Already announced this afternoon. Look at the Bloomberg link I posted on the tariff thread.

I hope they allow me to respond:

OK, now we have to dispute the death benefit.

We are improving, aren’t we?

The way it works is this:

The money you already spent via loans is kept in a collateral account earning “whatever %”. Isn’t that amazing?

The returns are paid into 12 buckets = 12 months. There are 12 loans, 12 simple interest payments from the death benefit, not your principal, nor your accumulated value or $. Get it? There is the beauty of these policies.

And, finally, the death benefit is by contract, rules, laws, whatever, an “increasing” death benefit. As I said, it’s like a debit card.

The reason the interests charged won’t deplete the death benefit is because we tell the clients to loan only what we planned, the planning is based in this case on an illustration at 7% return but the market has been doing better than that, so that leaves a good earned amount besides what they can loan. That’s the proverbial cushion for hard times (check the illustration on the cash surrender).

Don’t want to pay interests on a loan, don’t do it. Just pay your cost of insurance. Easy peachy, nobody is forced to pay an excess. If they don’t do it, they eventually will be using this policy as a term.

That’s it, no screaming, no insulting, no beaching. This is for people who want to go conservative on their approach to invest for their retirement. That’s all.

Your words don’t match you own illustration.

I did the math for you to show the loan is compound interest. The interest does lower the death benefit. Look at your illustration. The invested amount increases the death benefit beyond the policy amount. Once you start borrowing the death benefit is decreasing. The compound interest on the loan makes it decrease faster.

You cost of insurance is insanely high compared to a 25-year term policy. I can get that for half of your premium. I can invest the different in an index fund and have a ton of cash after 25 years. I did the math on the 401k thread.

Sorry man, I am so busy right now you wouldn’t believe it.

Last conversation on this subject, I am going to be so busy with the new program we have. Free pensions for key employees, no money from both employers and employees. Cha-chin!

On the subject: We are talking about the leverage of your own $. You got 80% of your “investment” and with that, as you say you are so smart, I bet you can earn $20K to compensate for the cost of insurance, right? Think of a pass through entity, the money you pass through is still there even though you spent it.

Then, you got the same 80% earning upwards of 12%, 16%+ as of today. And the simple interests are paid for by the death benefit, mind to answer why it decreases? because it is what it is, as a debit card to pay for the simple interests. We tell people to not loan what they are not supposed to. So simple to understand.

Your returns are never touched to pay for the loans, and with the miracle of compound interests you got a winner, a historical 7%+ last 20 years.

This type of “programs”, written so to not sound I am selling, pays itself at the end of the 7th year of contributions. $100 in, $100 loaned.

Of course, you are so smart, you answered yourself that at the end of the 25th year, you spent what? $30K and probably, to be safe and sound here, you will be healthy because that’s what you preach when it comes to the healthcare topic, right? So, does that make sense? Throw away $30K? Now, you are without a life insurance, and it will be costly, at the $ of 25 years from now. Who knows, you may then start to decay, and will need living benefits. Does that make sense to you?

You can teach me on that subject, but I may be wrong, you are at the wimp of the stock market with your index fund, right? You can go up positive, but as in 2008-2009 you can go negative, and negative big time, you can be wiped out! Isn’t the stock market today indicating you what way you are going? Up…or down?

Within my thing, zero is your hero. You only can go up, not down. Your principal is safe.

Oh, don’t want to pay simple interests on a loan, no problem! Just pay your COI. If you are a chicken, wait for better times. Anyway, the cash accumulation can be used to pay both COI and loans. Didn’t you see the difference between the cash value and the death benefit. A big cushion there.

If you have anything against that illustration, grab it and forward it to the DOI. Really, how dare you say that you can tell me that is wrong? Those are assumptions, based on x% returns, basically a historical return, which is higher but other insurance companies that don’t participate on this type of “things” complained so the DOI forced us to do illustrations with those numbers. Seem fair to me anyway, nobody should asure anything regarding the economy, never.

