This week’s earnings calendar:

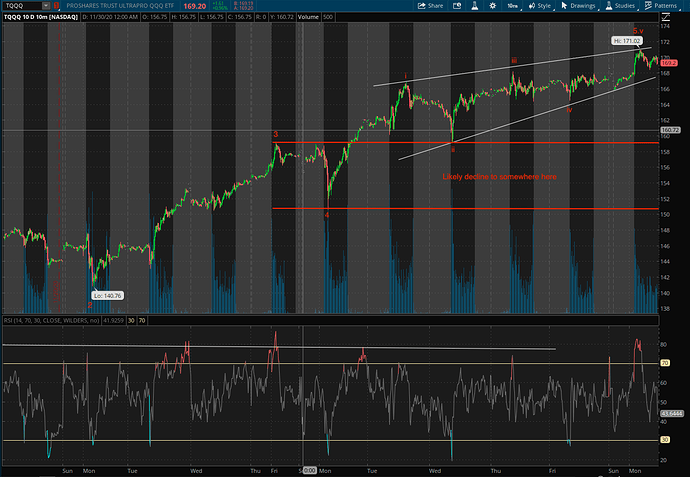

Flats are common corrective waves which can appear as B, X, two and fourth waves. Is not good enough to indicate fractals.

Can only short when the stock is technically damaged. Otherwise you would be short squeezed.

I do buy SQQQ or SPXU or puts instead of shorting and opposite side TQQQ or UPRO or calls. All based on algorithmic inferences (no news reading or reddit or robinhood blogs).

Long side is easy, but short side needs good amount of research to ensure I am winning.

Kaplan says “a lot of things are going to be dropping by 30% or 40%,” and believes we are in a bear market, so suggests looking at pullbacks between 2000 and 2003 for an idea of what’s ahead.

Could it be jumping out too early?

Kaplan expects it will take four or five months to flush out investors who bought shares at prices that were too high and reward the insiders who were getting out, before a rebound starts.

“When the ‘Three Musketeers’ top out and start moving lower again, perhaps in the late winter or early spring of 2021, that could be a signal to buy the most undervalued small- and midcap value shares which will benefit from a subsequent “surprise” trend for a year or so toward rising inflation and rising interest rates,” says Kaplan.

Rising interest rate? Tumbling stock market and RE from Spring 2021? Must re-fi fast while it lasts.

