Ahhhh…the tax cuts at work! ![]()

![]()

![]()

![]()

![]()

![]()

This photo reminds me of westerners showing the backward Chinese their advanced technology…

Mad man musk ! Going Crazy now !!

What? Not arresting Musk?

@manch already regretting not getting it at below $300. Pretty soon he will regret not getting it at below $400.

Better than buying at $300 only to see it sink to $50. ![]()

Now, it is justice department turn, for tweet 420, to arrest Musk

Is Tesla going to own it 100% or did they have to form a joint venture with a Chinese company? You need to manufacture in China with a 25% tariff on auto imports.

You mean Amzn dropping down to $50? Better sell sooner than later!

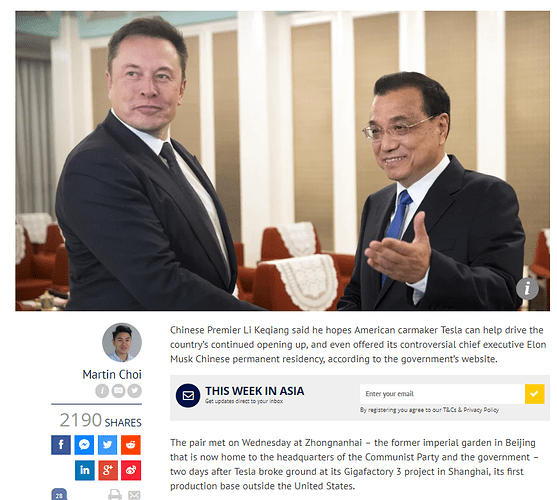

Tesla did not propose joint venture, everything - including technology - owned by Tesla. Musk said he is avoiding sub-contract and all developments will happen in his own factory. No issue of technology transfer and keeping his patented technology by himself.

I think China made an exception for Musk to keep his own brand without the need for joint-venturing.

Yes. Chinese government knows the value of Musk and his innovation ![]()

Once completed it will be the first car plant in China to be wholly owned by a foreign company, since Beijing relaxed its restrictions on compulsory joint venture partnerships in some sectors last year.

China will permit foreign carmakers to take full ownership of their local ventures, offering a trade-talk olive branch and a boost to global manufacturing giants hungry for a bigger slice of the world’s largest auto market.

Scrapping the current 50 percent ownership cap will benefit electric-car producers like Tesla Inc. first, with the restriction on such businesses lifting as soon as this year. The cap for commercial vehicles will be eliminated in 2020 and the one for passenger vehicles will end in 2022, the agency that oversees industries said Tuesday.

The move may help diffuse strains between China and the U.S. after President Donald Trump’s intensified rhetoric raised the prospect of an all-out trade war. Companies from Daimler AG and Volkswagen AG to Ford Motor Co. and Toyota Motor Corp. may find it easier to do business in China, while local carmakers will be under increased pressure to speed up building their own brands.

That’s huge then.

China also just started allowing full subsidiary ownership for foreign banks. I think UBS and another European bank already got their license. For some unknown reasons applications of American banks like J.P. Morgan are just not moving.

Why even put foreign banks into the equation. China is dominated by domestic banks and foreign car companies. Focus on the issue.

China lags behind two fundamental areas: semiconductors and finance. Opening up domestic market to foreign banks and insurance companies help Chinese modernize. Cars? Who cares about cars. China got cars nailed down 10 years ago.

Why you care so much about China modernizing? How does that help your portfolio? You are losing focus.