Is why he got unseated! The good thing about not borrowing is you won’t drop right down to the bottom if your judgement is wrong. He prefers that because he is already there. For you, you may want to bet all you have to catapult to his rank, then stop borrowing to float around there… at the top of the heap.

Borrowing comes with Risk, margin money has additional risk that broker can sell the equities automatically when downfall happens beyond a certain percentage. He (and many) suggests not to borrow margin.

For them, investment is acquiring companies and they suggest use the excess cash to buy them, hold forever.

Is warren buffett expecting hyperinflation?

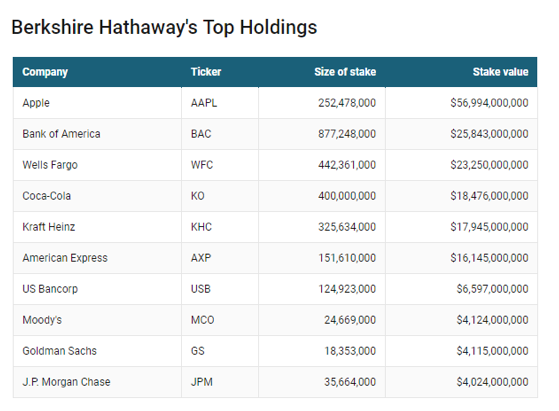

Investing in so many banks and cash rich companies like AAPL which benefits from rising interest rate.

Follow him into banks and RE? Really? Good hedge against inflation?

Rising interest rate, steady growth of economy, downward litigation expenses, less regulatory scrutiny under Rep leadership = all positives for Banks.

Here is the question

$100bn has been deposited into your holding companies account. What are your steps towards becoming the worlds largest and greatest company?

Answer

$100 Billion is more than enough so I’d focus on wealth preservation with no more than 25% of that going into venture capital or “risky” investments. That’s what Buffet has been doing recently, once your company becomes so massive it’s hard to get into small and mid cap stocks to find meaningful growth without creating a tsunami on the price so you focus on the large cap like these financial stocks.

Canada’s Warren Buffett’ Drives His Own Pickup Truck

On the road with billionaire Jim Pattison.

As the thief said to the judge after he asked him “how in the hell you keep robbing banks and getting caught every time?”………“Well…your honor, that’s where they keep the damn money!” ![]()

![]()

WF invest on anything that used the famous OPM.

And, anybody investing money has to pay a fee to play = borrowing money. That fee goes against your profit.

@hanera, here is some discussions about BRK (just copy and paste, not authored by me).

Berkshire Hathaway - P/B and P/E Metrics. When is it undervalued?

This post is a discussion on how to estimate Berkshire’s intrinsic value using simple metrics such as P/B and P/E. I started thinking about BRK’s intrinsic value when I ran a screen of companies last week and saw that BRK was very close to the 1.2x book value that Buffett was authorized to repurchase shares at. I got excited when I saw that but then I read BRK’s equity portfolio has taken a big hit the past couple of weeks during the bear market, making its true book value much lower. See below:

| As of 30 Sept 2018 | As of 29 Dec 2018 | |

|---|---|---|

| Market Value of Equity Investments | 218.68 B | 181.07 B |

| Approximate Shareholders Equity | 375.61 B | 338 B |

| Book Value per Share | 152.35 | 137.35 |

| 1.2x BVPS | 182.83 | 164.82 |

| P/B at 207 (average repurchase price in 3Q 2018) | 1.36 | 1.51 |

What a difference a couple of weeks makes. There has been a huge change between 3 months ago and today in BRK’s book value and what BRK’s valuation looks like in B share equivalents. Book value per share used to be a valuation metric that Buffett said is a good way to approximate intrinsic value.

Now that BRK buys whole businesses, the 1.2x BVPS metric is not as helpful anymore and Buffett is authorized to repurchase shares whenever he believes them to be undervalued. Since BRK repurchased shares at an average price of 207 in the 3rd quarter of 2018, 1.3-1.4x may be the new P/B at which BRK is undervalued.