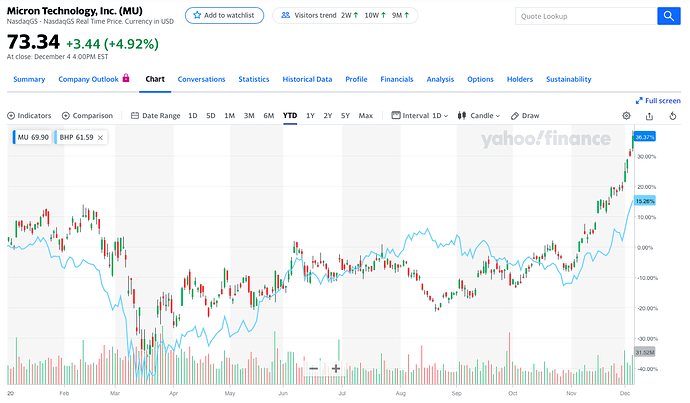

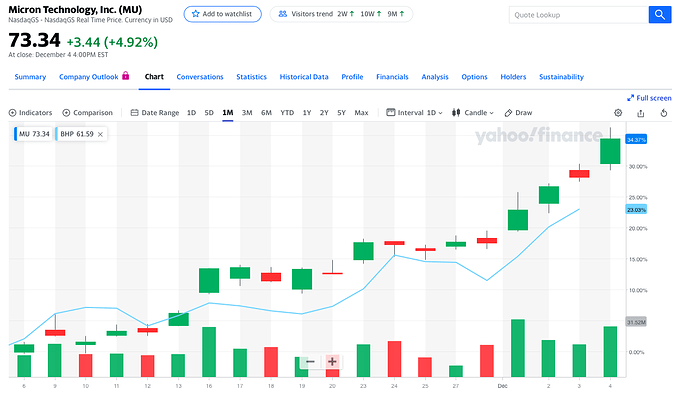

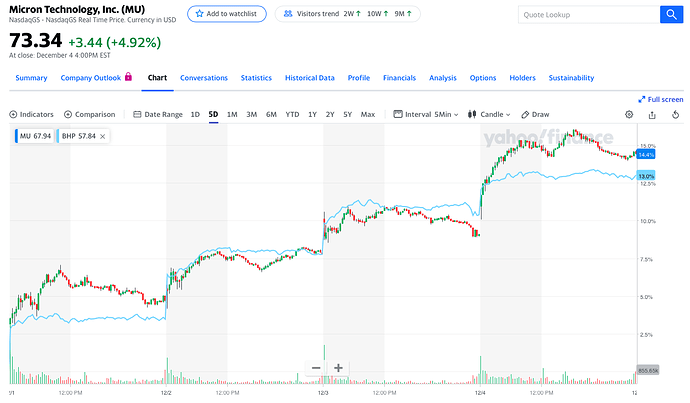

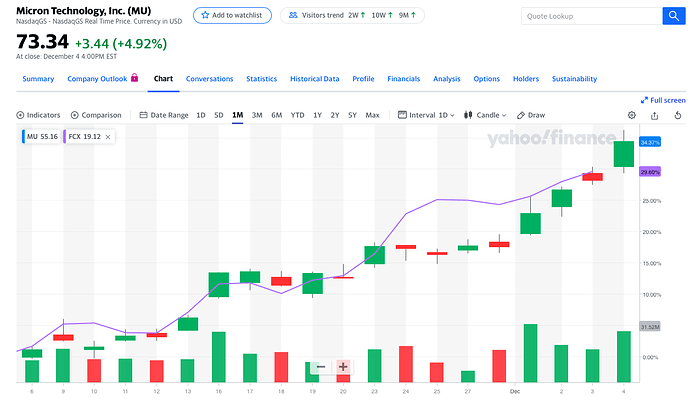

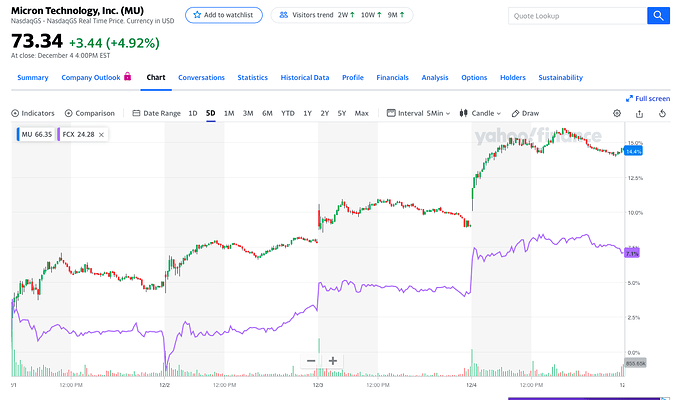

I bot MU calls of equivalent delta because I want to maintain exposure to 10% max for the semi portfolio. Essentially riding the same appreciation as shares with reduced capital, the con is more trades than just merely holding shares.

