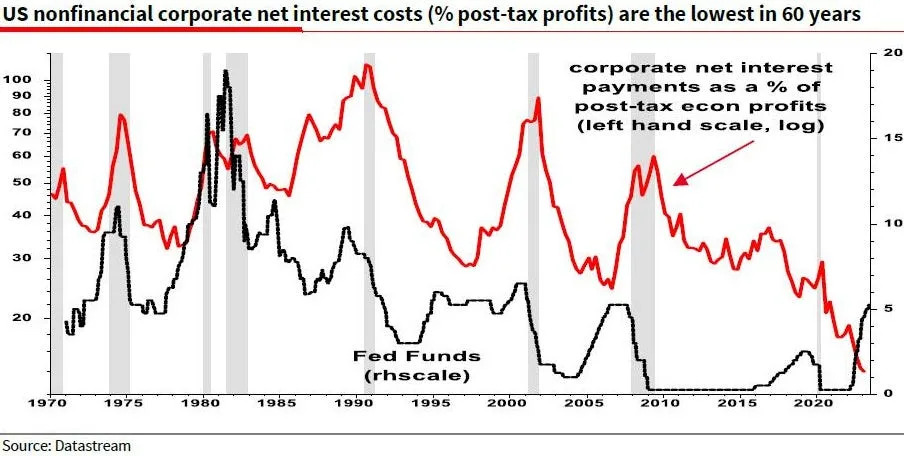

The bank highlighted that going back to at least 1975, corporate net interest payments would rise as the Fed raised interest rates. But for the first time in a long time, that isn’t happening. Instead, as the Fed raised rates over the past 15 months, corporate net interest payments actually fell.

“Normally when interest rates rise, so too do net debt payments, squeezing profit margins and slowing the economy. But not this time,” Societe Generale’s Albert Edwards said in a Thursday note, pointing to a chart that he called the “strangest” he has seen in a very long time.

It turns out that during the period of near-zero interest rates, especially leading up to the pandemic and during the pandemic, corporations took advantage and refinanced a ton of their liabilities into long-term, low-rate, fixed debt.

According to data from Bank of America earlier this year, companies bought themselves some time to navigate higher rates. The debt composition of SP 500 companies includes just 6% in short-term floating rate debt, just 8% in long-term floating rate debt, 10% in short-term fixed debt, and a whopping 76% in long-term fixed debt.

“Companies have effectively played the yield curve in reverse and become net beneficiaries of higher rates, adding 5% to profits over the last year instead of deducting 10%+ from profits as usual,” Edwards said.

The lack of a profit decline means companies didn’t have to resort to a big wave of layoffs that would have dented the economy and thrown it into a recession.

*The low-rate, long-term debt held by corporations, combined with their pricing power during a time of elevated inflation, means most businesses were able to grow profits in a big way. *

‘Something very strange’ explains why a US recession has been delayed