A small proportion of my net worth is with an advisor and that is for convoluted reasons that go back a ways. I had an annual meeting and, just to make it interesting, asked how federal revenues could fall 11% in 2023 with a growing inflationary economy and no tax cuts. Here was the response.

It was nice catching up with you last week. I hope your tax filing appointment went well.

Following our meeting, we did some additional research on tax conundrum. Federal tax revenues were lower by $350 billion in 2023 relative to 2022. The largest culprit was a $400 billion decrease in individual income taxes. Despite the decline in tax receipts, personal income rose by 5% in nominal terms 2023. We found two items that contributed to the decline. The first was lower capital gains tax receipts on the back of loss harvesting following the market decline. The second contributor was that nominal wage gains were larger in 2022 than 2023, but tax brackets are inflation adjusted with on a one year lag so a 7.1% increase in the tax brackets applied for 2023, but was related to inflation from 2022. This adjustment outstripped personal income growth during 2023.

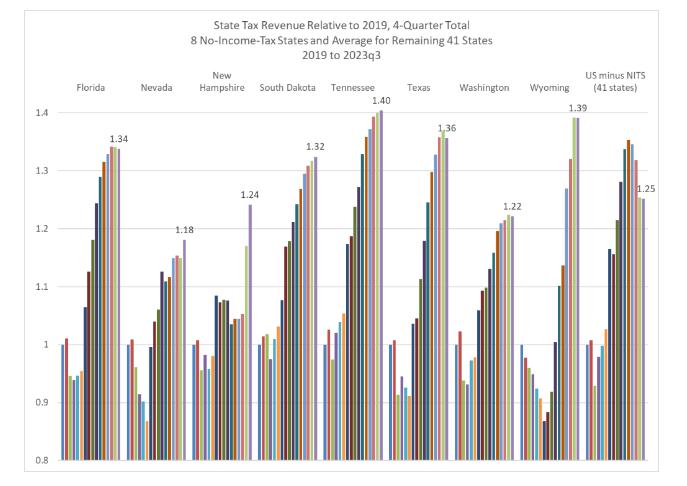

There has been a similar decline in state tax revenues, but if you look at states with no income tax, revenue has continued to increase. So it seems that the combo of inflation adjustments to the tax rate bands and lower capital gains is the culprit.