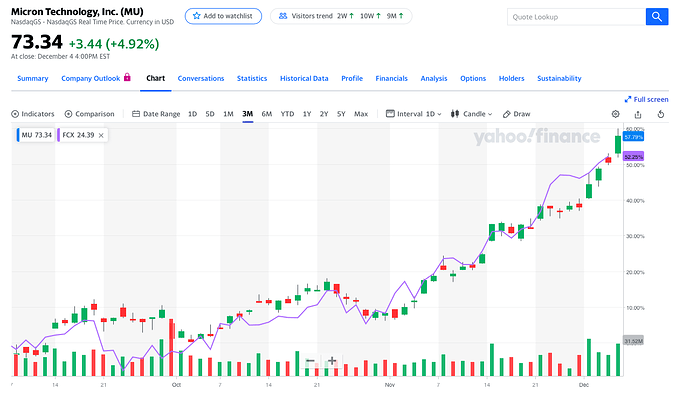

Investors are piling into wagers on industrial metals like copper and nickel, betting that coronavirus vaccines and stimulus programs will drive a boom in manufacturing activity as part of a global economic resurgence.

Prices for copper have risen to their highest level in almost eight years. Iron ore, the main ingredient of steel, is one of the best-performing assets in 2020. Other raw materials, such as aluminum and zinc, have added roughly 15% since the end of September and 40% or more since mid-May. And shares of metals producers, including Freeport-McMoRan Inc. and Century Aluminum Co. , are on a tear, climbing alongside other stocks closely tied to economic growth.

Are you still having TQQQ? I bought today SQQQs !

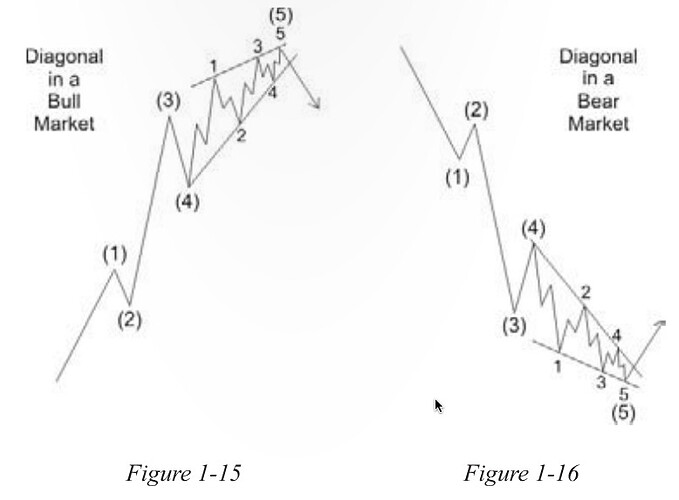

Yes, 300 TQQQs. Look like some kind of ending diagonal i.e. decline soon. However, I don’t want to sell these remaining 300, die-die hold through the correction? consolidation? No QQQ calls, no short TQQQ puts and no QQQs. Close them already. So plenty of cash to long QQQ calls ![]() or short TQQQ puts depending on the speed and depth of the pullback.

or short TQQQ puts depending on the speed and depth of the pullback.

TQQQ EW pattern

.

Definition of ending diagonal

Just bought few short term spy puts and qqq puts today, let me see tomorrow…

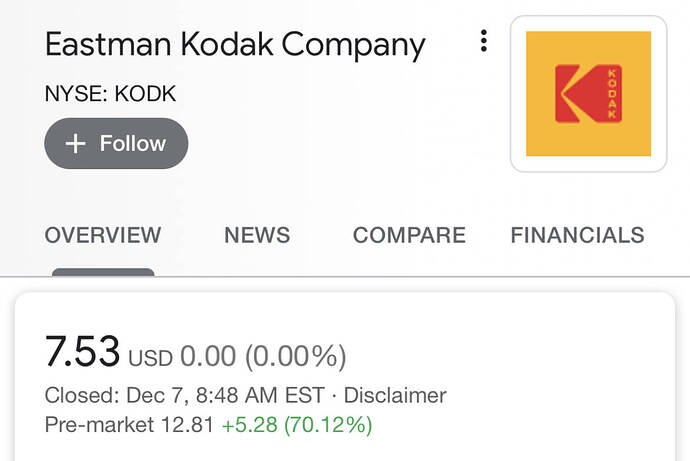

RHers are always right! Don’t listen to them at your financial peril.

Same is the case for CUK & CCL

% !

% !