Couple of my coworkers who have been looking for houses for the last two years paused their search because they are going on 4-5 week vacation (one to Taiwan, and other to India). Last year in Fremont inventory went up all the way till August. Then the prices took off. With so many foreign born residents bay area real estate is hard to gauge unless you see a trend for over 6 months.

But they still had 47 weeks left to search for a house in any given year.

Yes, and they couldn’t find homes within their criteria. They will continue looking after their break. I was just trying to point out the vacation factor.

They are only window shopping. Not any serious intention of actually buying a home. I’ve been there and done that. I window shopped for 3 years (2005-2008) until finally gave up.

Tomato, I think a few of us are trying to get you to see the light. Purchasing a home to live in is an emotion filled process. I sent this privately to someone else on here in response to a question on the current market action.

I don’t think that it’s cooling down. I think it’s adjusting to the new price range. A consolidation. Prices would be stratospheric if they kept up at the same rate where it made everyone think it was overpriced. I’ve seen this type of action repeatedly. It doesn’t mean this isn’t something different this time, but it’s likely just more of the same. A fundamental change in the market would have to happen to indicate something different.

The properties that will move the quickest will be the cream of the crop or the bottom of the barrel. Those inbetween will take a little longer. If you are shopping in that inbetween range, it will be easier to determine price for now. My opinion is that primary home buyers should buy once they find something that works.

Can hear noise from upstairs, didn’t see anyone coming down.

Unless a person knows this reality, there is no way to win a deal in this sellers market.

I remembered end of 2016 when the presidency hasn’t been decided yet was really bad too.

What is he saying? As per title of this thread?

“Surging mortgage rates would set off scramble to buy homes”

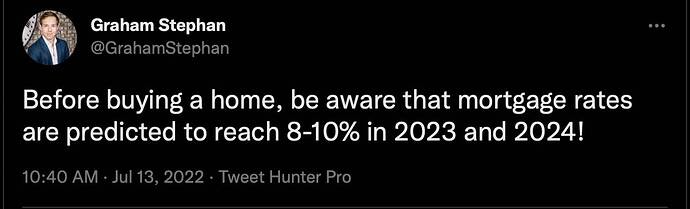

Mortgage rates were in that range in 2000. I double they’ll get that high this cycle. Mortgage rates have moved far ahead of actual fed rate hikes. They already include anticipated hikes.

I think he implied house prices would decline sharply so don’t buy now. I don’t like people to talk this way, just say what you intend to mean directly. Now we have to guess.

Actually, I am seeing 3-4 times more price reductions in the San Diego market since interest rates went up. People can’t afford new homes anymore.

I second Sheriff here. SoCal builders are offering seller paid 2/1 rate buydowns (ex: 2.75 year 1, 3.75 year 2, 4.75 years 3 - 30. These cost about 2.0 discount points to fund), upgrades, and other perks other than price reductions. When I heard a new construction sales office pitch this buydown to a potential buyer their first response was “Is that all?”

As for resale homes, even in the hottest markets, new listings will show up at the sellers dumbass $2.9m fantasy price, then drop to the markets $2.1m two weeks later. There’s even this listing:

https://www.redfin.com/CA/Laguna-Beach/1595-Arroyo-Dr-92651/home/4887018

Where the “realtor” thought it best to change prices almost every day just to keep the listing fresh. There are so many schemes like this going on in the LA / OC market it’s hard to keep up with them. Buyers simply aren’t accepting the prices where they are today, nor are they falling for these kinds of sales tactics.

Rates do not drive people to “scramble” for homes. Anyone who does buy because of rate movement frankly is being badly advised. Buyers scramble when the right home at an affordable price is put on the market. Remember: during the peak buying season of the past two years for every winning all cash offer there were 5-10 other buyers behind that offer. Those 5-10 buyers still exist today. They are called “renters” and are still looking to buy once employment continuity is established and inventory concerns are eased.

Thanks for reading.