Everyone offering free trades

Free trades  Expected that, take the industry that long.

Expected that, take the industry that long.

Schwab is going to offer free online trades now too. As more and more brokerages offer free trades, what makes Robinhood special?

Once the other traditional brokerages offer free trading, Robinhood can go down the toilet. Traditional platforms are much more sophisticated with many different options for trading with priority. Orders take forever to get filled in Robinhood.

Free crypto orders at robinhood!

Now TD Ameritrade reduces to zero

Expect much further consolidation of the discount brokerage industry.

Scale or sale!

Not only eTrade, soon Fidelity and Vanguard follows the same. Very likely Fidelity will announce details on Friday as per their support team.

Ally joins the party.

https://media.ally.com/2019-10-04-Ally-Invest-Joins-the-Zero-Commissions-Movement

Just wait for Elizabeth Warren to propose a trading tax. I bet it will be higher that the fees.

I already have free trading with Merrill Lync and, on the mobile app, Robinhood UX is head and shoulders above Merrill, Fidelity & eTrade for ease of use. On the back end, Robinhood doesn’t provide the same level of reports and support yet.

IMHO, for the unsophisticated customers Robinhood went after, the question will be the other way round - “Sure those traditional online brokers now offer free trade but their UX sucks compared to Robinhood and I don’t care about all those confusing trading options so why should I switch?”

All that money spent on CAC won’t go to waste in a hurry just because other online brokers caught up to Robinhood now.

Robinhood has more than 6 millions users and UI is easy, fast and quick to buy/sell. Even when I have other brokers, I used RH as it is free trade. Since others opened commission free, the growth of RH may be slowed, but can not be killed as it has taken Niche place with millennial users. Other brokers are forced to follow RH, that puts RH was leading and others were lagging Since the day RH started. Now, others stopped mass exodus and holding their existing user base with current change.

See here how millennial play with RH.

The average millennial is playing with options? Dang I must be way below average.

Wide bid/ask?

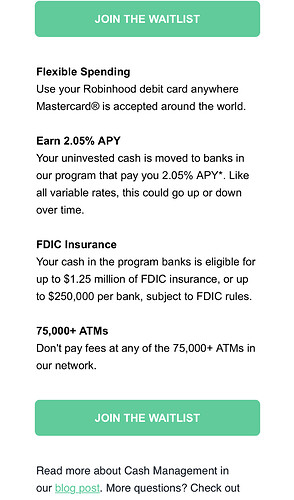

Well, somebody’s desperate. Anything that requires a waitlist is a sham. Guess the competition for commission free trades is really hurting them.