Yes I do. For me a mobile phone is an appliance.

Your first iPhone is…?

7 plus.

If similar, you would buy an Vision 7 plus ![]() That would make you a late majority consumer, definitely not an early adopter. By then, Vision would probably look like an oversized sun glasses with most of the processing + storage + battery in a black box… the best analogy I can think of is like TV + TV… that’s probably what SJ meant by he has finally cracked it (TV interface).

That would make you a late majority consumer, definitely not an early adopter. By then, Vision would probably look like an oversized sun glasses with most of the processing + storage + battery in a black box… the best analogy I can think of is like TV + TV… that’s probably what SJ meant by he has finally cracked it (TV interface).

![]()

we’ll see

Btw, I bought my 1st smartphone in 2009.

Here’s another data point. I still do not own any Apple Watch. I frankly don’t see any use of it at the moment. If we use this measure instead of iPhone, what does it say about my future Vision/VR purchase? ![]()

Do you wear a watch? If no, when did you stop wearing a watch?

can’t remember exactly when, but with a cell phone non-smartphone I stopped wearing a watch.

I am relieved. You are not an early adopter. Feel like a late majority.

A new day

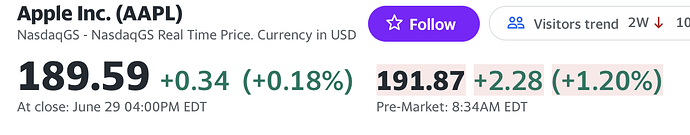

A new ATH $189.90

A new closing ATH $189.25

![]()

![]()

Among the people I know/hang out with AFAIR(remember) only one couple wears an Apple watch.

So based on that, I’m mainstream, not the person who wears an Apple Watch. ![]()

So, if VR is Apple Watch, I’m afraid it’s not such a good news.

They sold 50M of them last year…. That’s huge volume. I’m not sure how many electronic devices have higher sales volume.

worldwide?

Yes. How many other products hit those sales numbers?

I’m just saying Apple Watch whose ASP is probably 1/4th of iPhone sells @1/5th of iPhone volumes. So, it’s not a huge number when that comparison is made. VR, IMO is a more niche and obviously much more expensive product.

Anyways as I said earlier we’ll find out what the demand is. I’m not a VR enthusiast from a sales perspective, but I can be wrong.

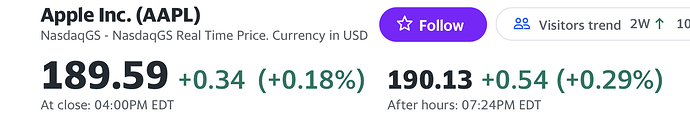

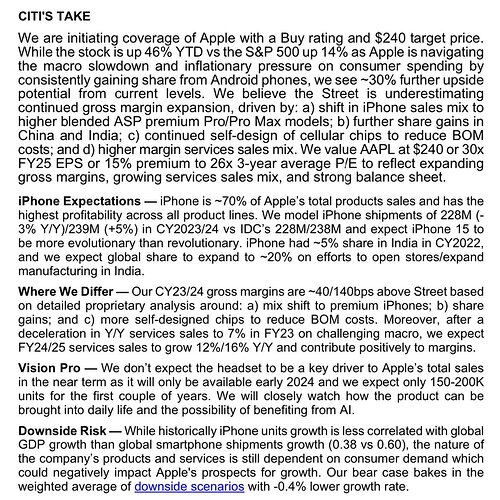

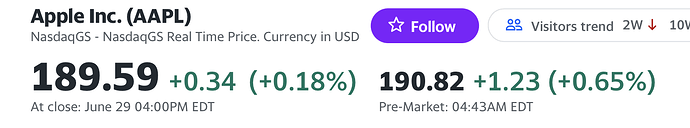

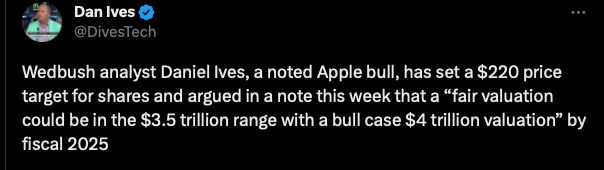

Citi Starts at Buy, ‘A Hardware Company That Thinks Like a Software Company’ PT $240

Yet another new ATH and new closing ATH.

Year 2022

Expect will hit $200 in short order.

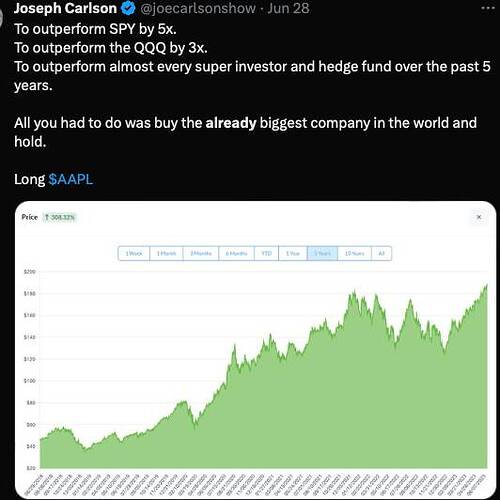

That is, 32% CAGR over 5 years despite a negative return in 2022. In fact, since 1997, CAGR of AAPL is ~30%. If this continue, AAPL is a 10-bagger over 10 years. $30T in 2033, possible?

Apple was the first company to cross $1 trillion in market capitalization in August 2018. Two years later, it became the first company to blow past the $2 trillion mark.

In order to maintain a $3 trillion valuation on Friday, Apple’s stock would need to close above $190.74 per share.

I remember when it hit $500B. The consensus was that was near a peak, since no company had hit $1T. This is insane. Products that could be a Fortune 500 company aren’t even considered major products for Apple.