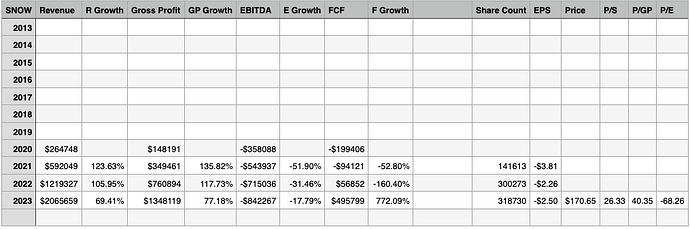

Since financial analysis is what many like… after many years of not using it… started… first… SNOW…

FCF in 2023 (in progress) looks high… I believe is due to cash from exercising of SBC i.e. not excluded from FCF. Look highly valued… have to pray that it will grow into its valuation.

You want to set up the guy’s screen and track it over time?

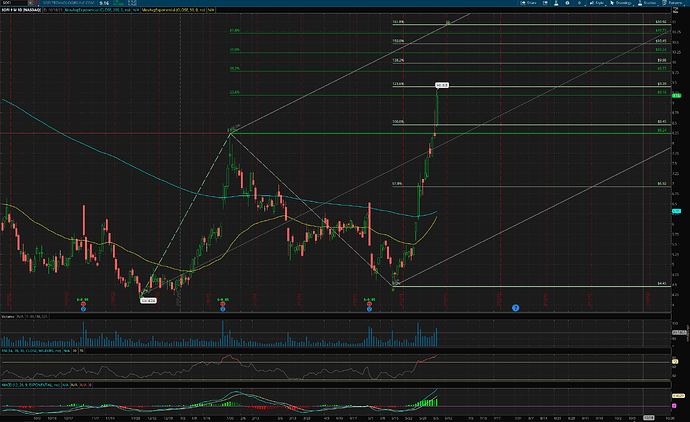

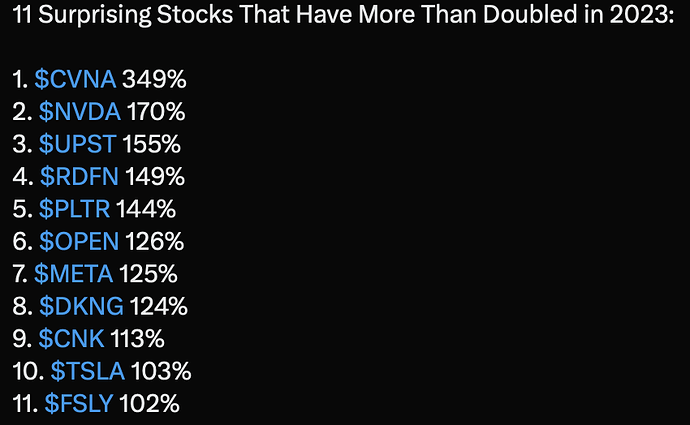

PLTR and SOFI are appreciating so fast that it might catch up with NVDA and SHOP. Now I feel like a fool to pump so much money in SQ… why oh why… not into PLTR and SOFI. The goal of the growth portfolio is to grow faster than AAPL, SQ is dragging down the performance. Jack is even worse CEO than the poet.

Market suddenly rushing into SOFI! Mission of SOFI is to help customers (mostly gen-z and student-debt graduates) to be FIRE… strike the right cord. Look like those CEOs / companies that have lofty mission statement that match gen-z are flying high e.g. Save the planet ![]() Make the world safe

Make the world safe ![]() Help you become FIRE

Help you become FIRE ![]()

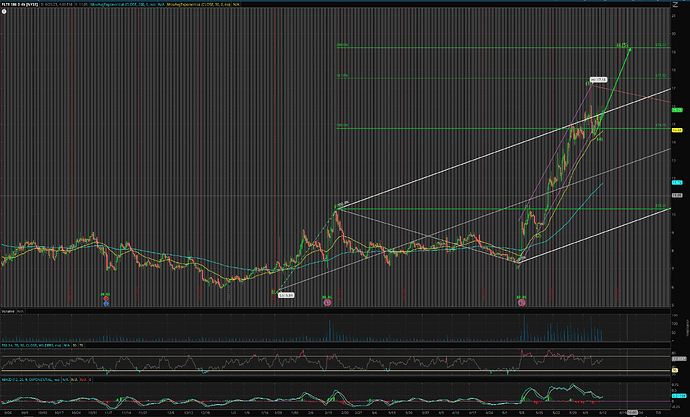

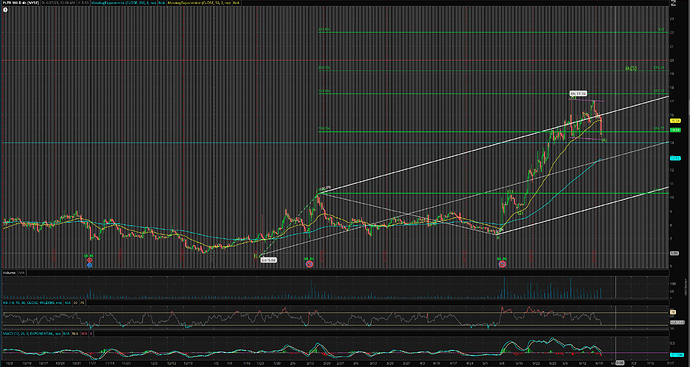

SOFI is in explosive upward Intermediary degree wave iii bullish impulse… target is indicative… no idea how high it can go before a wave iv… theoretically can go up to 7 times the length of wave i… very very high.

