He hates trump

Lol, you don’t even understand what you’re arguing other than you want to argue against anything Trump does. I bet if you were presented the same tax plan and told Bernie proposed it, then you’d be cheering it as the greatest thing ever. Your entire decision making process is based on everything person A does is good and everything person B does is evil. You can’t even evaluate what they are proposing.

I wonder if you’re in this video:

Who in the military, or anywhere else would support a draft dodging coward?

Live debate of why there’s no debate of the floor about tax reform by the republican commies

LOOK WHAT’S COMING TO THE BAY AREA!

Will Massachusetts residents lose tens of thousands of dollars in home value if Republicans succeed in ramming their tax overhaul bill through Congress?

The National Association of Realtors says yes. It has estimated that homeowners in the state could lose an average of anywhere from $21,050 to $44,130 in home value, depending on the congressional district they live in. Nationwide, homeowners are facing a 10 percent drop in values because of the bill, with potentially steeper decreases in higher-cost areas, the group argues. “Make no mistake, middle-class homeowners will see their home values fall if this proposal moves forward, while large corporations walk away with the bulk of the tax cuts,”

Wow, that’s shocking that NAR is against legislation that’d impact the mortgage interest and property tax deductions. Maybe they should look at income tax data that shows less than 10% of people would even itemize due to higher standard deduction. There’s no way it’ll impact home prices across the whole country by 10%. It’ll have zero impact in areas where people won’t need to itemize anymore, and that’ll be 90% of the country.

Even today, only 30% of households itemize deductions and only 75% of those itemize mortgage interest. That means only 22.5% of households are itemizing mortgage interest today. That means only 1/3 home owners is itemizing mortgage interest.

Not gonna lie, any legislation that has the POTENTIAL to harm our favorite industry (housing) in some manner I am against. At the end of the day, we all have special interests, right?

Looks like congress will pass this turkey… and it will affect BA real estate… Qualified buyers will be reduced in numbers, 10-20% less buyers means lower prices…

“Ms. Collins said that the president was supportive of her wishes that $10,000 of property taxes be deductible under the Senate plan, a change that would be similar to the compromise that House Republicans made on the repeal of the state and local tax deduction. She also said that Mr. Trump was supportive of backing legislation that would stabilize health insurance prices that could rise if the Affordable Care Act’s individual mandate is repealed.”

For all “house rich cash poor” areas it’s not going to be good, just not in terms of house prices but also in terms of local economy.

How do you figure? They calculate qualified buyers based on DTI of gross income. Gross income isn’t changing. Unless they change the DTI ratio, it won’t change who can qualify. This actually points out how dumb it is to use the same DTI for all states. States without income tax should be allowed a higher DTI ratio of gross income, since their net income is higher.

Buyers for $1m plus homes will have less after tax money… They will feel poorer

whether they qualify or not…

If it passes I am dumping my health insurance… total waste of money and moving to Nevada

Will get my health care in Mexico

Already get dental work done there

How they feel is different from if they qualify.

Also, people love to say BA real estate is cheap compared to Hong Kong, London, etc. None of those other places allow home owners to deduct property taxes and mortgage interest on their income taxes. It doesn’t see to hold back their property values at all give they are higher than the bay area on a $/sq ft basis. Many of them have lower income levels than the bay area too.

My exposure is limited. The only house I own in the BA is worth $650k in Discovery Bay… In fact it is actually sold on a lease option… That market will benefit. The rest of my BA exposure is multi family rentals… Rents may go up when there is no tax advantage to buying…

![]() People will reduce spending if they feel their cash hoard=RE is lower, while their cash position was poor anyways.(House rich cash poor). This reduced spending will affect other local businesses in the short term.

People will reduce spending if they feel their cash hoard=RE is lower, while their cash position was poor anyways.(House rich cash poor). This reduced spending will affect other local businesses in the short term.

Housing inventory is very low now. If there is any price dip, it’s going to be 1 year or more away.

Long term, this will make other states more attractive for sure

The low end will benefit… Mid range will be compressed. High end too volatile to predict… But-if the stock market takes off, high end could take off too

The way I see it is,mid range is where the US is productive/innovative & has competitive advantage (as compared to rest of the developed & developing world) & USA will tax them/penalize them for being productive.

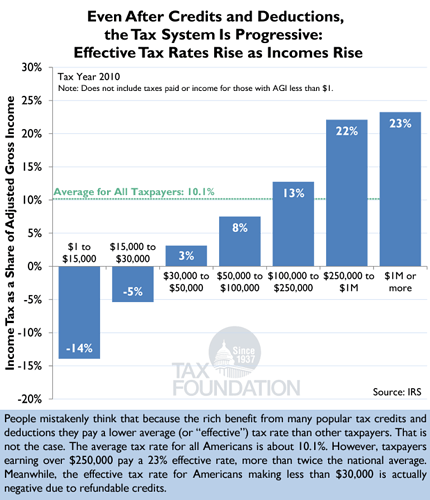

The mid range pays almost nothing. This is also why it’s insane when analysts say all the tax cuts go to the rich. How do you cut taxes on people paying -14% and -5%? Even the $50-100K group is only paying 8% effective income tax.

Even if you include payroll taxes which fund the social security and medicare people get later, the middle income group isn’t paying much. Keep in mind, only the top 10% actually pay enough to cover their social security and medicare costs. Everyone else is getting more than they paid in.

The people screaming for the rich to pay their fair share are the ones paying very little. I bet if you survey the two income groups with a negative income tax rate, they’ll tell you they are paying too much in taxes and the rich need to pay more to pay their fair share.

This is why I’d love to get to a super simple tax system. Exempt income below the poverty line and tax everything else at a flat rate regardless of type of income. Americans are so confused by our tax system they don’t even know how much they actually pay.

I was talking about BA house prices… Mid range is from $1-3m. Those houses will be hit 10- 20% when this tax turkey passes