Standard deduction of $24k for married filing jointly.

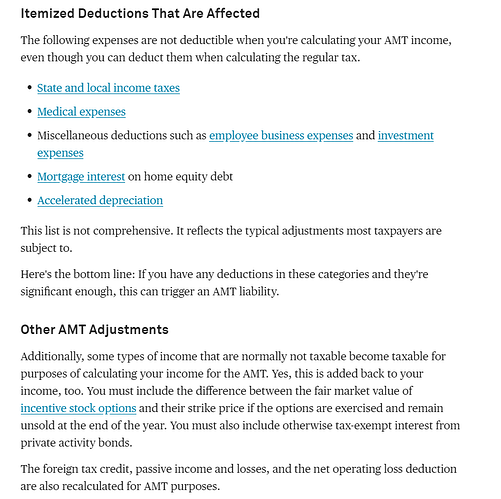

Max deduction for SALT = $10k.

Max mortgage interest deduction = $15k-18k for $750k loan (some recent primary home buyers in SFBA could fall under this category).

Very few of us would incur high medical expenses exceeding 10% of AGI and investment expenses (except wuqijun).