Simple stock buying advice… don’t fight the Fed. As long as rates are going up stocks are headed down. Two more rate hikes to go.

The only reason to increase rates is to slow the economy and lower inflation. Inflation isn’t a worry, so we should leave rates low. Everyone is irrationally paranoid about 70’s style inflation. If we don’t increase debt, then the economy grinds to a halt. I’m less worried about consumer debt, since people have jobs to pay it. Government debt as a percent of GDP is out of control.

The fact the fed lowers rates to stimulate economic growth and raises them to slow economic growth should tell you something about the impact debt has on economic growth.

Government debt has never brought down the economy of this country. Private debt has, multiple times. The most recent one was in 2008.

Rate kept too low for too long inflates huge asset bubbles which will bring down the economy when they pop, and they always popped.

Monetary policy acts with big time lag. That’s why it’s prudent to act today rather than when problem is already visible.

There is no reason why an economy growing at 3% real can’t handle a slightly above zero interests rate.

It can only handle it if wages are growing faster. If not, every rate increasr reduces people’s purchasing power.

When the government debt is a problem, it’ll be game over.

Powell has since softened his stance, but his comments were the start of the market decline. Interesting how his opinion changed from “a long way from neutral” to “almost neutral” in 2 months.

It’s ok, just a buying opportunity. It’s healthy to scare the greedy traders a little bit.

This is the key for FED to raise rates so that economy will withstand the pressure.

“More importantly, the fundamental backdrop was solid: The economy was growing at a better than 3 percent clip, corporate profits were around their highest levels in eight years, and the Federal Reserve seemed in control of monetary policy and interest rates.”

What changed from October to December for Powell to pivot so much? I don’t the economy slowed down given the holiday sales data. Growth was over 5% vs last year. Corporate profits are still strong. I wonder if the fed is realizing inflation isn’t a threat, so they don’t need to keep raising rates. That would be a game changer.

I suspect recent market declines are at least partially responsible. Whatever they say about managing a dual mandate, etc., they are keenly aware of market reaction. The challenge in a rising rate environment is to engineer a soft landing…historically about half the time it works, the other half we end up in a recession. Powell likely realized he’s pushing the market a little too hard given current or future headwinds (tariffs, politics, labor participation rate, etc.) many of which are not yet be appearing in GDP numbers.

The right wing amoral blinded as a bat deplorable racist people like Marcus, forgot, very conveniently that the wall is and will be built with Mexico’s money.

Don’t buy the BS from a worse than liberal, a libertarian, my God!. He avoids the high core topics on the lies thrown by this treasonous president. He is nobody to pay attention, his moral values are far from what the republicans used to possess.

Oh! He forgets to tell you his president, the anti-illegal immigration turd is hiring illegals, they were even in the same room with him washing his clothing and making his bed. ![]()

![]()

![]()

No need for a wall, he is hiring them after they cross the border. ![]()

![]()

![]()

![]()

![]()

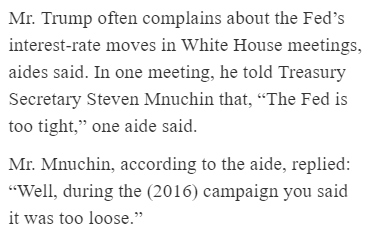

And, they forget their president was berating the FED guy, then praising him lately because the market picked up the pace.

They also forget that the democrats are supporting Twhitler on the wall, make Mexico pay for it. That was his promise, so, no problem, go ahead, they are sending him thoughts and prayers!

Mexico! Mexico! Mexico!

![]()

![]()

![]()

![]()

Do not forget the BS about the huge illegal invasion! The great, the most powerful army shooting people at the border for them to enter and then being dumped on our streets.

![]()

![]()

![]()

Happy New Year to everybody!

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Bear market back on with a vengeance.

We can not be in bear market for sure as economy growth is there.

The good part is now value speaks, real value, not hype!

Did we, the retail investors, got play out by the big guys? Scared us out of our shares at dirt cheap price and now that they got what they want, start pumping?