capital than directly buying the stock.

i think 1 year for time premium makes. i just wanted to do a small trade to get my feet wet on options and try to learn something. thanks!

The obvious strategy is call replacement aka stock replacement by marcus.

Replacing 100 shares with 1 call, delta of your position will drop.

To maintain the same delta, you need to buy more calls.

Using marcus’s suggestion of call (Jan 2019 $120), delta = 0.91. Replacing 1000 shares with 10 calls will have delta of 910 shares. If you want to have the same delta as 1000 shares, you need to buy 11 calls ![]()