You’re never paying back the $2,800 loan. So the next month you own interest on $5,600, the next month on $8,400, etc. All you’re going to gain is the delta between the return and the 6% interest. In your example, that’s 6.75% - 6.14% or 0.61% that’s going to compound for you. Yeah, I can do the math. I don’t need your illustration tool to do it.

No, you are using compound charges.

I’ll keep is simple. November I pay $3,400. I decide to borrow back the $2,800. Then December, I pay my $3,400 premium. I decide to borrow $2,800 again. I know owe $5,600 so I’m paying 6% on that total. If you keep borrowing every month, your loan balance increases. You’re paying 6% on a bigger and bigger numbers. The only “gain” is going to be from the index performance vs. the 6%. If the index only performs 4%, then you’re actually going to lose money that year. You’ll be paying 6% to borrow your money while it’s only earning 4%.

The way the ICs pay, as in IULs, it is payments on buckets. 12 months, 12 buckets. 12 loans, 12 interests charges. Simple interest charges.

January $2,800 you pay $168? 6% interest, right?

Feb. Same thing.

March, same thing.

True, most of them not using as their earnings are low and not savings with 401k. Right from 20 age, people need to set aside 15% of income for retirement which low earners are not doing. Most of them contribute just match (if company provides) until 30s and then think about their retirement issue. The lose lot of money as they do not take benefit of power of compounding long term.

This is the major issue for those earning less than 80k in bay area, but that extends to 100k level too.

see here, how people struggle to save

In short, you are telling me that I need to pay premium of $3400 per month and take a loan of $2800 per month.

If I continue this practice between 26th age and 60th age, I get paid $424,000/year till death.

If this is the statement, No, you are not understanding IUL correctly !

IUL can not survive with such calculations.

Read the link above, David will explain you why.

Contrary to 401K that goes up and down, so, if you lose 25% any given month, you need 50% to recover. You will never catch up to IUL. They never lose your money! And that money, remember, you used it already! It’s monopoly dollars!

Read this again, you are using OPM. Other people’s money!

You spent the $2800 on the mortgage of any of your properties. Got it?

But those $2800 are still earning % in your IUL policy. Got it? It’s like you are using $5600

Contrary to 401K that goes up and down, so, if you lose 25% any given month, you need 50% to recover. ==> This argument will not work against 401k or favor IUL.

Reason: Long term S&P accounts 25% (or downturn effect) and recovery. With that, it is able to produce growth at 7% to 8% rate.

While IUL accounts 6.88%, which is less than S&P growth rate.

In short, a person who does not have any investing knowledge can contribute to SPY or VOO or similar for 34 years blindly every month and reach the same state.

Only issue is tax when he sells. Roth does not have tax. In both cases, person is not at the mercy of anyone except Mr.Market.

In IUL, person is at the mercy of IUL (as they are owner of asset) and IUL depends on Mr.Market. The benefit is there is no tax on loan !

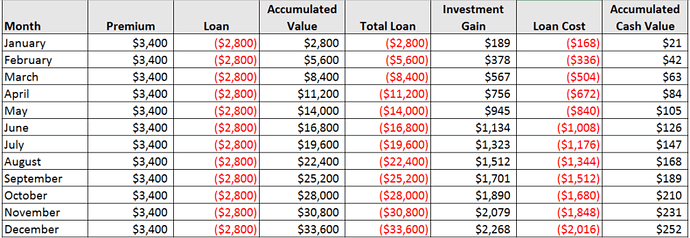

You’re only counting one $2,800 loan. What happens when you borrow $2,800 again in February and again in March? This is what 1-year looks like if you pay $3,400 premium each month, $2,800 of it gets invested, you borrow the $2,800 back each month. Assumed the investment gain is 6.75% and the loan is 6.0%. You’re hardly accumulating anything.

I explained that charges and returns are paid monthly. There are 12 buckets from where the IC deposits the interests earned and deduct the monthly charges from COI, raiders, etc.

