No, I called it once in front of my manager. The manager gave me a promotion for my foresight

So what does your crystal ball say about now?

It says you will shed many tears and go thru many sleepless night for not going in with me to buy Tsla when you have the chance.

.

Just pointing out your logic is flawed. Your statement is a common logic fallacy used by many people for two not correlated events as if they are correlated.

Well, I see correlation between the two, for people use essentially the same tools in both situations to make their calls.

The psychology is different. Thought you have read much about financial behavior

He buys in bulk at some price which he thinks bottom, hold on to it no matter whether it goes up or not.

He is not disturbed by daily, weekly or any fluctuations !

I do not think that I will get that attitude any time near future ! Solid one !

No, the same set of fear and greed work in both. But it’s fine, maybe the underlying factors are different but both tops and bottoms are hard to call. If they were easy there would be many billionaires among stock traders and WB won’t have that many fans.

Behavioral finance attempts to fill this void by combining scientific insights into cognitive reasoning with conventional economic and financial theory. More specifically, behavioral finance studies different psychological biases that humans possess. These biases, or mental shortcuts, while having their place and purpose in nature, lead to irrational investment decisions.

Behavioral finance encompasses many concepts, but four are key: mental accounting, herd behavior, anchoring, and high self-rating.

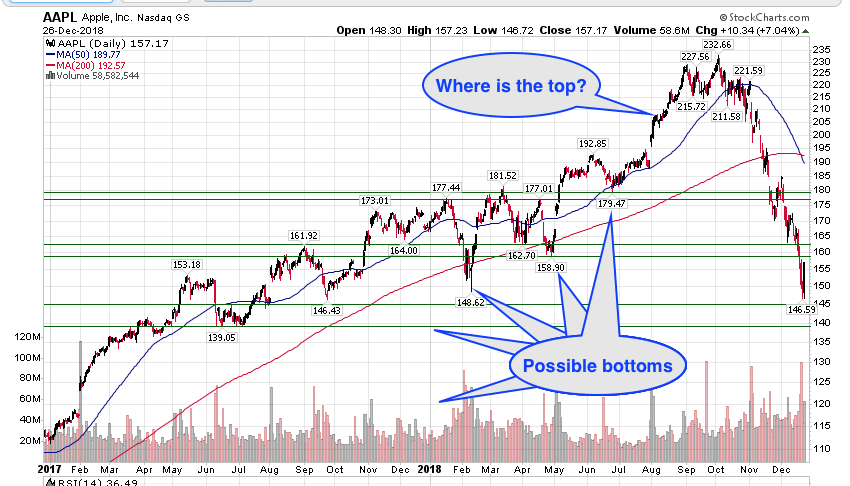

Just to point out 1 factor. There is no anchoring once a new ATH is established while there are many support levels ![]() while the price is declining. Refer to image below:

while the price is declining. Refer to image below:

Well, is not as dumb as the question on whether it will go to $190 or $150 first. Obviously you want it to go to $150 first because you can then buy at $150 and sell at $190. If you think it would go to $190 first, you shouldn’t buy then since gain is not much and you won’t know how fast it falls after that, and I notice you don’t short, so is not good. Now that it is here, did you buy with four limbs?

A hug from your loving child=$1M. He is a billionaire

Bears back today

Economy is good, Market will further turn around Jan 1, 2019 onwards until it hits next cycle.

Wednesday’s record-breaking gains came amid surging oil prices, positive indicators of retail sales strength for the holiday season and reassurances from the White House that the jobs of both Federal Reserve Chairman Jerome Powell and Treasury Secretary Steven Mnuchin were secure.

Markets will sometimes bottom and then post a massive rally in a reversal on capitulation selling. However, many analysts are skeptical that this was the case on Wednesday.

Dow drops more than 400 points after Wednesday’s historic gain

WQJ called the hype train on Bitcoin. Yes, it wasn’t exact, but you have to give that to him. There were plenty of people on the hype train trying to rationalize their decision making.

Manch has been yelling fire for months on end.

Manch always adds fuel to fire in order to sensationalize the topics and attract attention.

See Costco, amazon, Walmart Home Depot and target etc many shop are completely sold this period.

Jan onwards we will see next quarter results.

Turn around would have started yesterday. Today or next two days until dec 31st sell off is expected for year end.

I know. I’ve seen the local conditions myself. Local Target was emptied on the 24th. People were stuck buying gift bags because the wrapping paper was all sold out. Sections of the toy aisles were depleted. Local Costco customers commented on how much restraint I had compared to their cart load of goods (500+).

Maybe people are over buying ahead of potential price hikes from tarrifs.

Raising time has led to a recession 100% of the time. Correlation is not causation I’m afraid.