What is the news? Up because of cool CPI data?

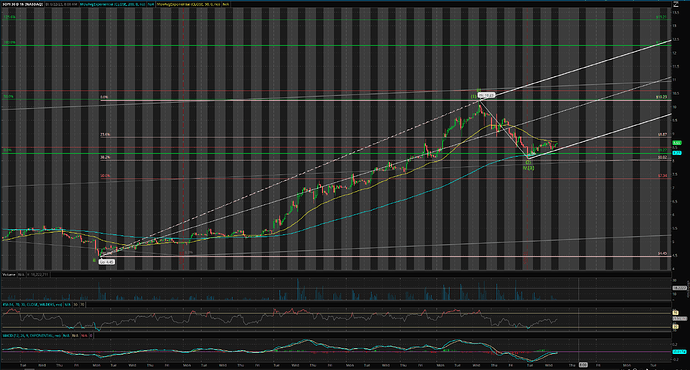

From EW perspective, is going for $50 after completion of wave (4)… completed? I am always not sure.

THE SECRET REASON WHY PALANTIR INVESTED IN SPACS.

In the long term, I don’t want to be investing in someone ordinary, I want to invest in someone extraordinary, and I’ll deal with all the good and bad that comes with investing in that visionary founder.

Should say this after PLTR 10x. Too early to say now.

Rationalizing the failure of Karp’s SPAC investments.

That’s not the question I asked myself.

The question I ask is this: if a stock crashed 50% tomorrow, do I know enough about the company to not freak the F out?

I don’t know what drives TSLA up. Their fundamentals look bad to me. So I won’t understand if TSLA suddenly crashed tomorrow. For that reason alone I avoid it.

Obviously that’s just for me myself. Everyone has their own way. No right or wrong answer here. Just what works best for one’s unique temperament.

.

So much info on social media and you say this? Anyhoo, I am not talented enough to do FA.

Only one company I know enough. The rest that I own, I know close to nothing. However, I won’t freak out even if they decline to zero because total worth of the growth portfolio is less than 5% of my total stock portfolio which comprise mostly S&P index and AAPL.

Then why even bother doing these side shows? Just relax and go touch grass somewhere.

That’s my way of touching grass ![]() Alternating with watching pretty women in TV serials

Alternating with watching pretty women in TV serials ![]()

My top 5 10x-100x hopefuls. Since S&P bottoms on Oct 12, 2023, NVDA, SHOP and U outperform ![]() AAPL. RBLX and SQ underperform… hopefully would do well in the 2nd half of the year. The goal of individual stock picking is to outperform AAPL which always outperform S&P and QQQ.

AAPL. RBLX and SQ underperform… hopefully would do well in the 2nd half of the year. The goal of individual stock picking is to outperform AAPL which always outperform S&P and QQQ.

Note: I am a great believer in metaverse and FinTech ![]()

Interviewing the author of the book, 100 baggers.

His current portfolio, only 10 stocks.

I didn’t own any.

A bear case for PLTR.

Another one is SNOW (ORCL + many others) could eat its lunch.

https://twitter.com/saxena_puru/status/1666225165578158080/photo/1

Didn’t pay attention to ORCL, is rising from the ash very fast… Larry Ellison is back.

Disclosure: Have about same $ amount invested in PLTR and SNOW.

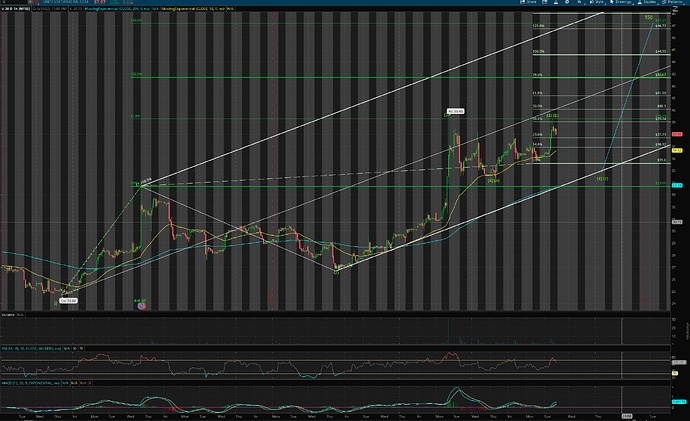

PLTR: Intermediate degree wave iv might be completed. Don’t expect to go lower than $14 if there is another push downwards.

SOFI: Not sure even though it bounces off 38.2% retracement because wave (2) retracements usually between 38.2% to 61.8%… if completed, it means the bull force is strong.

$PLTR is formidable in the sense that it taps right into humanity’s core wealth creation mechanism and meaningfully amplifies it. This is likely to make it a multi trillion dollar company going forward. To explain why, allow me to take you on a brief tour through some of my mental models.

I think it’s wise to steer clear of Unity’s stock until we better understand how the ironSource merger is going.

Although the partnership with Apple is intriguing, it isn’t a needle-mover for Unity, and investors shouldn’t see it as a catalyst that will turn the stock around.