Yearly, your loans are $33,600…interests paid are $2,016

Every month, you loan $2,800, let’s charge it 6% simple interest. $168 every month, month after month.

Now, I thought you were going to make me a $2800 at 7% compound interest month after month for 34 years?

You are simplifying. You are not compounding. I am going to go compounding, rounding up the numbers. Correct me if I am wrong:

January $2800 x 7% = $196 gain = $2,996

February $2,996 + $2,800 = $5,796 x 7% = $405.00 = $6,201

March $6,201 + $2800 = $9,001 x 7% = $630.00 = $9,631

April $9.631 + $2800 = $12,431 x 7% = $870.00 = $13,301

See the beauty of compounding interests?. Imagine 34 years of compounding when you see only 4 months?

Just in 4 months you have a gain of $2,101 minus the 4 months of $168 = $672. $2,101 - $672 = $1429 gain.

Remember, you have a gain of $11,200 from your loans, plus $1429 from the gains of the $11,200 in your insurance policy.

You have gained $12,629 with other people’s money. And your family will have $2M if you die.

Do we forget the $600 monthly COI fees?

OK. $600 x 4 = $2400

$2400 - $1429 = $971

Your cost of COI now is $242.75 a month!

Deduct this amount from your $12,629 = $11,658 gain.

Now, you guys are into real estate. What type of property and what type of returns would you have paying a mortgage of $2800 a month? $1,500 - $2,000 a month? Add that return to the $11,658 and go from there month after month.

I wish you good luck trying to see anything wrong here but may be a dumb mistake from me. But numbers don’t lie. Sometimes.

By the way, you guys missed something I left there for you guys to criticize, whatsoever, you missed it. Signs you weren’t looking to be curious, to open your mind, to find a solution but see a problem where there’s none.

I am going to Costco, take care.

That’s only if the market always beats your 6% interest. You’re indexed, remember? What if the market is only 4%? Now you owe more than the gains. Interest compounds against you.

Either way, you’ll never build up the money to borrow $400k/yr starting at age 60. The only way you accumulate that much money is by not borrowing.

I am glad you don’t dispute the compounding I used as an example.

The compounding of interests from money that is not yours is amazing, right?

But I think you are still calling the interests charged to the loan as compounded. No, they are simple interests, month after month or, yearly, it wouldn’t affect the equation. You are paying the 6% on the loan you make, and it can’t be necessarily $2,800, it can be more, you saw the account is growing thanks to the compounding effect. I believe year 10, you pay $1, you loan $1+. Nice!

The net death benefit increasing is paid to beneficiaries if you don’t loan money, that’s the only purpose of leaving the cash surrender value alone, but that’s the type of policies other agents use because they can net $40K commission easily when the cash surrender value is only 20%. I can net $15K with this one, with CSV at 80%.

Last recap. You made your mind.

$2,800 in the IUL earning historically 7%, compounded.

$2,800 loaned paying a mortgage.

The mortgage paid by the loan of $2,800 will allow you to get another $1K-$2K a month from a rental. 6% paid on interests to get $1K-$2K is like getting what? 60% return on your money.

You are basically getting free money. Who cares about the market going 4%-5%

Win, win, win situation.

You are just being negative, it is understandable, but not my problem, I just present the illustration, which is approved, sanctioned by the state of CA. The rest will be told by the market performance, which is doing 11%-12% right now, the S&P 500 index going towards 14% I heard.

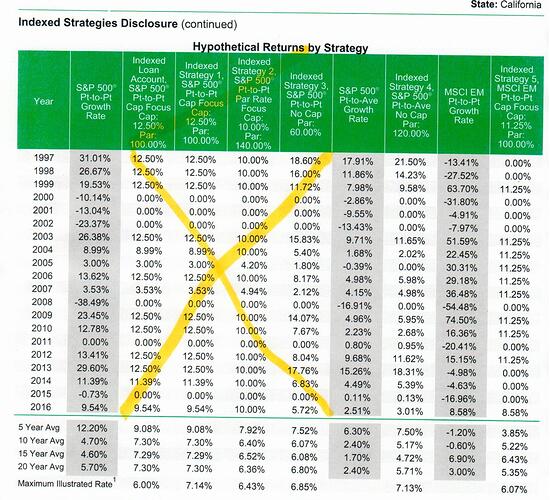

Let’s see the 4 strategies we may use.

