Finally slowing down…Could it happen here?

Argentina, Venezuela, Canada economies are oil depended countries. Last 18 months, they have been hit by oil and related issue.

Along with these, Russia and Gulf Countries are hit long time. China economical correction is the unexpected one, surprise to many.

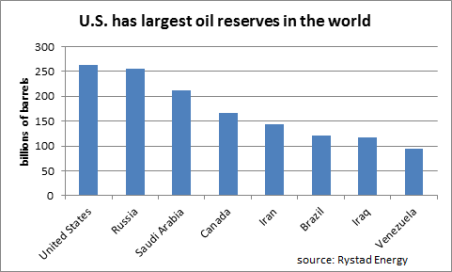

Two giant consumers of oil, USA and China, are the root cause of the oil issue. China consumption reduced by its economy hit, but USA increased local oil production, reduced imports.

For USA, being a consumer of oil, helped it overall, but US based oil companies are also hit by that wave.

Energy companies appx 78% down.

Tech and Bio-tech also went down, but exact percentage is not clear yet.This has impacted Bay Area to some extend.

If FED increases rate any time in future, we are likely to enter correction mode like what we have seen in Feb 2016. But, no one knows about future.

Vancouver never have correction even in 2008. There was slow down, but never a correction. I think Vancouver is hitted with the big pause button from local and foreign buyers due to that special tax for foreign buyers. And on top of that current SFH house prices are too much multiple from median income (including tech). New college grads in tech start at 55K/yr vs 120K/yr in Bay Area. But regarding the house price, Vancouer could be higher

Vancouver and BC is the only livable place in Canada. …that said it reminds me of Oakland with bad weather…I dont think oil prices effect Vancouver…just Calgary and Edmonton. …

You forgot the Saudi influence. They hit back hard, selling oil cheap and stressing their own financial future in an effort to kill off the new production coming to market.

The end result will be interesting.

Remember 1974-75 oil embargo and it has impacted US. This time US is the creator of oil issue and reversed the effect of 1974-75. OPEC (or Saudi) may not have any choice, but to reduce it even though it hurts them.

Think of this situation: If US economy goes down (when FED raises rate further - very likely) and oil price at the current low level, it is going to hurt OPEC future as oil demand further reduced.

Unlike dot.com recovery or subprime recovery, Oil recovery may take long or may not even recover for a longer period. It depends on how fast China recovers and what is the strategy at US for oil production and alternate energy. If current US strategy continues next 8 years, oil price recovery is really hard.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=mcrfpus2&f=m

Yes. And Saudi (and Russian) reaction to increasing U.S. output due to new exploration and shale development:

The Russians have the long view…Oil is their national treasure. …No need to rush to get it out of the ground…They can wait out impatient Americans who are in a big hurry to deplete our treasure…

In the future, oil is as good as coal, low demand. In any case, USA has yet to tap into the vast oil resources in Alaska.

They just passed 15% tax on foreign purchases.

Copy Singapore. ABSD of 15% on foreigner was introduced by Singapore on Dec 7, 2011 to cool the residential RE market.

I know a VP at Chevron who said the same thing when the anti-oil crowd was beating them up here in CA. He pointed out that capping the existing, proven reserves and leaving it in the ground provided as much profit over the long run as pumping it and selling currently. Without the constant headache of the fighting the activists.

The Saudis know this too. But, they are worried about the competition. They want to put higher cost extraction operations out of business so they can continue to control the market.