So, as I said, we see people like you in a daily basis. We tell them to grab the illustration and go to the DOI to let hem know this is fraud, but we tell them to wait to be laughed in their face. Literally.

Take care now. Consider yourself a winner of this debate. I don’t care, my people think different.

You constantly repeat the same lies that have been mathematically debunked. Since you ignored the math before. Here’s the math:

You again misrepresent basic math. The real math is:

-$100,000 into policy

+$6,300 (7% gain on the $90K cash value of policy)

-$4,000 (5% interest on the $80K borrowed)

+$80,000 (borrowed from policy)

+$5,600 (7% gain on the borrow $80,000)

Total is -$12,100 for the year. As you can see, the $90,000 in the policy is only earning you $2,300 after the interest expense of borrowing $80,000. Your net return is a whopping 2.6%.

Alternatively, one could simply invest the whole $100,000, earn 7%, and be +$7,000 for the year. That means just investing the $100K is $19,100 better than buying the IUL and borrowing from it. What can I buy with that extra $19,100/yr or $1,592/mo? I can buy a $3M term life policy for 25 years for under $600/mo. Do you realize $1,000/mo compounded for 25 years at 7% gain is $810,000. Plus, I’d have my $100K/yr compounded for 25 years at 7% worth $6,325,000. That brings my total to $7,135,000.

Another reckoning day coming. Fellow Micron bull here:

I am ok not being part of the “last Goldilocks rally” as he calls it. If the bears will arrive at the house soon, I will start running now! Why stay to eat more???

I have yet to see any payment in my PM.

Accept Apple Pay  only

only

Not in a charitable mood?

May be is a blowoff rally ![]() Blowoff can easily be twice as much

Blowoff can easily be twice as much ![]()

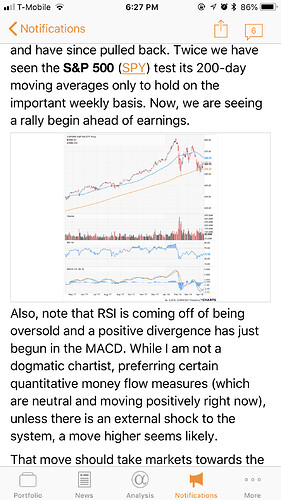

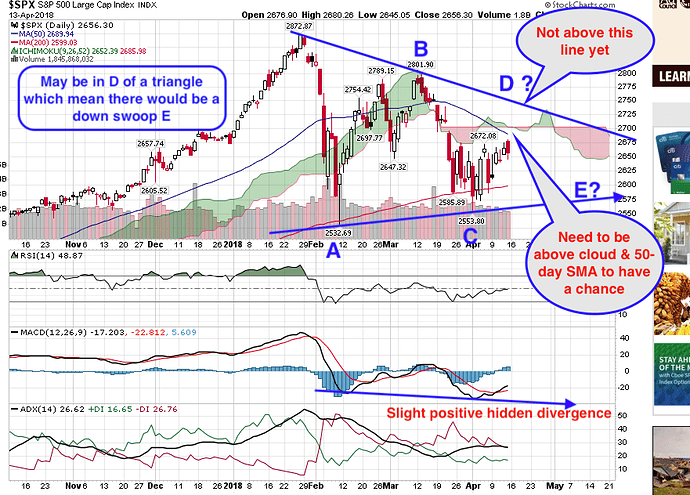

I’m not short-term bullish until we’re back above the 50-day. That’ll be a critical resistance on the way up that’ll test the rally. I don’t think anyone knows the odds of success/failure at the 50-day. That’s why I wait for the confirmation. We clear that and next resistance is at prior all-time high.

A major reason I’m not bullish short-term is there’s not a single sector with a chart that shows it’s going higher and will lead the market higher. We need a leading sector to emerge.

I own 3 of the stocks that Kirk is currently holding ![]()

![]()

Folks here are more interested in Nasdaq.

Look like the uptrend is led by NFLX (new ATH today) with his cloud siblings like NTNX, NOW, SPLK, ADBE, RHT… about to achieve new ATHs.

FOMO calling?