Besides book value, another way I attempt to value BRK is by looking at normalized, comprehensive earnings with “look-through” earnings from owned equities. Here, I’ll define comprehensive earnings as net income of BRK owned businesses like GEICO, BNSF, Mid-Atlantic Energy, etc, interest income from cash and bonds, “look-through” earnings from equities, and other earnings (derivatives). Normalized earnings remove accounting increases such as unrealized investment gains or tax benefits.

| Normalized Earnings Estimate | |

|---|---|

| Earnings from interest, dividends, etc (before income taxes) | ~6 B |

| Earnings from BRK owned businesses (before income taxes) | ~23 B |

| Other Income | ~2 B |

| Look-Through Earnings (FY18) | 14.65 B |

| Total Earnings before Taxes | ~44-45 B |

| Comprehensive Earnings after Taxes | 35B |

This suggests that as of the end of 2018, BRK has about 14.2 $ / share of comprehensive income. When Buffett repurchased shares, he did it at about 14x comprehensive earnings. One reason why I try to simplify BRK’s earnings as much as possible is because BRK is composed of many operating businesses and it can be difficult to get in the weeds and try to value businesses separately. This rough analysis is the best I can do right now.

What do future earnings growth look like for BRK? Two drivers of growth for BRK seem to be the increase of future earnings of currently owned businesses (equities and wholly-owned) and how Buffett can deploy nearly 100B in cash the next two years. I think it is conservative to assume 2-3% long term earnings growth rates for businesses BRK currently owns and 5-7% earnings yield on the additional capital Buffet deploys in the next 2-3 years. If Buffett is able to successfully deploy up to 60-100B in capital at the 5-7% earnings yield, BRK’s growth can easily compound at 10% over the next couple of years. That would be a successful scenario but Buffett’s new investments could also turn out less than stellar, yielding very low growth in earnings. Here is a table showing different valuation metrics and approximate prices at which BRK is undervalued:

| Metric | Approximate Share Price |

|---|---|

| Buffett’s Repurchase Price | Average of 207 (About 14x P/E) |

| 1.2x Current Book Value | 165 |

| 1.35x Current Book Value | 185 |

| Scenario 1: Low Earnings Growth, unsuccessful capital investing (1-2% growth) | 170 |

| Scenario 2: Moderate earnings growth, moderately successful capital investing (3-5% growth) | 200-210 |

| Scenario 3: High earnings growth, successful capital investing (8-10% growth) | 230-250 |

I was surprised at the relatively high price Buffett has repurchased his shares but he is clearly pricing in high growth and successfully deployment of capital the next few years. I would say if you agree with Buffett, the current market price of 203 is a good price to enter BRK. If you want a higher margin of safety, a price between 170-175 would be more undervalued. With more market volatility in 2019 almost certain, it would also be wise to stagger purchases of BRK if it got to the 170 level.

Any one interested in Graham Papers? Someone shared it (not me)

https://drive.google.com/drive/folders/1F484ZSMTZzHQSD_asjwILhHr_uNc8jZz

Berkshire Hathaway is refinancing floating-rate notes with 30-year fixed-rate debt.

Warren Buffett is wading into the bond market with a new deal, leaving traders wondering whether the Oracle of Omaha is making a prediction about the direction of interest rates.

Berkshire Hathaway Finance Corp. is issuing 30-year fixed-rate bonds to refinance $950 million of floating-rate senior notes that mature at the end of next week. The decision to switch from floating to fixed could be viewed as a bet on where interest rates are headed. Or, at the very least, it could indicate that the company sees the steep decline in long-term yields over the past two months as a market-timing opportunity that’s too good to pass up.

Berkshire, with the third-highest credit rating from both Moody’s Investors Service and S&P Global Ratings, is expected to price the debt on Thursday with a spread of 150 to 155 basis points above benchmark Treasuries. The 30-year U.S. yield fell to 2.91 percent on Thursday, the lowest since January 2018. The recent bond rally equates to millions of dollars of savings a year for Berkshire, if its plan all along was to convert from floating to fixed rate.

