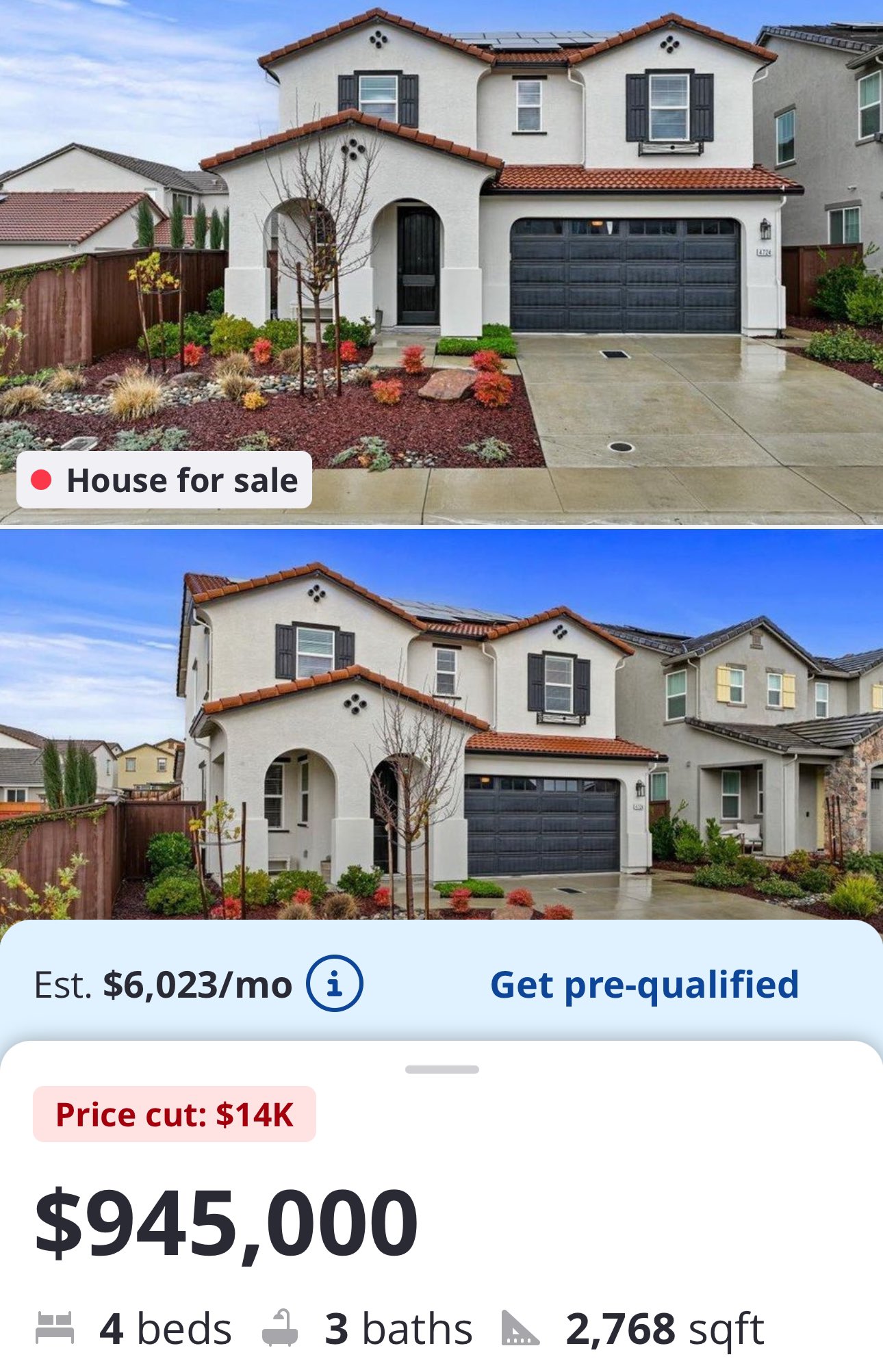

Rent vs Buy comparison between 2020 and 2023. It’s now cheaper to rent now in most of the country.

For SF currently is renting better than buying? I saw a calculation someone did where 1.4M which is rented for 5K and buying at 6% rate is better than renting for 3 yr time frame.

