Need to know where is Austin-Round Rock MSA.

Other than Travis and Williamson counties, pray.

Definitely. It’s important to look at the specific market for determining conditions for buying and selling.

See??? We special here in the Bay Area!!!

Are homebuyers suddenly backing out of deals in the SF Bay Area? (sfchronicle.com)

Saw this today too. When CAR predicts declines, you know it’s rough out there!

Almost 9% decline in home prices in the largest state of the union. And yet the Fed still says we have to hike to the moon to contain inflation. What inflation?

Inflation is past. FED only works with past data. Will over shoot

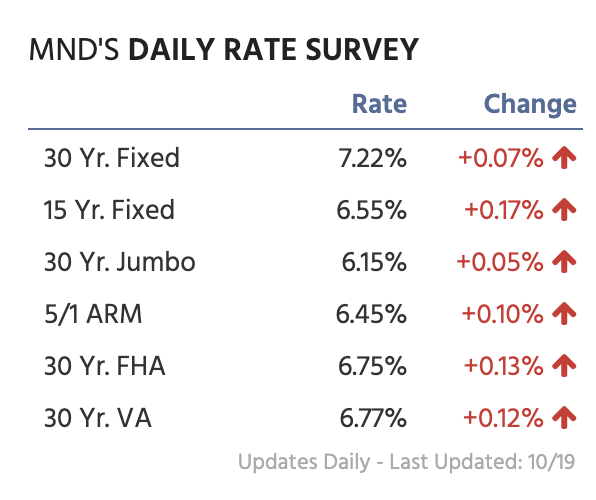

Rate makes a new cycle high:

And Redfin share price fell 96%, from $96 back in Feb 2021 to $3 today.

Case Shiller is out today, and it ain’t pretty.

The MoM decrease in Case-Shiller was at -0.86% seasonally adjusted. This was the second consecutive MoM decrease, and the largest MoM since February 2010. Since this includes closings in June and July, this suggests prices fell sharply for August closings.

High price markets like SF (which includes more than just the city) and Seattle are under a great deal of pressure because of high mortgage rates:

On a seasonally adjusted basis, prices declined in all of the Case-Shiller cities on a month-to-month basis. The largest monthly declines seasonally adjusted were in San Francisco (-3.7%), Seattle (-2.9%), and San Diego (-2.5%). San Francisco has fallen 8.2% from the peak in May 2022.

The August reading is an average of June, July and August. There is a lot of lag in the data. Most likely the current situation on the ground is much worse than the data suggests:

The Case-Shiller Home Price Indices for “August” is a 3-month average of June, July and August closing prices. June closing prices include some contracts signed in April, so there is a significant lag to this data.

Still, would I rather own a home in Vegas, Phoenix, Sacramento, Boise or San Francisco??? Fab 7x7 baby!!!

Looks like the housing market still has a lot more downside to come.

Lots of people commented on the tweet saying they are seeing the same thing in their city.

https://twitter.com/markjenney/status/1584061008498200576?s=46&t=H7btCxMf2bPOQ0MUt7CjQA

I don’t get why people would sell them now then people are traveling in huge numbers. If they had financial stability with get through covid’s lack of travel, then they should be in great shape now. There’s a travel boom happening, and their costs should be fixed.

Well, they are seeing the bloodshed and want out before there is no more blood. I don’t blame them…

What bloodshed though if they bought 3+ years ago? By the time they pay selling commission, taxes on gains, taxes on depreciation recapture, etc then there’s no way they’ll be able to rebuy the same home with the remaining cash. if covid didn’t convince them to sell their short-term rental, then selling now is just insane. People are that impulsive and emotional about financial decisions aren’t going to be in financial position to buy rentals. They’re more likely to excessively shop and have massive CC debt.

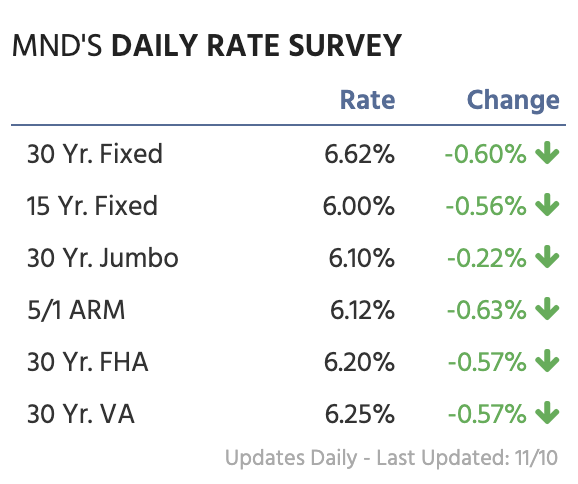

Holy cow! Mortgage dropped 60 bps yesterday! Back down to the 6’s.

Check 50 year history of yield curve inversion, it happens like this way.

Rates are going down as investor demand for 10 year note is high as more and more yield curve inversion happened now. This is very short term, may be around 25-40 days and then Yield spikes when market touches the bottom and stays higher longer.

This shows that we are at final leg of sharp drop in market soon and thereafter slow bull run for many years (of course, nice correction every 2 years, may be next election time, natural to instability)

The buy vs rent debate to me seems to hinge on the following variables: future real estate appreciation, rent inflation and stock market growth. Depending on where these variables land, buying could be a lot better or renting could be a lot better. I will say, looking at the numbers, real estate needs to continue appreciating at a modest pace in order for it to breakeven with rent.

Let’s look at some numbers. I found a property that is listed both as a rental and for sale.

Rental: 1417 Sierra Creek Way #1, San Jose, CA 95132 | Zillow $5000/month

Sale: 1417 Sierra Creek Way, San Jose, CA 95132 | MLS #41012532 | Zillow $1.8M

It’s a bit complicated to do all the numbers but one way I think of it is. If you bought it outright, you would still owe about $1900/month in property taxes (plus insurance/maintenance), let’s say maintenance is minimal and round it all to $300 or total costs of $2200/month to collect about $5000/month in free rent. That’s like a dividend of $5000-$2200=$2800/month or $33.6K/year.

A return of 33.6k/year is just a 1.86% return on the purchase price of 1.8M. Pretty low when long term treasuries yield around 4% or buy TIPS for a 2% real yield. Hence, the property much appreciate substantially for you to break even with treasuries or S&P 500.

Also, owning the property at a 5% mortgage interest rate or asset backed margin loan is 1.8M * 0.05 = 90k/year plus you owe property taxes of 22.5k/year or total cost of 112.5k versus just 60k/year to rent. The money you throw away just to own is almost double that you throw away to rent. So the delta is future appreciation.

Rent is almost always cheaper in the short run but missed appreciation is costly in the long run. Don’t wait to buy RE . Buy then wait. Mantra of a friend of mine. Bought his first property for $18k in SF in 1970. He is now worth over $100m.

Right. Plus the RE market is still going down but S&P may be near bottom.

That being said, I think one big advantage of real estate is psychological. It’s much harder to sell RE, so one is more likely to sit still, hold it for the long term and let appreciation work its magic. Much harder psychologically to buy and hold in the stock market.