i need to thank someone for IRBT - who mentioned it first?

It’s due to the Sonoma fires.

That’s a real risk. Is bankruptcy a possibility?

Good job. My sCap is up 7%, guess I have reduced exposure too early ![]()

mCap about 8%.

This guy copied my portfolio!!! My portfolio is mostly composed of all the stocks in his ETF minus AMZN and NVDA.

F10, replacing TCEHY with Twitter

I own Twtr as well. My portfolio is basically his portfolio minus Amzn and Nvda, but adding Yelp and Ebay/Pypl.

No more Citron strike, traditional analysts are striking.

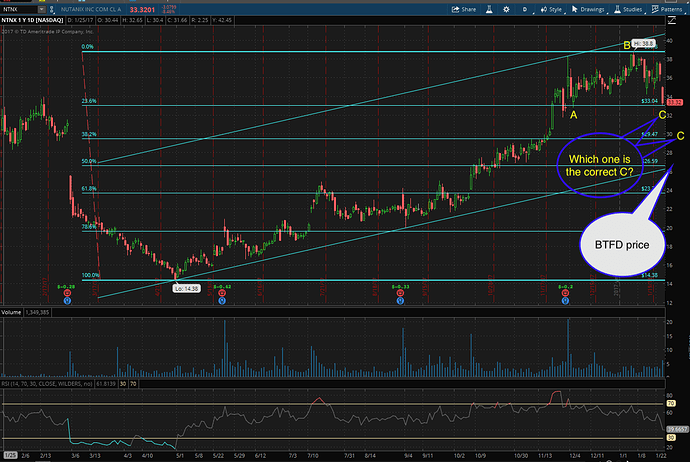

NTNX tumbles more than 7% from a downgrade note by J.P. Morgan talking down something was known long ago, transition to software-oriented model.

Investors In Nutanix Inc (NASDAQ:NTNX) Are Paying Above The Intrinsic Value

This results in an intrinsic value of $25.79, which, compared to the current share price of $37.49, we see that Nutanix is rather overvalued at the time of writing.

Bear assault. Linked article is published one day before J.P. Morgan downgrade.

So that naturally means you will be buying?

Reverse reasoning? Why want to buy an overvalued stock?

I don’t like anything that’s in amazon’s warpath so I ruled out NTNX long ago. You agree with its priced higher than intrinsic?

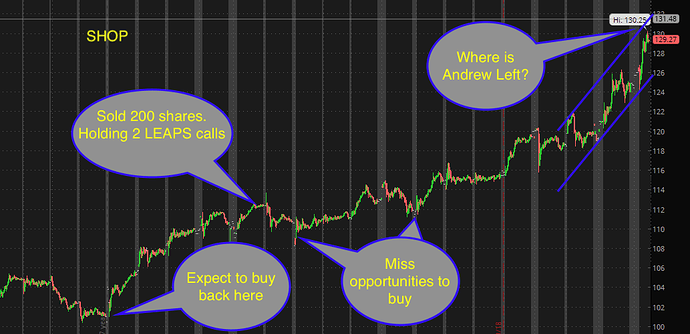

Thought is complimentary. You also think SHOP is in AMZN’s warpath, but is actually complimentary. SHOP is racing to new high, up $5, about 4%. NTNX - really not sure how good is the business model, at $37 smell of over-exuberance.

Right I still think SHOP is in Amazon’s path. It’s a bubble IMO.

By the way I don’t trust DCF analysis on young companies like NTNX. That’s a bad reason to sell.

Is only good for traditional companies like JNJ, PG and VZ. Pointless for hi-tech.

Holding 300 shares of NTNX. Used to have 600, sold 300.

FAANG is looking for new areas of growth, mainly go into other turfs. Recently, Alphabet is entering cybersecurity arena, now I have to think whether to sell PANW and SPLK.

When bubble formed/forming, better be safe with traditional companies than crazy ones

DCF usually doesn’t take into account new products under development, since they aren’t publicly disclosed. The biggest assumption made is future growth rate, and no one really knows what it’ll be.