Bozeman, Montana:

Wow, Ive been to Billings Montana 10 years ago when I went to Yellowstone.

Can’t believe houses there are 500k. There is nothing there - except for YNP.

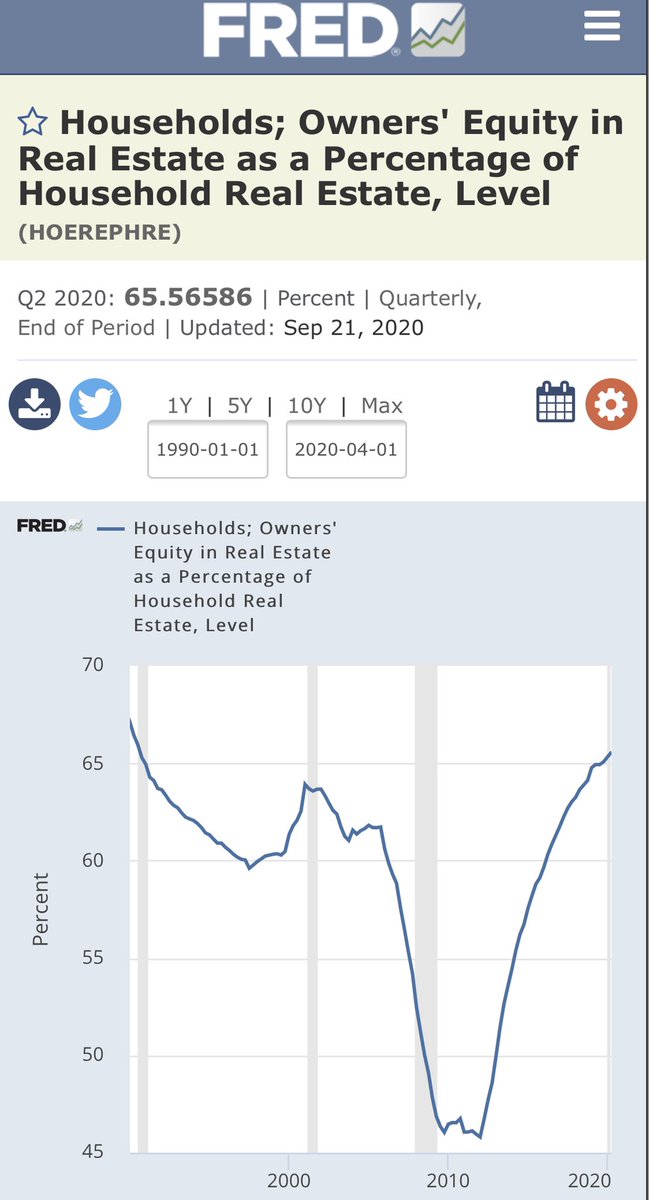

In case people want to fool you saying it’s another housing bubble, look at how much equity homeowners are sitting on. What if they cash out some and spend it? Interests rate has never been lower.

Roaring 20s here we come.

I thought only bay area real estate has right to climb.

We appreciate real estate of all counties, colors and creeds here.

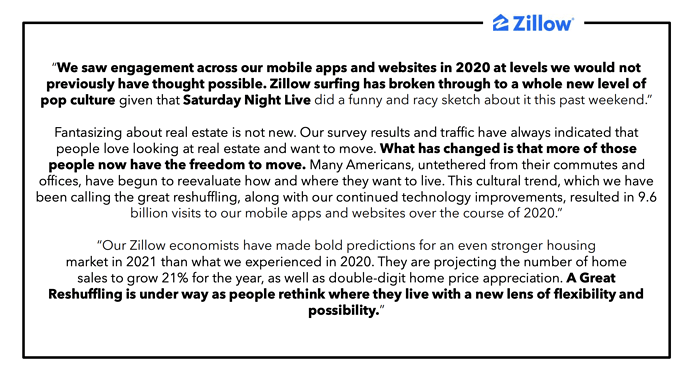

All this larger home sales in suburbia makes people buy more stuff. trade deficit is already increasing and we didnot even a new Iphone yet.

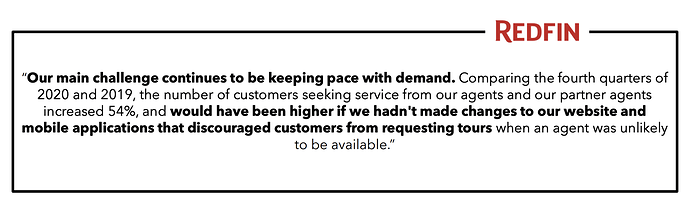

Pending home sales at record high in August.

Great to see RE shine especially with bears shiiting in the woods.

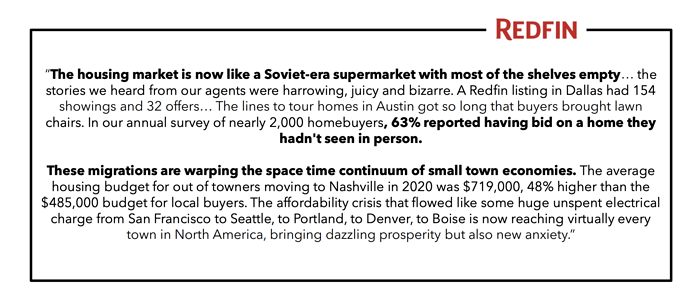

i see alot of inventory in Peninsuala and SF at this point of time. seem the rich are fleeing.

I heard someone argue you are taxed for nice California weather (which by the way is a creation of nature, not government). The point is that there is no end of excuses to tax you.

Phoenix is on fire.

In April, Tamboer said the median time for a Valley home to move under contract was 21 days. Today, that time frame is less than eight days.

According to Redfin the average American has been in their house for 25 years. A record. Not good for buyers or RE brokers

About time haha!

November home prices rose 9.5%, one of the highest gains on record, Case-Shiller says

- Prices nationally rose 9.5% in November from the year before, according to the S&P CoreLogic Case-Shiller Home Price Indices.

- The 20-city composite showed a 9.1% year-over-year gain, up from 8% in the previous month.

- Phoenix, Seattle and San Diego continued to show the strongest price appreciation of all the major markets in November.

Phoenix, Seattle and San Diego continued to show the strongest price appreciation of all the major markets in November. Phoenix led the way with a 13.8% year-over-year price increase, followed by Seattle with a 12.7% increase and San Diego with a 12.3% rise. All 19 cities reported higher price increases in the year ending November versus the end of October.

It’s honestly hard to tell with so little inventory. There haven’t been many sales to use a comps. There are 7 lots and 2 SFH home for sale.