First is a scammer statement !

Second is scary statement !

Oh boy!

I knew I was wasting my time with ignorant people.

Wow, I don’t really need to say anything else. You don’t even realize that if you keep borrowing the full cash value, then you’re screwed the first year the index pays less than 6% return. You’ll owe more in interest than the policy generates in investment gains. You’re whole idea of protection against market downturns goes out the window. If you’re doing this, you’re screwed the next market crash. You’ll get paid 0% on the investment gains and still owe 6% on your loan balance.

Paying 6% interest on your own money to earn an average return of under 7% is terrible. It’s far worse than paying 35-45% taxes on investment gains.

At least you’re just ignorant and not fraud. Congrats on that.

Wow, I don’t really need to say anything else. You don’t even realize that if you keep borrowing the full cash value, then you’re screwed the first year the index pays less than 6% return. You’ll owe more in interest than the policy generates in investment gains. You’re whole idea of protection against market downturns goes out the window. If you’re doing this, you’re screwed the next market crash. You’ll get paid 0% on the investment gains and still owe 6% on your loan balance.

Paying 6% interest on your own money to earn an average return of under 7% is terrible. It’s far worse than paying 35-45% taxes on investment gains.

At least you’re just ignorant and not fraud. Congrats on that.

Here we go again.

I asked the smart guys here to figure this out. Nobody, only negative, obsessive with their own ignorance in the matter:

Under the rules, you can open an IUL, say $600+$2,800 excess that the MEC allows you to contribute. What you can loan, and what you are going to get in retirement it is a mathematical equation the illustration comes up with based on age, health and premiums. I don’t have anything to do with that. It is a contractual situation, no hearsay, if the market performs as it is doing 12% is nothing new.

Again, open your brain, look, think…you leave $600 as COI, and take a loan for $2,800. Those $2,800 again, are there in the policy earning 6%-7% + compound interests, not simple interest, compound! Don’t you get it?

But, then, you, unless you are a dummy to not do it, take the $2,800 you loaned to use that money to pay for a mortgage. Such mortgage I believe it is going to give you what? $1.5K? $2K a month from any rental or any other business you have? Do you worry about what? $168 a month on the $2,800 loaned when you get $1K-2K every month. Really?

I asked you to run an illustration of the $2,800 earning 7% compound, month after month for 34 years and you came back with a tabulation of 1+1+1=3. Jesus!

Interests charged to the loan of $2,800 is what? $168 x 12 months = $2016 a year. <------Isn’t that the money you are getting from a rental which mortgage is being paid by the loan every month? Wash out. Free money.

I thought you were good at spread sheets?

I rest my case.

Lol. Wow. You don’t even realize you’re screwed the next time the stock market has a bad year.

Lol. Wow. You don’t even realize you’re screwed the next time the stock market has a bad year.

Then, sorry, but it seems you don’t know the beauty of the IULs. You certainly don’t have any idea that the excess can be stopped from being contributed. And the COI can be lowered. And, I haven’t even told you the interests are lower than illustrated. But that is not the point.

Next time, read David McNight

Upside market potential with downside protection

For starters, the IUL allows you to participate in the upward movement of a stock market index while guaranteeing against market loss. To illustrate how powerful this is, I ask my clients the following question: “If you lost 50 percent in your Roth 401(k) this year, what would you have to accumulate next year, just to break even?” Nine times out of ten, they say 50 percent. The truth is they’d have to get 100 percent just to get back to square one.

http://www.thinkadvisor.com/2014/08/27/the-roth-401k-vs-the-iul?amp%3Bslreturn=1510954479&page=2

I don’t work for them.

http://www.thinkadvisor.com/2017/10/09/are-your-clients-prepared-for-market-downturns