Which is a better buy at this point: Amzn or Tsla?

One on its way to 5T the other to zero.

Tsla will never go to zero. Corollary: Amzn also won’t go to 5T

Jerome earmarks as successor? Track record?

Track record of saying yes to every dumb idea coming out of Elon.

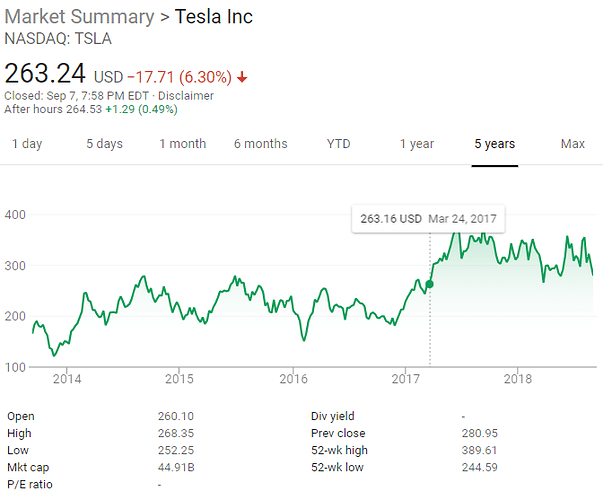

With current price, around $250, point of view, TSLA. It is like buying AMZN at $750.

Had Elon shut his last mouth, by this time TSLA would have crossed $400. He tried to cut the geese that lays golden eggs !

I do not know how much tariff affects TSLA, but AMZN may get tariff issue. Plenty of amazon sellers importing goods from China. When tariff comes, their cost will increase and ultimately pass on to consumers. Consumers will likely reduce the purchases. Somewhere now analysts will be running all those programs (how much impact) in next few days.

This is my own view, but I do not know the actual values. I already purchased a very small qty (14 shares) of TSLA at $263, will keep adding Monday when I free up some amount (and if the TSLA price remains same level).

This is one hour video about clean energy and its future (by Tony Seba). If someone is interested, view it

After having pot, ELON has actively started working

“We are about to have the most amazing quarter in our history… Ford Model T, which held the world record for the fastest growing car in history, didn’t grow as fast in sales or production as the Model 3.” -Elon

Got some money, I have already placed a limit order $260 for Monday, my final price may change depending on Monday pre-market quotes. If I get it at that time price, I really feel lucky !

It sounds so positive… I’m so excited…

So 100 years later Musk has surpassed the Model T?

Absolutely. Model T made Ford the preeminent company of its time. Model 3 will make Tesla the preeminent company of our time.

Bet so much?

What are chances of TSLA going down to $225 (with RSI technical indicator is 26.66 now)? IMO, very less. It can go to $250 (If so, I am happy to get).

See this chart, TSLA has gone back to Mar 24, 2017 level. I guess that I am buying TSLA its one of the bottom (Unless recession comes to picture) as we see lot of Model 3’s on Road. If there is a recession or deep fall, I still can recover. But, getting TSLA at 260 or 250 seems to be attractive now.

Since everyone knows these updates, I really do not think that I will be able to get TSLA by 260 coming Monday ! Remember, I regretted not having this money last Friday (Yesterday) as funds are settled yesterday night.

Buy buy buy!!! Does it matter whether it’s $250 or $300 when you know down the road the price will be multiples of what it is today…

Why play with knife? Tesla has no monopoly on EV and will never have. It has no moat. Buy FB instead if you like buying RSI < 30.

BTW: This is my own view and it may change depending on changes happening in these companies. I may also be right or wrong. Viewers, you do not take any action based on this feedback

The TSLA RSI rule will not apply for FB now.

Reason:

WQJ says “Does it matter whether it’s $250 or $300”, buy, buy, buy. Remember that when TSLA was 280 you asked any one buying TSLA? I was negative at that time as the price was not attractively low at $280.

When it dipped to $250 range, I see it is attractive. Reason is that TSLA Stock price went down without any fundamental change. i.e., The price did not go down by the sales numbers, or expenses or debt increase securities. It went down for Elon Smoking and few VPs resigning. These are sensational news, not fundamental changes.

FB is well established company, esp for sales, revenue and earning.

Regarding FB, I am still negative because of fundamental change ! Since multi-countries are enforcing (including high pressure from our senate+house committee), FB needs to spend money to secure sites getting rid of some customers and revenue streams. There are two issues 1) Additional expenses 2) Reduction in revenue. Mark acknowledged that it affect profit margin (Fundamental change), but he did not say how much. Everyone is guessing that EPS will be 1.48 from last qtr 1.74.

Now, market is correcting the price from $217.50 (Related to 1.74) to $163 range (related to 1.48). This is fundamental change (not sensational). If FB meets 1.48 EPS, the stock may stay same, otherwise FB price may vary depending on UP or DOWN after Q3 Results.

Even with this 1.48 EPS, they are expecting PEG=22% and Profit Margin = 35.25% which I really doubt.

I have given complete details in marcus reply.As I said in that thread, if we want to hold FB for 10 years, we can blindly buy, buy, buy.

I do not want to put my money at this FB’s precarious situation.

Every company is different and every situation is different.

If I do not analyse the situation, my money will become fools money easily.

Why play with knife? Tesla has no monopoly on EV and will never have.

Playing with knife is safer as long as we analyse it carefully. Buy low, sell high will happen when it falls down.

Tesla has no monopoly on EV and will never have: Yes, GM beat Tesla in production too, but Tesla is innovator with massive high quality infrastructure.

It is very difficult to win the leader and innovator. Winner takes all first !

If you have time, listen to this Tony Sega video, how things are going to change in 2025 or 2030.

As I said in that thread, if we want to hold FB for 10 years, we can blindly buy, buy, buy.

![]()

For buy n hold (hopefully forever) investors, BUY.

For traders, use your trading rules.