Correct, I happily agree that I am not millennial, but a boomer !

Now, I understand why you want me to buy NVDA ! ![]()

![]()

Correct, I happily agree that I am not millennial, but a boomer !

Now, I understand why you want me to buy NVDA ! ![]()

![]()

I am a millennial

In the social media context and what’s been bubbling around, it will hit 900+ by year end. Short term, expect 750 by March/April I believe. They recommend buying long option call on every dip.

I was in the market in 1998, so definitely not a millennial.

Thanks for the info. EW indicates max $783.

I know. No need to be so serious. If you’re in the market in 1998, we might be around the same age. I lost a fortune in dotcom bust. Ditto for @Jil. The difference is I pumped whatever remains to AAPLs and held till now. He sold everything and bought the fast appreciating RE in SV.

Its more inflation and drive away real business that need real skills to build/operate and replaced with dead beat firms that is all hype.

It is always about railways.

They have a major, major new initiative on rail and they already have rail that goes 225 miles an hour with ease,” Mr Biden noted.

HSR works connecting huge cities with existing mass rapid transportation. Not connecting cities like Bakersfield and Fresno

where there is no mass transit. Basically you have to rent a car

upon arrival.

Market mostly red, semi stocks mostly green ![]()

Sold NVDA yesterday @$608, FOMO in today at $604 (miss the bottom $600)… price changed too fast. Now holding 150… was holding 250… well, didn’t go low ![]() enough for me to buy back. When millennials are involved, price doesn’t go down for long

enough for me to buy back. When millennials are involved, price doesn’t go down for long ![]()

Edit: While doing other stuffs, it drops to $603? Stocks require so much attention!

Race to who to see who spend more money???

Obviously China spends more on railways, Xi has a BRI initiative going on. USA can have a new new deal. Every Americans have been saying infrastructure not just rails, also roads, bridges,… need to be upgraded to cater to increased population and to facilitate commerce.

These people need to talk to Elon about how to fund factories even at most expensive place.

HSR is second phase. It is the first phase that most damaging. It is moving trade and factories to overland routes.

You are so intelligent made me to work for you with NVDA analysis ! Ultimately, you sold and waiting with cash to buy at bottom. ![]()

You have indicated lowest $575, but my take is $500 to 525 range ! Unless fundamental driving force is there, both NVDA and TSLA is no way to go up except goings up and down with flat range. ![]()

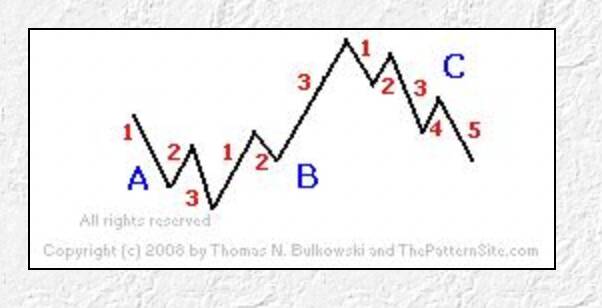

When it has hit the price zone $680-$780. From here, no. Stock is under controlled by millennials, until they let go, it won’t come down. You have ignored the up down up down up down. Just like MRNA, I was right! Do you even realize that? Was in wave 4. Reviewed the past posts if you want to verify. Told you is in wave 4 but is too complex to predict shape… can be zigzag or regular flat (wave B lower than wave 3); or expanded or running flat, wave B is higher than wave 3 which is the case for MRNA (I had shown you cases of expanded flats). Wave 4 of MRNA is a running flat ![]() if you know EWT.

if you know EWT.

You are living with illusions that this NVDA is held by millennials and they are the real driving force !

Here are the millennials stock where NVDA is not at all there !

You are right on MRNA correction (which I noticed late in my algo), but rest of the wave 4 flat is wrong. The current pull back for MRNA and BNTX are really good so that it has momentum to go more.

You don’t have a complete list  for sure.

for sure.

Complete list is waste, this is scraped top 10 list. Even this top 10 is a waste list (IMO) as I do not follow them. In fact, those millennials are miserably failing and blogs/news/media taking advantageous of them and circulating wrong messages (with one or two interesting stories) to public !

Wrong? You’re not friendly, I told you I don’t know what kind of flat would develop… too many possibilities. So I choose to short put and trade shares for safety… no long calls… that’s what I did. You’re lucky that it turned out to be a running FLAT… best kind of flat… pretty bullish type of pattern for a corrective wave. Anyhoo, I notice you don’t read the charts posted all most of the time… plenty of info on it. Anyhoo, this is what happened… a running flat… $102 is wave a of wave 4 exactly what I said and pointed out that Paul is wrong to say is completion of wave 4. Take note, wave b of 4 was completed during PM (yes, PM) at $218.45. I think you should read the basics of EW before commenting on EW ![]() I always have to tell you the basics… and you forget again and again.

I always have to tell you the basics… and you forget again and again.

What is a running flat?

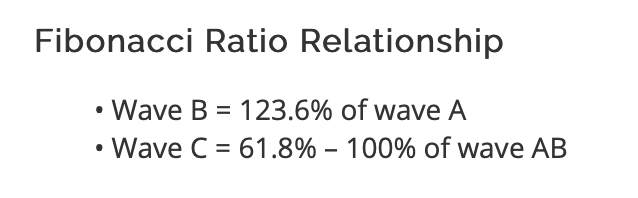

Length of ab of 4 for MRNA = 218.45 - 102.66 = $115.79

Length of c of 4 for MRNA = 218.45 - 147.10 = $71.35

71.35/ 115.79 = ~61.8% ! ! ! ! Yes, perfect! Running flat.

Learning from you, this is the last time, I will show you how to compute!

Still, I do not agree as you look like wrongly presenting the wave 4 !

The main point what Paul showed is $102.66 is wave 4.c, where as you are showing this as 4.a ( $102.66) , that is where difference comes.

What is your 4.b and 4.c $ value?

I have explained why Paul is WRONG the first time ![]() The retracement is 61.8% which break the EW guidelines.

The retracement is 61.8% which break the EW guidelines.

Huh? You are not kidding me, right? I repeated so many times in the last post.

a = $102.66

b = $218.45

c = $147.10

A running flat abc.

I recalled showing the chart of CRM which has a running flat! The intention is to show you wave b can rally like an impulse and be higher than wave 3, although I didn’t mention it… thought you would look at it and realize… so is obvious… apparently, not so obvious to you or didn’t look. So much for the conventional wisdom of a picture is worth a thousand words…screw that wisdom. Same picture, some people see a lot, some people see a little.

The difference is wave c for CRM is 100% of ab.

Whereas wave c for MRNA is 61.8% of ab.

![]()

If I’m the professor teaching you, I would vomit blood ![]()

I am not kidding, but I read enough about EW. This is where your issue/mistake of wrong nodes.

Wave 4 is correction wave, the last node 4.c must be lowest point of the correction wave which is $102.66.

You are wrongly assigning bullish wave $102.66 to $218 as correction wave. The previous peak 3 was $178, wave 4 never goes up above wave 3.

The correct wave must be wave 2 ($65.74) wave 3 ($178) to 4 ( $102 ) and wave 5 must be 102.66-218.45 => Bullish wave

wave2-3 length = (178 - 65.74) = 112.26

wave 3-4 length = ( 178 - 102.66 ) = 75. 34 => 75.34*100/112.36 = 67% appx 0.682

wave4-5 length = (218.45 - 102.66) = 115.79 = almost 100% of retracement