That’s a good story! For all your YTD returns across multiple brokerage accounts, do you use any service like personal capital or just plain old spreadsheets?

I wasn’t referring to any specific example. It’s just the time/effort/cycles  required are more than most people can handle. Most people are affected emotionally if there is volatility like we have seen recently.

required are more than most people can handle. Most people are affected emotionally if there is volatility like we have seen recently.

Real GDP is inflation adjusted.

Now you could certainly argue that CPI/PPI are inaccurate…but then you’re really digging into the data. My point is that for things that grow exponentially, you need to look a log plot or % change over time to draw conclusions visually.

That’s kind of like creative accounting. The only GDP figure I look at is nominal GDP.

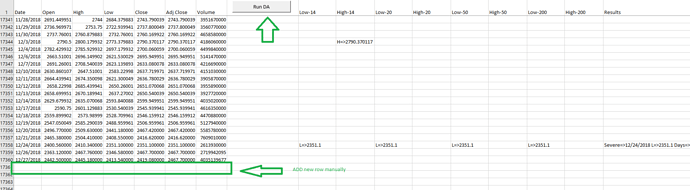

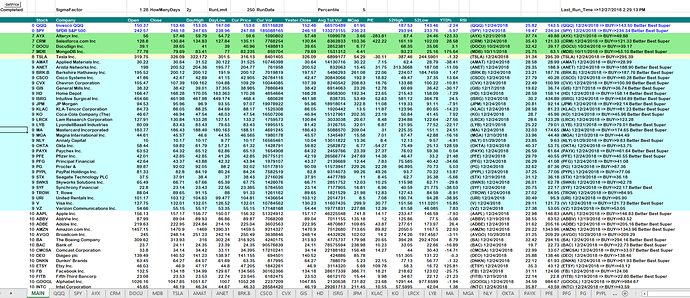

Spreadsheet only. I developed my own vbscripts that updates market price to my spreadsheet.

It emotionally affects me too as I am not strong like WQJ and hanera - they are simply great investors.

I dedicate 9-5 for work and rest of the time focus on internet reading, weekends & holidays reading books, listening Bloomberg TV+Audio Channel helps me to up to date.

I read lot of SSRN papers, algo trading rules, technical analysis…etc

Like I said, I write my own algorithms using vb-scripts that help me (like calculator) to know some of the issues/points. It needs manual reviews as they are half-baked ones. They are loss making devils if it is not properly reviewed/Analyzed.

I am scared to publish these as it may result loss unless manually reviewed, individual (users) Risk

Again, this is half-baked, and suitable to me as I understand the details and the false/flaw signals.

To know more about writing algos, visit (you need to know python at least read python logic) and github.

I also run an excel that takes historical technical analysis for 75-100 stocks directly reading from iex-Trading. I daily check two times, once morning and another after close. I review them daily. The screen looks like this (today run). These help me a lot

Market has rallied. Did Trump meet Powell without telling us?

Is Salty Wet Santa trying to convince that lady to sit on his lap?

Good piece by Martin Feldstein on Fed’s raising rates:

This is exactly the same as what I have been saying:

First, the current level of the real (inflation-adjusted) interest rate is remarkably low. The most recent annual inflation rate as measured by the rise in the Consumer Price Index was 2.2%. Subtracting that inflation from the 2% nominal federal funds interest rate implies that the real interest rate was slightly negative before the recent increase and approximately zero even after it.

A zero real rate might be appropriate in a very depressed economy, but not in an economy in which real GDP was growing this year at more than 3% and the unemployment rate was an exceptionally low 3.7%. The Fed’s own estimate of the sustainable level of the unemployment rate is considerably higher, at 4.4%.

No, she volunteered ![]()

The fed has a dual mandate: low unemployment and stable inflation. Unemployment is low. Inflation is stable. There’s no data driven reason to increase rates. Rates shouldn’t be changed if both targets are being met. You change rates when you aren’t hitting targets.

The most compelling reason to increase rates is to create room to cut them next recession. Why can’t the fed just be honest and give that reason? Instead they keep mumbling about inflation which is minimal. The fact they remain unable to accept or understand the deflationary forces of the Internet, technology, globalization, and slack in labor force participation rate is scary. They could leave rates unchanged and just reduce the balance sheet as debt matures.

I’d love to see them question tech companies. I’m sure it’d be as laughable as when Congress did. It shows how out of touch with the world career politicians, government employees, and academics are.

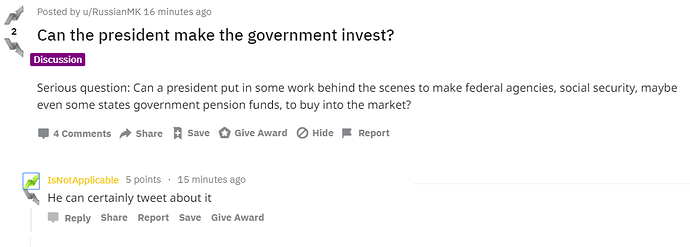

Many countries have a sovereign wealth fund that gets invested into markets. The US doesn’t. We just rack up more and more debt with excessive spending.

Bespoke likes Intel and Pulte Homes, and emerging markets.

Intel and Pulte were losing momentum when the market was going strong earlier this year and “led us on the way down . . . [but] are now showing signs of stabilizing and aren’t making lower lows,” Hickey said.

Intel has climbed 10 percent since falling more than 25 percent from a year-to-date high set in June, while Pulte has climbed more than 25 percent after plunging more than 40 percent from year-to-date high set in February.

Hickey argued that the emerging markets sector, which also led markets on the way lower, could hold some promising results.

The iShares MSCI Emerging Markets ETF has “been below its 200 day moving average for 140 trading days That’s happened two other times: 2008 and 2016,” he said. “A year later, EEM was up 75 percent and 26 percent,” respectively.

Hickey also pointed to tech stocks Apple and Netflix. Apple, he said, is more attractive than the consumer staple section and Netflix, which is not a value buy, is transforming TV.

Why listen to him when you have your own brain.

Sure about that  ?

?

If you doubt debt expansion the key, then what was different about the Great Recession? Why did the economy crash faster and harder than other recessions? Why did the government pivot the bailout from buying bad assets to buying equity to directory capitalize banks?

The economy was on the brink of total disaster because banks didn’t meet capital requirements and stopped lending. Even a short stop in lending is catastrophic for the economy. The whole point of the bailout was to get bank lending going again. There’s a reason it was so urgent.

Rising interest rates reduce the ability to borrow. Less borrowing means less economic activity, since a huge portion of current activity is financed with the promise to pay it in the future. Even stuff as simple as businesses financing inventory, because they owe suppliers faster than their inventory turns. It’ll hit car sales which the vast majority of people finance. You can already see car sales are slowing. Every dollar spent on interest is a dollar that can’t be spent on goods or services.

I am confused. Are you saying we should keep real interests rate at zero regardless of economic conditions? So households and businesses can rack up gigantic amount of debt because the cost of money is zero? Are you worried about debt piling up or not?

If we should keep real interests rate at zero when economy is already expanding above long term trend at 3% real, then when will we ever get to raise it? We should always keep it at zero? Why even bother with positive? Why not go negative?

Your Martin Feldstein update is perfectly right on why FED is increasing rates. If we keep real interest rate zero or negative, US will not grow further.

FED is doing right things for country’s economy, but Mr.Market is scared with FED (like me often) and brings down the market.

Skip all others and listen to yellen’s discussion, you will know how FED is modernized/equipped nowadays