Why don’t you try investing into TSLA when things are still shaky. You will not gain much when it’s a sure thing. Just like when you should’ve invested into FB back in 2012 which would’ve been way better than doing it today or in the future.

I do the reverse. When I was visiting AZ to look at property I almost always drove. Less hassle. Everything on my timeline and terms. Fourteen hours driving but by the time I drove to SFO, parked, got through security, got to AZ, de-planed, went to pick up my rental car and then drove to my location the fastest I ever made it flying was still 7 hours and it was much more stressful.

Also - on the the price of the electricity - my last PG&E bill, for 15 days of service, had me at 0.32 a kWh, all in Tier 1.

As for a car that works 95% of the time - I don’t want two cars with one sitting around most of the time. I want a car that works 100% of the time. My Mazda 3s fits the bill. With 6" of clearance and a large wheel base it’s fine even on rough forest service roads a Tesla could never handle unless there was a way of adjusting the clearance. The internet is fuzzy on whether and how much adjustment is possible.

I know people that rent for long trips just to not put all the miles on their own car.

Maybe they shouldn’t have bought Fords ![]()

With conservatives’ newfound fondness for debt and deficit we can always borrow and print our way out.

If Trump were to runs deficits for the next six years at the same rate he has for the last two he would cut the rate of growth of the national debt in half compared to his predecessor.

Meanwhile, the new Dem Congress passed a rule which allows the majority to put debt limit increases on auto-pilot, which means they can spend without any regard for the debt piling up. Another new rule will eliminate the requirement that bills, such as the extreme “Green New Deal” proposal, be analyzed for how they will affect the economy.

I calculated the cost of traveling from SF to LA using different methods:

Air+Rental: $600 ($300 ticket + $300 rental)

Rental only: $400 ($300 rental + $100 gas)

Use your own car: $200 ($100 gas + $100 wear and tear)

Tesla has been such an interesting stock to follow over the years. In the end, it comes down to whether their head start in EV technology can overcome the infrastructure and institutional knowledge of traditional auto makers. So far the answer is yes…in the last ~18 months they’ve grown from 20% to 70% of US EV market share.

I think we’ll see a pause due to the expiration of the tax credit and delay of the 35k model 3. The layoff likely reflects that. It’s interesting that Hyundai, Jaguar etc. are going after the small crossover segment where Tesla has a big hole but I’m skeptical that they can produce at sufficient volume. Musk needs to get cracking on model Y to maintain his advantage. Eventually competitor tax credits will start to expire and that’s when we’ll see who’s got the best combination of compelling products and fat margins.

OMG. Buy buy buy!!! What are you waiting for?

I’ve been in since $30…should have bought more back then. Sold some at $150…more at about 325 when the SEC was investigating but am now back in since that is resolved. It’s not a huge position…I’m not supposed to be investing in individual stocks.

I’m not supposed to be investing in individual stocks.

Makes no sense.

put debt limit increases on auto-pilot

That’s the same as setting auto payment on your credit card bill. The drama about raising the debt limit is like have a debate on whether to pay your credit card bill, after you have eaten all these fancy meals and bought a car and a boat on your card.

If you want to cut spending, fine, tell the American people in their faces. Let’s be adult about it. Don’t have this childish tantrum about paying your bills. If you can’t cut spending, again, be a responsible adult and raise more revenue.

Used to do it but with W2, rentals and young kids don’t have the time to put in anywhere near adequate diligence. Hence am at an intrinsic disadvantage to the person on the other side of the trade…and have become an index guy with the exception of TSLA and some legacy stocks.

become an index guy

Are most of your funds in US indices? If so then you are also gambling that America will always win over the rest of the world. Since you are biased with your indexing, might as well go for individual stocks for more positive bias.

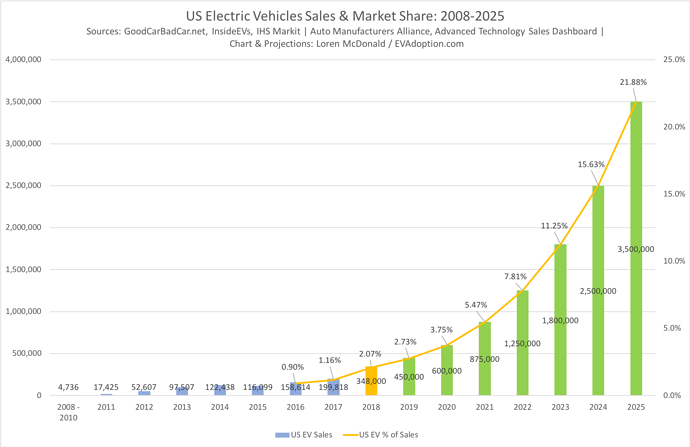

The market share chart is really a short term chart. Only covers one year.

I think people often confuse these two questions:

A) Does Tesla make good cars?

B) Is Tesla worth 100B market cap (or put your own ultra bullish number)?

For me it’s perfectly compatible that both, “Tesla makes good cars” and “Tesla is worth 30B” are true at the same time. I haven’t seen any rationale, backed up with concrete numbers, that Tesla is worth far more than what it’s worth today.

I admit I may be wrong. But Tesla is such an enigma why bother? There are way easier bets to make.

But Tesla is such an enigma why bother? There are way easier bets to make.

![]()

Market is just as ![]() swinging up and down,

swinging up and down, ![]() Day it will resolve

Day it will resolve ![]()

There are way easier bets to make.

What have you made besides Amazon?

It isn’t about whether they make good cars. In terms of quality I think the germans will remain the leaders.

A bet on Tesla is about 1) EV adoption and 2) Tesla being ahead of the competition in terms of technology, COGS, brand appeal, etc. and able to retain a dominant position in the EV market. The bull case is that Tesla has a great product, nice margins and we are at the curve of the hockey stick.

Buy buy buy!!!

Looking at the curve, won’t be buying an EV during my lifetime, adoption is painfully slow, nothing like a hockey stick.

-

There are not a lot of people that can buy $45k cars.

-

Even if Tesla makes $35k car, with a range of 220 miles, it will just be a commuter or second car and not the main one.

-

The electric car revolution won’t happen till you have a 330 mile range cars at $25k - $35k.

I don’t see these cars coming till 2023 as currently there are simply no manufacturer that has those plans.

Why? You can’t live another 7 years?