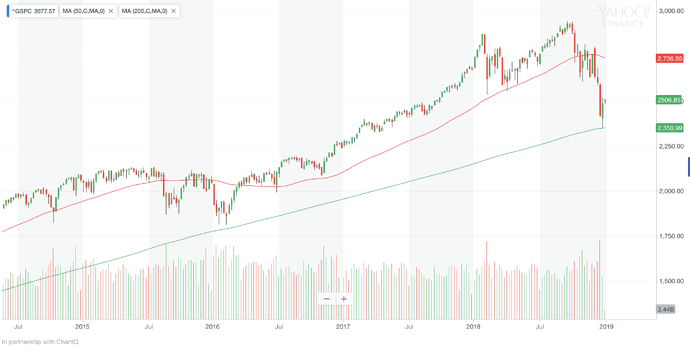

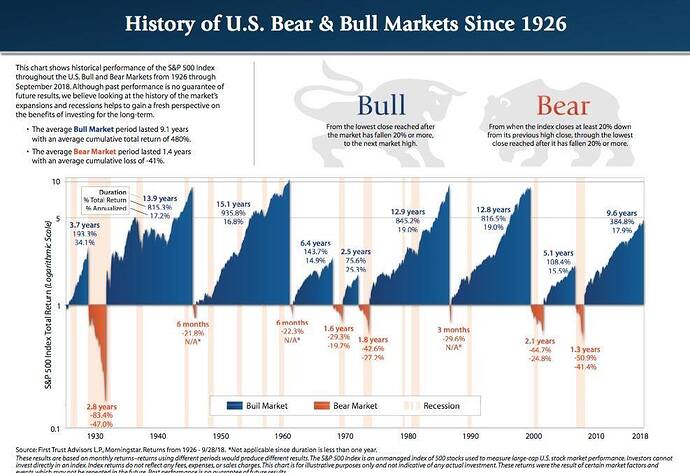

Supercycle degree Wave [V] is a multi-decade (don’t like to use undefined timeframe like secular, long term) bullish impulse ![]() started since 2009. I don’t need that guy to tell me. For most people, should blindly DCA purchase S&P index (VOO, VFINX, VFIAX or Fidelity equivalence). Of course, there would be many those 38.2%-61.8% retracement which in absolute term could be substantial, but is ok because you’re using CASH (not on margin) to buy those index funds. I believe, is hard to beat this strategy over a period of 20+ years.

started since 2009. I don’t need that guy to tell me. For most people, should blindly DCA purchase S&P index (VOO, VFINX, VFIAX or Fidelity equivalence). Of course, there would be many those 38.2%-61.8% retracement which in absolute term could be substantial, but is ok because you’re using CASH (not on margin) to buy those index funds. I believe, is hard to beat this strategy over a period of 20+ years.

The current secular bull should have another 10 years in it easily. May be the last one before I and you are too old to profit from. The next secular bull could be 20-30 years away. So ride the rocket ship and don’t let go…

Not interested in profiting from the market, now enjoying a brand new house, not staying in an old shack.

You have quitted the W2 slavery. Time to get out of being a money slave.

It’s the pursuit that’s energizing. Like that old man hunting whales.

You moved to Austin already?

Want to meetup in a strippist club?

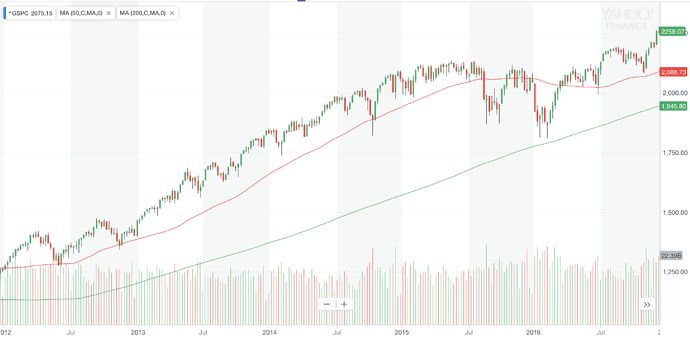

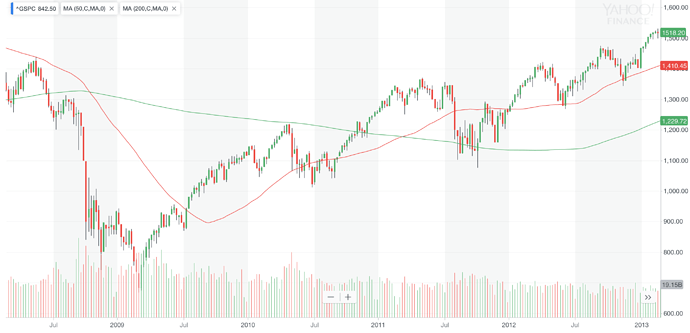

2015: Didn’t quite touch and got off 200-wk MA:

2011: Went slightly under but bounced right off 200-wk MA:

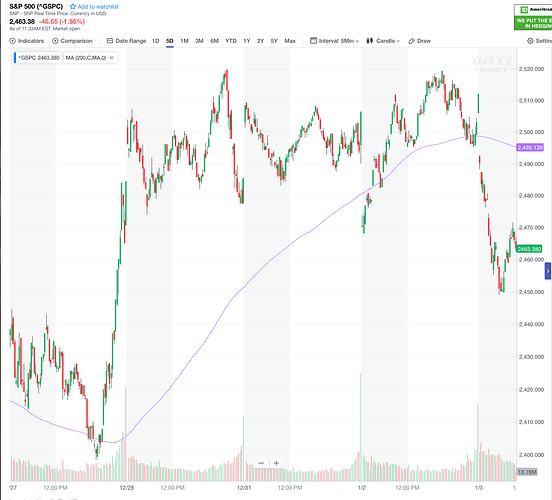

Right now:

Will history repeat?? ![]()

History won’t repeat, it rhymes. Btw, touching MA without breaking it is max 3 times. So if this one held, any signs that there would a 4th one, scram. Put this in your sticky somewhere.

Dropped back below the 10-day though. This is really no man’s land from a trading perspective until it makes a new low or goes above the 50-day.

Did @hanera move to Austin without telling us his intention? He must have planned this for years. It requires his children to move out and requires his wife to quit job. I don’t believe it’s an impulsive move.

Retirement in Austin seems a novel idea. I haven’t met anyone doing that.

Didn’t he say he’s there because one of his sons is going to college there? He made reference to that or I’m confusing with another poster.

Now that you don’t need to pay CA income tax maybe it’s time to sell your AAPL?

hanera’s AAPL is not for sale. No matter whether cook changes estimate or not, he gets his dividend gift promptly !

Of those towns I would prefer Prescott or Charleston to Austin. Charleston has the ocean and Prescott has skiing close by.

Now you can host a summit at your mansion, and host an investor tour. You can be the man on the ground and take cut from all the out of state investors ![]()

I think I’ve seen that chart on here before. Someone else on here also part of that Facebook group?