Where’s @acre , our resident Arizona RE expert?

850K. 4000 ft with 5 bathrooms. More than one bathroom per butt for most families.

https://www.redfin.com/CA/Folsom/327-Sprig-Cir-95630/home/19115381

In Marana waiting on a tow truck.

Scottsdale is hot as blazes in summer. Pretty but not pretty enough to put up with that. Go North. If places like Pine or Strawberry or Payson are too lacking in amenities go for Sedona or Prescott. Far better climate and less congestion.

He is asking to invest in a rental. Or he could buy short term rental in places up north.

I looked in Folsom and EDH. But I have a lot more SF and acreage. 20 minutes away. Less money but not for families that have to chauffeur their kids everywhere.

farm living isn’t for everyone.

The original question was about buying a rental. Buying a homestead is good if one wants to go and live there. But, what about buying a property to rent? Which cities within a few hours of drive from Milipitas are good? The cities that come to my mind are like Modesto and its suburbs (salida, Riverbank) . Stockton and its suburbs. and Sacramento and its suburbs (like Folsom and EDH). Or merced.

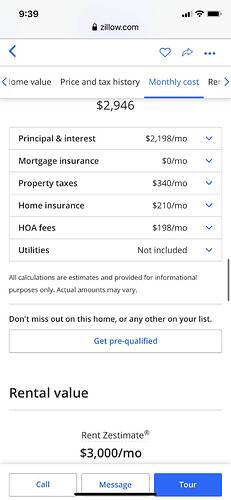

I doubt that $600k house in Scottsdale could get more than $3000k rent( the Zestimate)

Not great cash flow even with a cash deal. Appreciation is uncertain. Maintenance will make it negative cash flow with 20% down. Let alone the property management fees and vacancy factor. I know people in the BA are used to negative cash flow. That is why out of state sellers love dumb rich California investors. Don’t buy unless there is at least a 5% cash on cash return and good potential appreciation.

From a rental standpoint Sacramento was the best investment I ever made. But I recently sold my interest in a large multi family complex in Sacramento. In fact I recently invested in a multi family development project in metro Phoenix, build and sell. It is growing. Boomers are moving there with retirement money, which may be the most stable income source. I just don’t want sfhs to manage several hours away.

I don’t know what is going to happen to rentals in post covid19 times. The demand is there and the supply will be restricted even further. The wild card is government regulations and rent control. Too much uncertainty right now.

Are the “ZEstimate” figures reliable in general? I don’t know of a website that discloses what a house actually rented for vs the asking rental price. The house next door to the one in my original post is currently asking $6500 a month as a seasonal rental and who knows what for a long term rental. Not sure if they are actually getting that price or not, but if so, I am surprised at the high rental amount.

https://www.zillow.com/homedetails/7979-E-Princess-Dr-UNIT-15-Scottsdale-AZ-85255/8015521_zpid/

Seasonal rentals are BS. Four months no rent.

Lead time for a new tenant. Sorry but you don’t understand the landlord business. If you want to make money go for bread and butter housing. Not trophy vacation homes. Talk to a local property management company to find out what’s really happening in your area. Why troll a BA forum. Unless like I suspect you are actually a realtor trolling for gullible BA investors.

You can assume 50% occupancy for short term rentals. You can google websites that will give you an estimate of no of days a short term rental at a given address will be occupied.

Treat Zestimate as Kelly blue book for the cars. I have never seen a car that is actually sold at KBB price.

Golden lines for running rental business. As I mentioned in my earlier email, before you find what you can rent a home for, find out how much would it cost to operate it as a rental and then work backwards. Here is what I said:

Make sure you run a good estimate of elements of operating expenses (like

repairs and maint,

vacancy factor,

property tax,

insurance, and

management fee, etc

).

That is the key for picking a good rental. Start from the above. Else you may end up with a negative cash flow property.

I don’t think Fascone is for real. So we might as we highjack his thread.

Forever, sfhs were not considered a great investment vehicle for professionals. Then the 2008 crash created a unique buying opportunity. Many became wealthy riding the sfh rental trend.

That era ended in 2016. Where is the next investment wave coming from?

Will the millennials start buying in the burbs.?

Mass exodus of boomers to gated retirement communities with covid19 testing and extreme controlled access, like Bolinas?

Will all shopping malls go bankrupt and be converted to housing for the covid19 vulnerable?

I am for real and my post was genuine. In the mid 2000’s there were people lining up in metro Phoenix and in inland CA waiting to buy and flip tract houses since mortgage rates were low and as an alternative to stock market investing. Many made good profits until the music stopped. Now, with the massive stock market dip of a few weeks ago, I, and possibly many other people are seeking other types of investments.

You missed the opportunity of a lifetime.

Those people you mentioned mostly got wiped out.

The real money was made by the vultures that picked over their bones.

Time to think differently. Many in government want to turn all rentals into government regulated utilities. Make money flipping, maybe. But you will have to wait for the fire sale at the courthouse steps. 6-18 months from now.

But being a landlord is high risk right now. The government is telling tenants they don’t have to pay rent.

Great time to be a tenant. Bad times for landlords.

I have been a builder investor flipper and landlord since 1975. Buy local. Buy the cheapest house in the neighborhood. Add sweat equity, flip and move on.

Basically, the only way to earn income remaining will be govt approved activities at the rates fixed by the bureaucrats.

You can beat that flipping. But you will have to do your own work. Contractors are charging outrageous prices. Do work without permits. Means interiors only. No inspections being done right now.

How about small parcels of raw land that only have yearly property tax? You paint an ominous, but perhaps true picture of the future, where stable, consistent income earning might only be through W-2 income.

I know of an office coworker who inherited lot of agricultural land somewhere near Tracy. He was a tech workers and did not know how to use the land. The tax bill ran so high that he ended up selling all that land. I do not know if he could have been able to keep it if he did farming. Or why did not not lease it to some other farmers. No details.

If USA does follow the path of confiscation that some countries took, the bureaucrats might say that you can only own so much of land. Many countries have land ceiling laws. Or they may give the title to the sharecroppers too. Anything can happen if we get to that point. Keep in the mind that for government, land is the easiest asset to confiscate from you. I am sure you are not planning for that kind of eventuality.

If the parcel of the land is too small, it may not be even fit for a profitable farming. I do not know what is the minimum size to farm profitably.

Owning raw land is high risk. Zoning can change and make the land worth less or nothing. And is cash flow negative thanks to property tax. And you have maintenance. The county will confiscate if you don’t maintain weed control to their standards.

Now I know why the coworker in my example lost his inheritance.