The other interpretation is that the company chose to refinance with long-term fixed-rate debt because it sees the big drop in 30-year yields as unsustainable. After all, if a borrower expects interest rates to rise in the future, it would prefer to lock in a fixed rate now rather than face higher payments down the road.

Now, the Berkshire unit also issued 30-year bonds in August to refinance a portion of floating-rate notes. But before that, it hadn’t issued debt with such a long maturity since May 2013, which just so happened to be right before the “taper tantrum” that sent interest rates soaring. Buffett said at his annual meeting ahead of the offering that he felt sorry for savers who depend on fixed interest payments, given the low yield levels at the time.

WB losing it?

Kraft Heinz Plunges Near Record Low on $15.4 Billion Writedown

https://finance.yahoo.com/news/kraft-heinz-slumps-sec-subpoena-221852980.html

I sold to WB ![]() ditto for COP long ago. He is data driven, not a visionary.

ditto for COP long ago. He is data driven, not a visionary.

Kraft Heinz plans to slash its dividend to 40 cents a share each quarter, an annualized $1.60 a share rate, from a $2.50 a year rate, a reduction of 36%.

KHC feels like KMI - value investors keep hyping it as it declines and declines.

Operation costs shot up faster than expected.

Customers weren’t the problem: Sales were up about 1% in the fourth quarter. Instead, Kraft Heinz CEO Bernardo Hees blamed the company’s operations. Higher-than-expected manufacturing and logistics costs plagued Kraft Heinz. The company anticipated savings from its 2015 merger would continue to help lower costs, but those efficiencies dried up.

“We are overly optimistic on delivering savings that did not materialize by year-end,” Hees said on a conference call with investors Thursday. “For that, we take full responsibility. And we have taken steps to ensure this does not happen again by planning process, procedures and organization structure.”

The prices of many commodities that food companies use are rising, such as agricultural products and materials like aluminum and pulp for packaging. Transportation costs have also added pressure on food companies, in part because of a shortage of truckers in the United States.

These so-called brands aren’t what they were used to be in the age of online shopping and social media.

Old paradigm no longer works. Business books need to be rewritten. Is why the UCLA marketing specialist gets it wrong again and again by sticking to knowledge learned long ago. For this case, the problem is operational… costs rise faster than expected… pretty sure Kraft is not the only company affected by fast rising costs due to tariff war started by…

What went wrong at Kraft Heinz

Many were quick to point out that the biggest problem for Kraft Heinz, the maker of Jell-O and Kraft Macaroni & Cheese, is that the company hasn’t adapted to changing consumer tastes. There’s a growing interest in healthier and organic food as opposed to processed cheese and lunch meat.

I like Kraft cheese.

“We think it is fair to ask if 3G has created any value since Kraft and Heinz merged,” Goldman wrote.

But even before Thursday’s earnings bombshell, many investors were worried about the pressure Kraft Heinz and other food companies were facing.

Don’t understand why they merge. Sold upon the news.

Prices have come down for many supermarket staples as Amazon (AMZN)/Whole Foods, Walmart (WMT) and Target (TGT) become even bigger players in the grocery business. That’s hurt profit margins.

Don’t understand why a supplier (KHC) is affected by increase in retailers (AMZN, WMT, TGT).

Kraft Heinz: Buy When There Is Ketchup In The Streets?

While investors may also be worried about the SEC subpoena, we see this as immaterial to the issues at hand. Let the dust settle and then look for an entry.

Kraft Heinz Stock’s Massive Selloff Could Make It a Buy

Bought 20 shares. Let’s how much ketchup is let off.

Kraft is not a premium brand. Most just buy store brands or whatever is on sale. No future for Kraft or Heinz

2018 & 2019 is the issue for Berkshire, repeated declines with WFC, AAPL, KHC, where Buffet has most of his money.

Pre-results, look at profit margin at 39% and high dividend yield. Post results, dividends are reduced, 16B write off and SEC probe resulted 27% decline.

This is an opportunity to buy KHC at low price.