Three Chip Stocks Hitting New Highs

Micron Technology Inc. (MU) makes memory chips. The stock has booked a respectable 19% return this year but the rally off the first quarter low tells an even more bullish tale, doubling in price and lifting into a critical test at May 2018’s high in the mid-60s. A breakout could presage outstanding 2021 upside because the advance will face little resistance into the all-time high in the 90s, posted at the height of the Internet bubble in 2000.

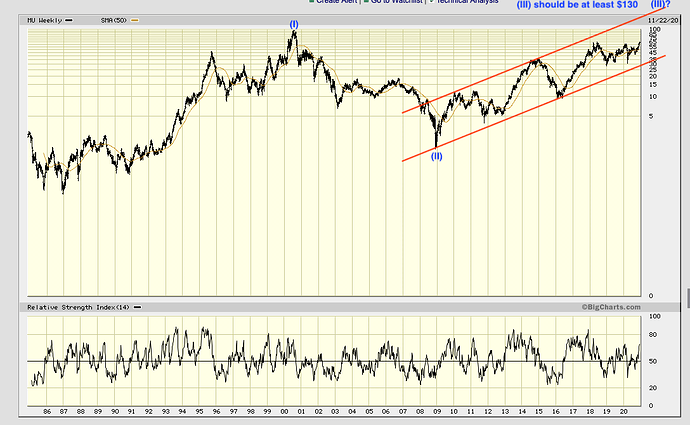

Kind of expecting that ![]() New ATH ~$100 in 2021.

New ATH ~$100 in 2021.

Because of AI, IoT and cloud, tons of memory are required. Many years (may be decades) of strong growth. This fundamental is reflected in EWT, Cycle degree wave (III) of MU should complete above $130. I am expecting $180. However, not likely to rocket like TSLA or SPWR, is a slow and steady appreciation. NVDA and AMD are also good but I didn’t follow them, is going to be too much effort to start. A bird in hand is better than two in the forest.

Cycle degree is a multi-year to multi-decade long wave.