I check the floors with water level…

Convert into rental and wait for appreciation.

Sound like buyers don’t care…If the house is old a bit of settlement is not unsettling…pun intended…I don’t mind owning old lumpy houses…But I do worry about slides, erosion, flooding and mold…

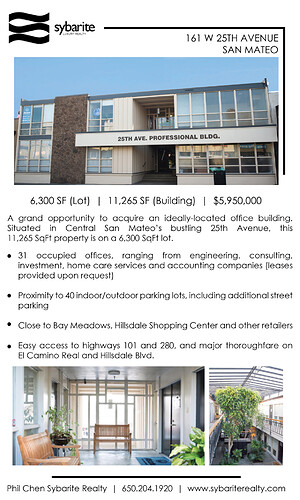

Office used to be in San Mateo. Loved the area, not surprised at the prices.

It just blows me away that the cheapest part of San mateo is $1200/sf…It has freeway noise, plane noise, smells from the sewer treatment plan, settlement, flooding, high tensile wires radiation…The real estate market has gone off the rails…

Perhaps, but when the wifey says not south of Millbrae, she means not south of Millbrae…

I love San Mateo, even with all the negatives…Have lived in Foster City, San Mateo, Belmont and RWC…all great areas…

Talking about being blown away. I saw this pop up on my phone today and was really blown away. Even this location in Milpitas can sell for over 1 mil. Lot is standard size, house is old (but remodeled), location is not great, and still 1 mil. Wow.

I used to live in Milpitas but in one of the newer Shapell houses. 3 bedroom, 5k sq ft lot, a little bigger than this one. Last year I saw a house with exactly the same floor plan as my old house sold for over 1 mil, and it still had the original kitchen and bathrooms (but house was clean and well maintained). I was blown away back then, and now even this house is over 1 mil. Guess I have been out of touch from south bay market for a while.

https://www.redfin.com/CA/Milpitas/224-Krismer-St-95035/home/1042723

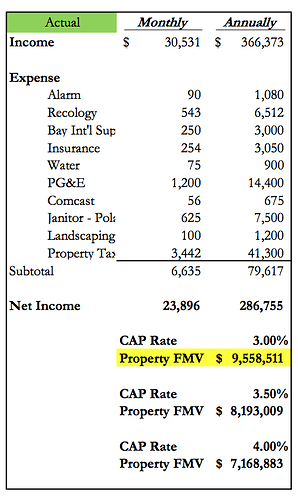

What’s the CAP on those?

It didn’t say what the cap is. Are you interested in offices?

OK, I just went to their website. They have rent roll in the pdf.

Cap is between 3 to 4%. depending on sale price. Office rent is remarkably low.

triple-Net leases are nice, but apartment buildings might be my next step instead of offices. But good to arm with knowledge.

So low ![]()

Note that the FMV’s in their flyer are all higher than asking price. They are expecting price to go much higher than 6M.

Out of curiosity I calcuated the cap rates of all my rentals.

Lowest one being 3.7

Highest one being 13.1

Average: 6.2

As expected, the most desirable home has the lowest rate…

Did you use the current market price or your purchase price to get 13.1?

How about weighted average using market value as weights?

Office building probably does not attract multiple over bids. You may even negotiate and buy below asking. But don’t buy this before you net worth exceeds 60M