Before going out, I happen to notice this coming change, both Trump and Rep, in 2017. Imports depended companies pays extra taxes while domestic enjoys tax benefit. Looks to me nice for US Based companies. It is a step towards domestic production and domestic companies which Obama or demo missed last 8 years.

Hail Trump !

How border adjustment works

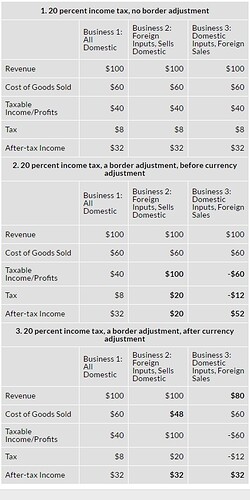

To see how big a change this would be, it helps to imagine two US-based companies. One of them makes most of its money from exporting US-products abroad and one the makes most of its money from importing products and then selling them to US consumers. Let’s call them ExpCo and ImpCo. (Thanks to Kyle Pomerleau at the Tax Foundation for this example, which I’ve borrowed with some alterations).

Suppose, for ease of illustration, that ExpCo and ImpCo each earn $1,000 a year in revenue from selling their products. ExpCo spends $800 a year buying component parts for its products, meaning it makes a $200 profit. ImpCo spends $800 a year buying imported products from abroad, so it also makes a $200 profit.

The way the corporate tax works now, those profits would (all else being equal) be treated the same: each would be subject to a 35 percent tax rate, so both companies would pay $70 a year in taxes, and have $130 in after-tax income.

But border adjustment changes the math dramatically. ExpCo makes all of its revenue from exporting its products, but because that revenue would be exempt, its taxable revenue would be $0, and its taxable income would fall to -$800. Under the new 20 percent tax rate, it’d get a rebate of $160 from the government. The Republican plan gives ExpCo a tax cut of $230.

ImpCo, by contrast, would still be accountable for all its revenue, but also would not be allowed to deduct the $800 it spends on imported goods. Its taxable profit would spike to $1,000, and even with the lower tax rate, it’d face a bill of $200, eating up all its profits.

ImpCo and ExpCo are fictional, but their predicaments loosely fit those of a lot of real companies. Boeing, for instance, makes a large share of its revenue from selling planes abroad. It would benefit, just like ExpCo would. Walmart, by contrast, imports an enormous share of the products it sells to American consumers. Not being able to deduct imported goods would dramatically change its tax situation.

Another example given by other site

Source: