Today’s editorial in WSJ skewered Obama and Lawrence Summers on their policies resulting in stagnation. It heaped praises on Trump. Does this really mean the bull market will continue for at least two more years?

Here is the abstract:

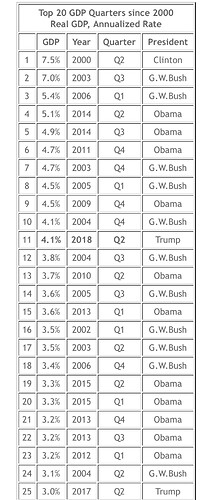

So much for “secular stagnation.” You remember that notion, made fashionable by economist Larry Summers and picked up by the press corps to explain why the U.S. economy couldn’t rise above the 2.2% doldrums of the Obama years. Well, with Friday’s report of 4.1% growth in the second quarter, the U.S. economy has now averaged 3.1% growth for the last six months and 2.8% for the last 12

The lesson is that policies matter and so does the tone set by political leaders. For eight years Barack Obama told Americans that inequality was a bigger problem than slow economic growth, that stagnant wages were the fault of the rich, and that government through regulation and politically directed credit could create prosperity. The result was slow growth, and secular stagnation was the intellectual attempt to explain that policy failure.

The policy mix changed with Donald Trump’s election and a Republican Congress to turn it into law. Deregulation and tax reform were the first-year priorities that have liberated risk-taking and investment, spurring a revival in business confidence and growth to give the long expansion a second wind.

The nearby chart shows GDP growth by quarter over the last four years. The numbers show that the long, weak expansion that began in mid-2009 had flagged to below 2% growth in the last half of 2015 and in 2016. Nonresidential fixed investment in particular had slumped to an average quarterly increase of merely 0.6% in those final two years of the Obama Presidency. An economic expansion that was already long in the tooth began to fade and could have slid into recession with a negative shock.

The Paul Ryan-Donald Trump growth agenda was targeted to revive that investment weakness. Deregulation signaled to business that arbitrary enforcement and compliance costs wouldn’t be imposed on ideological whim. Tax reform broke the bottleneck on capital mobility and investment from the highest corporate tax rate in the developed world. Above all, the political message from Washington after eight years is that faster growth is possible and investment to turn a profit is encouraged.