AFRM is again at the point we discussed after it made a big move up. Going to by both.

Pissed with myself for the hesitation. So I FOMOed into MTTR.

Short 10 put(Oct 15 $20).

Will be away from home through the weekend. I will short put mttr next week.

Bought some DNA this morning but I’m not sure if this is a meme stock or something that can 100x. Just a story (AWS of biotech) sounds good to me but I don’t know anything about the feasibility and the tech itself.

DNA

Given Kelly’s spiel, it is surprising that 13 years after it was founded, Ginkgo can’t name a single significant product that is manufactured and sold using its organisms.

No blockbusters? Only flavors?

He compared Ginkgo to an online app store, except that the apps are programmed cells. Like an app store, Kelly says, Ginkgo will eventually profit by taking a cut of customers’ revenues, in the form of royalties or shares. It will be up to them to make and sell the biomanufactured products.

Given current environment, royalties cut App Store may not be a good model.

All of biology is being pushed forward by the ability to read DNA, write it, and use those instructions to program organisms or human cells. By automating the use of these technologies, Ginkgo’s backers believe, the company is uniquely positioned to take a commanding position.

Automation ![]()

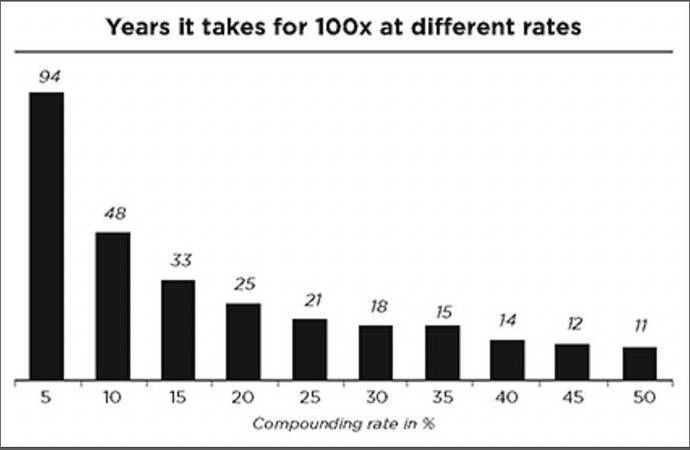

This is on its way to becoming a 100 bagger in the old fashioned way - so far has appreciated 62x in 47 years

. Probably will be a 100 bagger in 10 more years

. Probably will be a 100 bagger in 10 more years

Good grief

Most of my real estate investments are “infinite baggers” because I used 100% debt to purchase them. So my gain is infinite

Not true. You paid interest on the loans, property tax, and upkeep costs. It costs money to own real estate

.

For RE in Bay Area,

At 8% annualized appreciation, house price should be 100x at 60th year.

At 6% annualized appreciation, house price should be 100x at 80th year.

So far, my houses are appreciating at 6-11% p.a.

For RE in Austin ![]()

So far, my houses are appreciateing at 12-30% p.a. ![]() If 12% is the new sustained annualized rate, would be 100x at 41th

If 12% is the new sustained annualized rate, would be 100x at 41th ![]() year.

year.

Re-post for easy reference,

Those costs are covered by rent payments. So the gain actually is more than infinity

Ok, then you really did make infinite gain. Hats off

Say you invested $1000 in a stock, appreciated $1200, sold $1000 worth, now your return for the remaining $200 is infinite ![]() Easy to make infinite gain.

Easy to make infinite gain.

Found this video on DNA (Ginkgo Bioworks). Watching now.

Good video. Could be a good meme stock short term but I wouldn’t bet big until the business model is more solid. They are losing too much money.

.

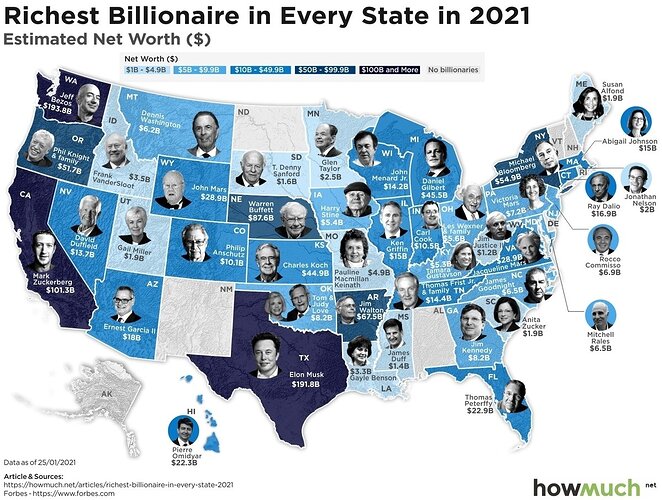

Too much hype in biotech now. IMHO, is all about execution. Is the founder a Mark Zuckerberg quality? Mark defeated all social networking companies by outstanding execution.

Did you hear of BEAM? BLI?

Got 500 DNA

I am wondering, is it the time to invest big time in biotech just like 5 years ago in e-commerce. Checking the chart, I noted SE and SHOP shot up 30x since IPO in just 5 years, wow! 3x more to 100 bagger.

Both outperforms TSLA.

What you think about evergrande? I gave a less detailed reading and they say it’s similar to 2008 crash and will have ripple effect all over the world

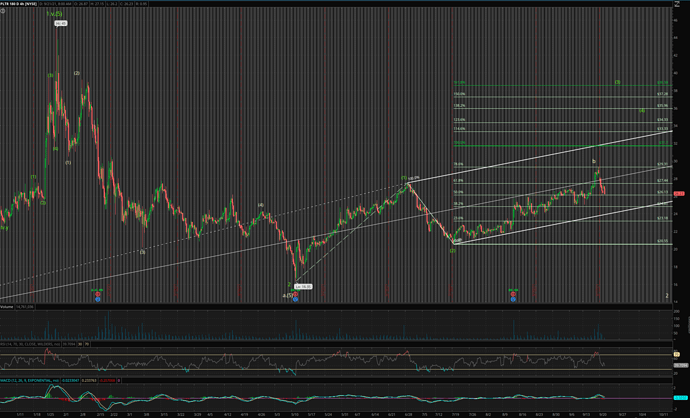

Chart of PLTR is ambiguous. In wave (2).c (downtrend to below $20) or wave (3) (uptrend to $38)?

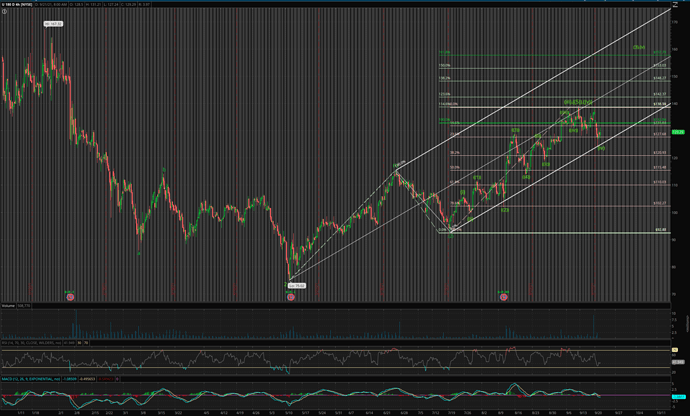

Chart of U looks bullish. In wave (3).(v) (uptrend to $157).

I like the chart of MTTR best. Seems very bullish yet I have invested the least $. I am wondering what I am doing. Do I believe in TA or not? MTTR looks so bullish, expect to break above $28 before end of the year towards $40-$50.

Chart of ABNB is like U, bullish. Regretted not adding yesteday. In the midst of volatility, hard for me to make decision.