Could explain some of the slowdown? “That’s about a 29 percent drop in both dollars invested in startups and in the number of deals done, compared to last year’s third quarter.” http://www.bizjournals.com/sanjose/blog/techflash/2016/10/venture-funding-exits-continued-to-drop-in-q3.html

I don’t know, I just think it is a combination of the time of the year and just that pricing levels have gotten a tad high around here. The desirable homes yes people fight over and overbid. No doubt. But the average to ones with warts are going to be scrutinized and have to be really priced right or the market will be merciless on them. Also, not everyone wants to or can pay 1M+ for a home. Yes, some techies make a lot but they may not have the down payment (200K plus) yet and they may not see the need to settle down with such a huge financial arrangement just yet. There is something to be said about enjoying your life some while you are young and free. Some people like me don’t like condos so they aren’t buying those for that reason alone.

At some point, at the end of the day, one must step away from the buffet table…

I don’t think VC Funding is immediately related to market. If you works in the startup, it is rare that you can afford a house while working there (possible, but rare). But exit from startup or working at IPO’ed companies led to first time home buyers. So if VC funding in decline, maybe more people will work in big companies, hence more liquidable cash.

Singapore is out for you. Mostly condos ![]() or HDB apartments

or HDB apartments ![]()

You got to be in the billionaire club to afford a freehold GCB.

For sure the decline in exits has an impact on the high-end of the market. There are a few new 4-5millon dollar homes in my neighborhood. Speaking with the owners, they were mostly bought by executives w/ exit money or money from China.

Also, I wouldn’t say that those at startups don’t make enough to buy homes. I was at a startup a couple years ago. The market was tight and they had very competitive salaries…$150+ for experienced engineers. Many of them bought homes. Now, they need another round of funding, an exit, or a new job to keep paying the mortgage.

Plus, the whole tech boom of the last 5 years was VC funded. If that money dries up, it will impact Bay Area housing negatively.

I think that’s overstating the importance of VC and startups. Just the daily market cap fluctuation of Apple and Google could dwarf the 10 or 20B VC investment for the whole quarter or year. For every early startup employee, there are 100X or 200X more regular joe and jane toiling in Big Tech, many as boring as Oracle and Intel. For these people it’s much more important that a) economy is good, b) their companies are doing good business, and c) the stock market is up. We hit all three.

I think companies are cash flow positive much faster. So they quit raising money earlier.

I bet that a decent percentage of FB, Google, Oracle & Apple revenue the past few years has come from VC backed companies. They are likely to feel some impact.

I’m not saying it is all doom and gloom. The bay area will always be expensive but I do think things are slowing down and this maybe one of the reasons…particularly for the $3m+ homes.

Things are definitely slowing down. But I always think back to @ptiemann’s post about his Sunnyvale buyers. They all have ample cash but suddenly became much pickier this year for some reason. So I think people still have lots of cash. Maybe the VC funding slowdown contributes to the sluggishness. I don’t know…

Wait until after the election. Things will speed up.

If Hillary is elected and interest rates remain unchanged, things might speed up.

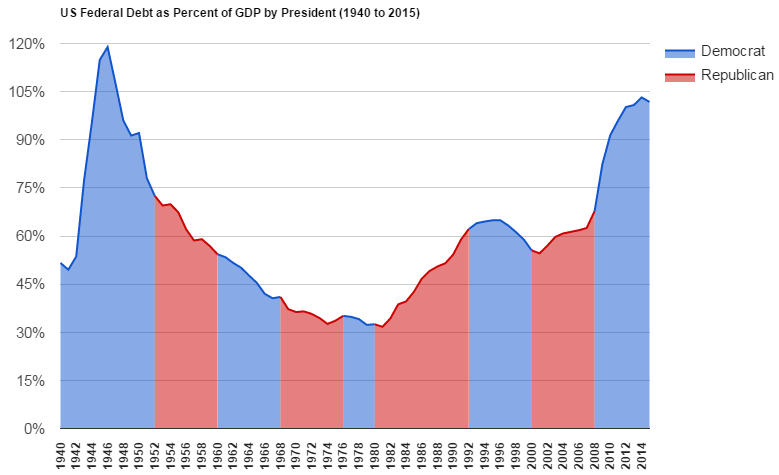

I don’t think who wins matters as much as certainty does. They’d both be bullish for different industries. The real problem is that since 2009 debt is up $8T and GDP is up $3.5T. Neither of them will change that trend. If we keep growing debt twice as fast as GDP, then we are screwed.

Reining in debt is most effectively done by growing the economy, not by doing foolish tax cuts like Reagan and the 2nd Bush did. Look at what the Great Recession did to the debt. Now that economy is on much more solid footing it’s not the time to worry about debt, especially when Treasury bill rate is at historic low. Time to borrow more to fix our crumbling infrastructure and lay the foundation for the future.

You might be surprised to know that every time we cut tax rates tax receipts go up (JFK, Clinton, Reagan, and Bush). GDP grows goes from 2.4% before cuts to average 4.2% the three years after the cuts. Taxes consistently average 17.5% of GDP regardless of tax rates. We should lower rates until tax receipts actually decline. If we want to control the growth of the debt, then spending needs to be closer to 17.5% of GDP.

Also, there’s some good science that tax being less than 20% of GDP lead to more long-term growth.

Notice how little spending there was pre-WW2b

Well, I am willing to accept a condo living situation (even here) when I am retired and could care less about paying the HOA (after I cash out all of the properties). It will be all about enjoying the rest of the your life. Something we should strive for!!!