Pat Gelsinger is Intel’s Steve Jobs.

He is not a founder

The best Intel can hope for. At least Pat knows technical product details. Can’t be said of the previous few loser CEO’s, including that genius who refused to make chips for iPhones.

This person does not know alot about fabs. Taiwan succeeded because of China, Malaysia, Korea Japan and Vietnam were able to consume its foundry services. Apple come much later.

now Taiwan cannot make or afford desalination plants for water. Its reputation now damaged because of lack of chips to European firms operating in Asia and Europe.

If this trend continue of not paying attention to European firms. that time will soon come that China with european engineering will cripple Taiwan and no one can save it.

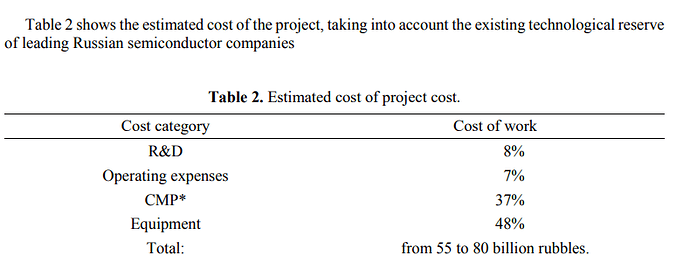

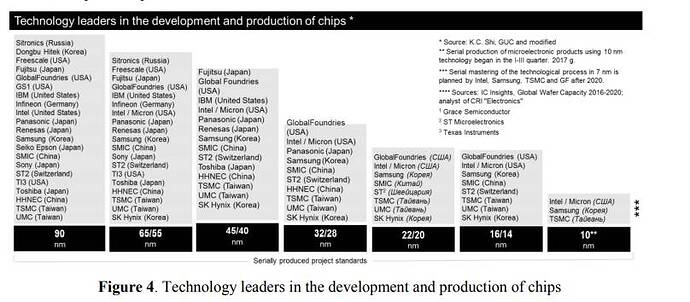

this was written before 2016 by Russian engineers. but predictions were pretty accurate all the way to 2020 for below 7nm. (predictions based on exports from Europe). and they gave there own estimate of $1b to get to next level.

pay attention to Swiss HQ firm STMicro. that was at 16/14NM at that time. Swiss has unique role in very important things that will define alot of things.

Along with millions of white collar workforce as those are easiest to automate with AI.

aircrafts are the most automated systems with multiple redundancies and we have two pilots in cockpit. i doubt we will have robotic taxis widespread. cost of semi conductors are going up as things get complex.

Taiwan is already running out of water. fight between rice and semi.

Europe is moving towards stay at home technologies. they will only provide production constrained equipment at exorbitant prices.

I see only Korean real wealth increasing. this service is for Korea and Japan faster connectivity to Europe. this supply chain has no US.

this is the result of paying 10X to software engineers. billions for stock prices and nothing on the ground and on top of that no tax revenue without creating trillions in debt.

bolded the relevant part.

there is global shortage. why everything got outsourced?. . all those sensors in automobile need chips. we are not even in battery vehicles yet.

i dont see Korean/Japanese or that Chinese/German makers impacted so widely like US.

seems no more display panels. we need display panels for everything. even operating a Tesla.

Samsung Foundry has filed documents with authorities in Arizona, New York, and Texas seeking to build a leading-edge semiconductor manufacturing facility in the USA. The potential fab near Austin, Texas, is expected to cost over $17 billion and to create 1,800 jobs. If everything goes as planned, it will go online by the fourth quarter of 2023.

America is coming back!

![]()

.

FIFY ![]()

Silicon is back in style in Silicon Valley:

Equity investors for years viewed semiconductor companies as too costly to set up, but in 2020 plowed more than $12 billion into 407 chip-related companies, according to CB Insights.

Though a tiny fraction of all venture capital investments, that was more than double what the industry received in 2019 and eight times the total for 2016. Synopsys is tracking more than 200 start-ups designing chips for artificial intelligence, the ultrahot technology powering everything from smart speakers to self-driving cars.

This 90-min long interview is very helpful to understand the lay of the land in semiconductors. It even goes into the analog side of the business like Texas Instruments which I have zero understanding before.

On semiconductor equipments the article below goes over the basics of the Big 5: Applied Materials, KLA-Tencor, Lam Research, ASML and Tokyo Electronics, what they do and their risk/reward profiles in this bull cycle. Very informative.

JC recommends buying these guys.

The article says Lam may not do as well this cycle because of their exposure to NAND. I need to do more research on the players in advanced packaging.