If it’s your primary and you can afford it with ease, I think just buy and don’t worry too much about detailed costs. Very few people will sell after only 3 years. Experience tells me the amount you get from a sale is always less than what you’d expect.

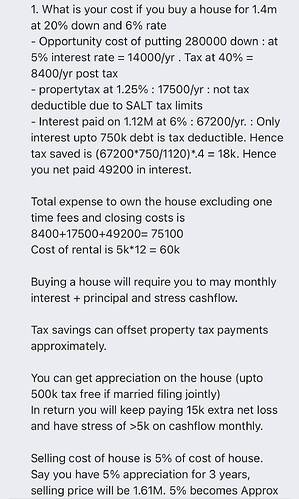

This guy also missed some:

-

If you work from home you can get home office deduction. Talk to your CPA.

-

He totally neglects maintenance costs.

Also I believe interests rate is about as high as it would get. Buy now and refi later is not a bad strategy.

.

Cost of sale should be 10%, author uses 5%.

Is this Wolf Street guy crazy. He is still spouting housing bubble and price crash.

And he deletes comments like these:

Kunal

Your comment is awaiting moderation.

[Feb 21, 2024 at 2:07 pm]

It’s not a buyers strike, it’s a sellers strike. There are plenty of buyers but there is no supply that they can afford. In this environment, prices will go sideways / rise.

Asking and sale prices are at record highs for this time of the year. Go check Redfin yourself. This is hard data, rest is propaganda.

CA Median Sale Price: $739,200

+6.6% year-over-year

CA # of Homes for Sale: 65,628

-7.0% year-over-year

CA Homes Sold Above List Price: 35.9%

+9.7 pt year-over-year

US Median Sale Price: $402,343

+5.2% year-over-year

US # of Homes for Sale: 1,326,005

-3.7% year-over-year

US Homes Sold Above List Price: 23.9%

+2.7 pt year-over-year

Kunal

Your comment is awaiting moderation.

[Feb 21, 2024 at 2:11 pm]

And keep in mind that the prices are still rising after almost 50% rise compared to pre-pandemic. So all these folks who were spouting RE bubble even before pandemic are lunatics and whoever listened to them are the biggest fools.

Lol, weren’t you predicting doom and gloom for a long time?

Yeah but my stock portfolio is doing so well now that I have taken a permanent pause on buying more RE. And I feel that I was wrong on RE doom and gloom all along. It’s going to rise and rise as USD loses value.

Gloom and doom for commercial buildings only.

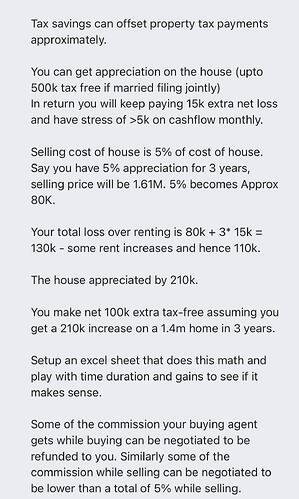

Buy vs Rent in San Francisco.

16k mortgage payment or 8k rent. I am usually pro owning but 2x delta is pretty hard to swallow.

Also doesn’t it make more sense to do ARM now so payment will come down automatically when rates adjust?

This is an interesting story:

Singh and Dudani decided to take the leap and buy a home in the Bay Area. “We thought, since interest rates were high, there wouldn’t be a lot of buyers,” Singh said.

Don’t be so sure, their agent, Jeet Dholakia, advised them. Even with interest rates around 7%, the Bay Area market was still flush with buyers, and there would be fierce competition for homes in their price range, between $1.3 and $1.5 million, just below the median home price in Santa Clara County of $1.8 million.

Their agent was right:

They quickly realized that in Cambrian Park, homes would be listed at $1.5 million and then end up selling for closer to $1.7 million, which was outside of their budget. Such was the case for the split-level they looked at there, which they bid on but lost.

Interesting tidbit:

The couple had initially been quoted at a 6.37% rate for a 30-year fixed-rate mortgage, but they found a bank willing to offer 5.75% — a difference of $1,200 a month.

Which bank offers 5.75% rate?

Maybe Fremont Bank? Back in the day, my Big Bro loved Fremont Bank. (Until my killer mortgage broker came along…)